Brief • 2 min Read

1: Healthcare: An Industry Snapshot

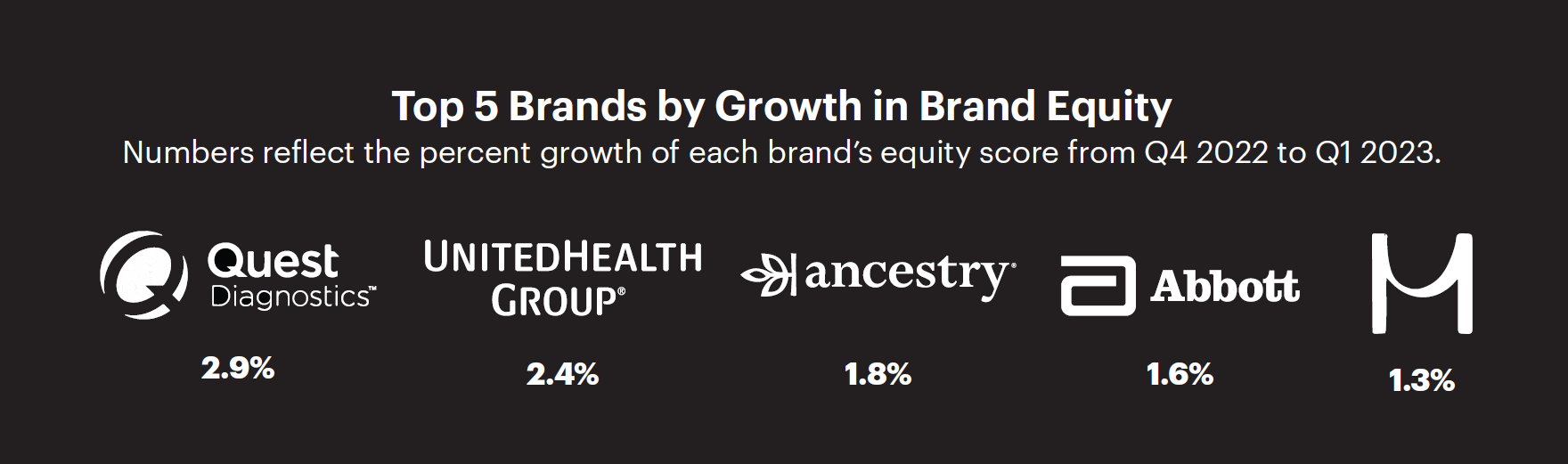

Our recent report on the state of the healthcare industry explores consumer sentiment towards healthcare costs and the use of emerging technology. Using QuestBrand data, we rank the leading healthcare brands by brand equity and growth. Here are some key takeaways:

- Less than half of Americans are comfortable with healthcare providers primarily using new medical technologies (e.g., robotics, artificial intelligence) to complete tasks, including: collecting health data (42%), performing administrative tasks (40%), and analyzing health data (40%).

- Despite this mistrust, 69% of US adults would opt-in to healthcare that involved new technology if it lowered healthcare costs.

- Eight-in-10 (82%) US adults agree that the cost of healthcare (e.g., insurance costs, costs of medical procedures) is the biggest problem with America’s healthcare system.

2: Do Cosmetics Brands Have Personalities? – Brand Story

To the uninitiated, all makeup may look the same. However, a makeup enthusiast understands each brand’s unique character and value proposition. Using QuestBrand data, we compare the emotional attributes female consumers ascribe to five leading cosmetics brands – E.L.F. Cosmetics, Estée Lauder, Fenty Beauty, L’Oréal and Revlon.

- Women consider Revlon “dependable,” L’Oréal “trustworthy,” Estée Lauder “classy,” Fenty Beauty “unconventional,” and E.L.F. “young.”

- Read our full brand story to discover why women attributed these adjectives to each brand.

3: Are Americans Concerned About the Recent Banking Crisis?

In an op-ed for Fortune, Harris Poll co-CEO Will Johnson explores how Americans feel about their money’s safety, and the relative security of banking institutions, after Silicon Valley Bank’s recent collapse.

- More than 90% of US adults feel their money is safe at a bank or credit union (regardless of the institution’s size).

- Wealthier Americans (those with a household income of at least $100,000) are the most worried about bank failures – 55% worry about small banks closing versus 46% of all US adults.

- Gen Z adults (ages 18-26) are wary of larger banks – 78% of Gen Z adults feel their money is safe in large banks while 84% feel their money is safe in medium-sized banks.

Want more? Read the full article for more in-depth insights into Americans’ banking anxiety.

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Related Content