Brief • 2 min Read

1: Apparel & Fashion: An Industry Snapshot

Our recent report on the state of the apparel and fashion industry explores consumers’ fashion purchase priorities and budgeting habits. Using QuestBrand data, we rank the leading apparel and accessories brands by brand equity and growth. Here are some key takeaways:

- Three quarters (72%) of US adults agree that they have decreased the amount they spend on fashion items over the past year.

- Half (54%) of young adult shoppers (ages 18-34) agree that spending money on fashion items is a source of financial stress.

- Sixty-two percent of young consumers, but only 31% of older consumers (ages 55+) are willing to pay more for a fashion item that embodies social responsibility.

- Nine in 10 (89%) US adults who purchase fashion items for themselves typically set a budget or spending limit before shopping.

2: Abercrombie & Fitch: From Exclusive to Inclusive – Case Study

A visit to Abercrombie & Fitch in the 90s and early 2000s promised shuttered windows, dark rooms, cologne-filled air, pumping music, and shirtless male models. In 2006, Abercrombie’s then-CEO described the brand as for “the cool kids,” and said that “a lot of people don’t belong [in our clothes].” Abercrombie faced many criticisms during this period, including accusations of racism, discrimination, body shaming, and overtly sexualized ads that objectified young people.

- In 2017, a new CEO, Fran Horowitz, took the helm. Horowitz has reimagined the Abercrombie brand, replacing an ethos of exclusion with a spirit of inclusion.

- The company also shifted its target consumer from popular teens to young professionals.

- Abercrombie’s more inclusive ethos has appealed to Gen Z and Millennial shoppers, and the brand has been steadily gaining steam with this demographic.

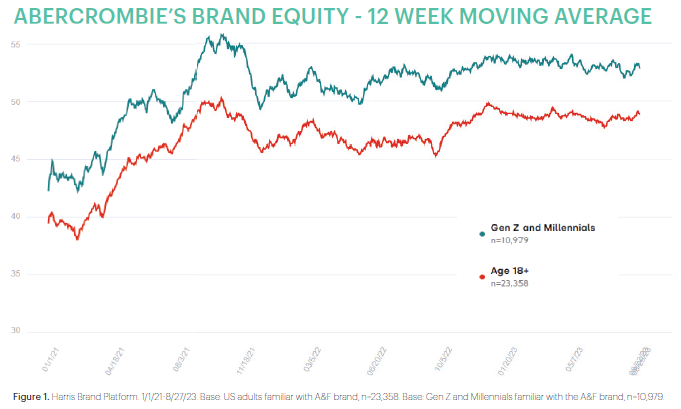

- According to QuestBrand data, from January 2021 – August 2023, Abercrombie’s brand equity has continuously, and significantly, risen among Gen Z and Millennial adults.

- Notably, Millennial and Gen Z adults familiar with the Abercrombie brand were significantly more likely to describe the brand as “hip” (+5.7), a “good value” (+5.0), and “stylish” (+4.2) in 2023 than they were in 2021.

Check out the whole story – download the case study today!

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Related Content