Brief • 3 min Read

After seemingly endless months of pandemic-inspired trip cancellations, travelers are more than ready to pull their dusty suitcases out of storage. Popular online travel agency Booking.com is reaping the rewards after the COVID travel slump.

In June 2022, Booking.com saw a significant increase in site traffic. Their site is a one stop shop for traveler’s booking needs, so it’s no surprise that this was a hot destination for vacationers getting back into gear. From Booking.com, you can browse and book lodgings, flights, transportation, and activities.

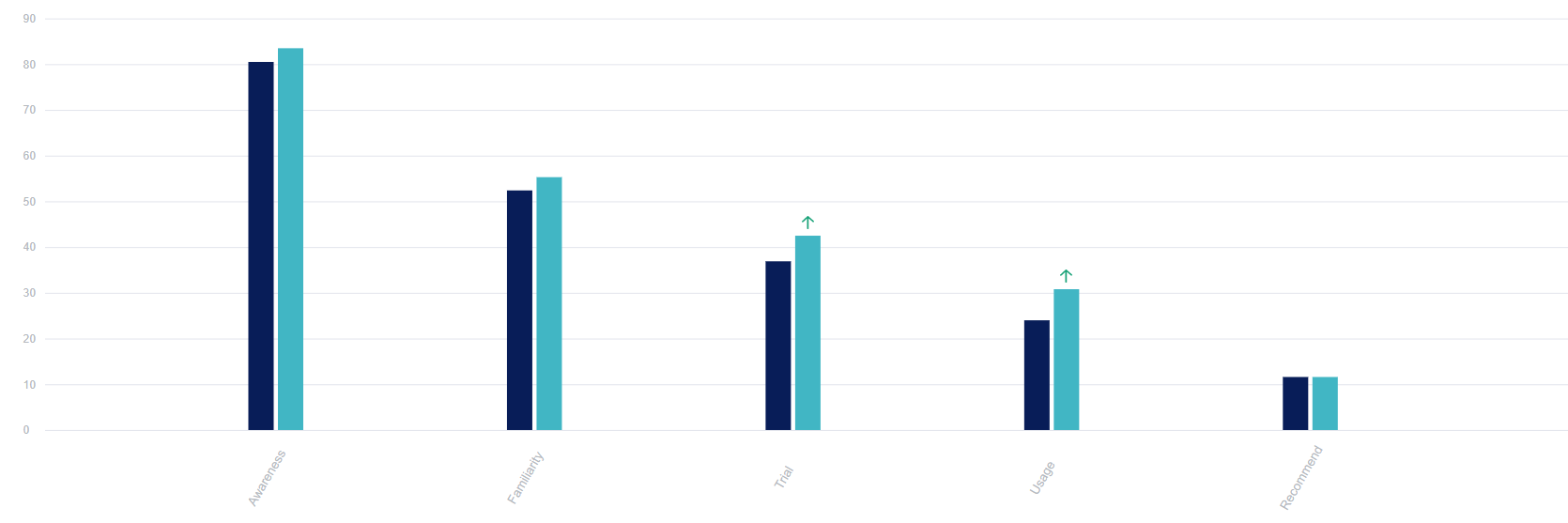

Estimates show that Booking.com’s search traffic increased 4.75% from May to June (a 26.6% boost from June of last year). Consumers’ increased use of Booking.com is also evident from the brand’s QuestBrand sales conversion funnel. When we compare Booking.com’s sales funnel from May to June, the brand shows significant lift in both the Trial (+5.6) and Usage (+6.8) stages, a strong indicator of overall brand growth.

Booking.com’s Sales Conversion Funnel: May vs. June 2022

QuestBrand. Base: Familiar with Booking.com. 5/1/22-5/31/22, n=443. 6/1/22-6/30/22 n=503.

Want to read more about emerging travel industry trends? Check out our Travel & Hospitality: An Industry Snapshot report for insights and brand rankings.

This travel frenzy is no surprise. The U.S. Travel Association recently forecasted travel trends through 2026. Within the forecast, they predict a short-term surge across all travel segments followed by a slower growth curve in the subsequent years. The shorter-term rise is primarily contributed to consumers’ pent-up demand for travel along with higher than usual levels of consumer savings. U.S. Travel estimates that $1.05 trillion will be spent on travel in the US this year; however, this is still 10% below pre-COVID 2019 levels. If the pandemic had never happened, U.S. Travel predicts that June’s travel spending would have been 16% higher than it was.

However, we cannot solely credit travel’s popularity comeback for Booking.com’s success. Especially since both AirBnb and Expedia experienced decreased search traffic volume during Booking.com’s period of growth. Booking.com spends a significant amount of money on marketing their brand and has the largest marketing budget in the travel industry. In 2021 alone, Booking.com spent $3.8 billion on marketing. They are particularly invested in social media marketing and TV advertising (you may well remember their Super Bowl LVI ad featuring Idris Elba). According to Harris Brand Platform’s brand touchpoint data, consumers report most often interacting with Booking.com through their TV ads. Their TV ad touchpoint number also increased in June (+10.6).

However, if U.S. Travel’s forecast holds true, we can expect a slower travel growth curve in the near future. As the current surge slows, we may see Booking.com’s Trial and Usage level out as well, unless their marketing powerhouse is able to continue engaging enthusiastic globetrotters.

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Related Content