Brief • 3 min Read

Travel & Hospitality: An Industry Snapshot

Our recent report on the travel industry explores Americans’ spring break plans and thoughts about airline baggage restrictions. A few key takeaways include:

- Stepping off the beaten path: 37% of US adults try to avoid traveling to places that are known as “spring break destinations.”

- Similar vibes at a fraction of the cost: 20% of Gen Zers have booked a trip to a “dupe destination” – a lesser known, more affordable alternative.

- Can you fit it all in the carry-on?: 40% of regular airline travelers (travel via airplane at least once a year) try to avoid checking bags when they fly.

- Is that on top of the ticket price?: 60% of regular airline travelers agree that airlines should not charge passengers for checking luggage.

- Luggage-anxiety: 40% of regular airline travelers agree that they are often stressed about getting all their luggage safely to the destination when they fly.

Over-Index Report: This month’s over-index report uses data from QuestBrand by The Harris Poll to capture travel brands that over-index with US households with children. See below for a sample of the included brands:

Chili’s Sees Huge Sales Boost From A Viral TikTok Trend – Case Study

Have you tried Chili’s popular Triple Dipper appetizer? The Triple Dipper is a customizable combo of three appetizers and three dipping sauces that took TikTok by storm in 2024. Last year, customers began posting TikTok videos of the dish and the fried mozzarella’s legendary cheese-pull.

- By November, TikTok had amassed nearly 150 million posts around this single menu item.

- The internet fame translated into real sales growth for the chain – Triple Dipper sales were up 70% from the year prior.

- The Triple Dipper’s success meant a 14.1% increase in same-store sales growth, and a 6% increase in restaurant traffic.

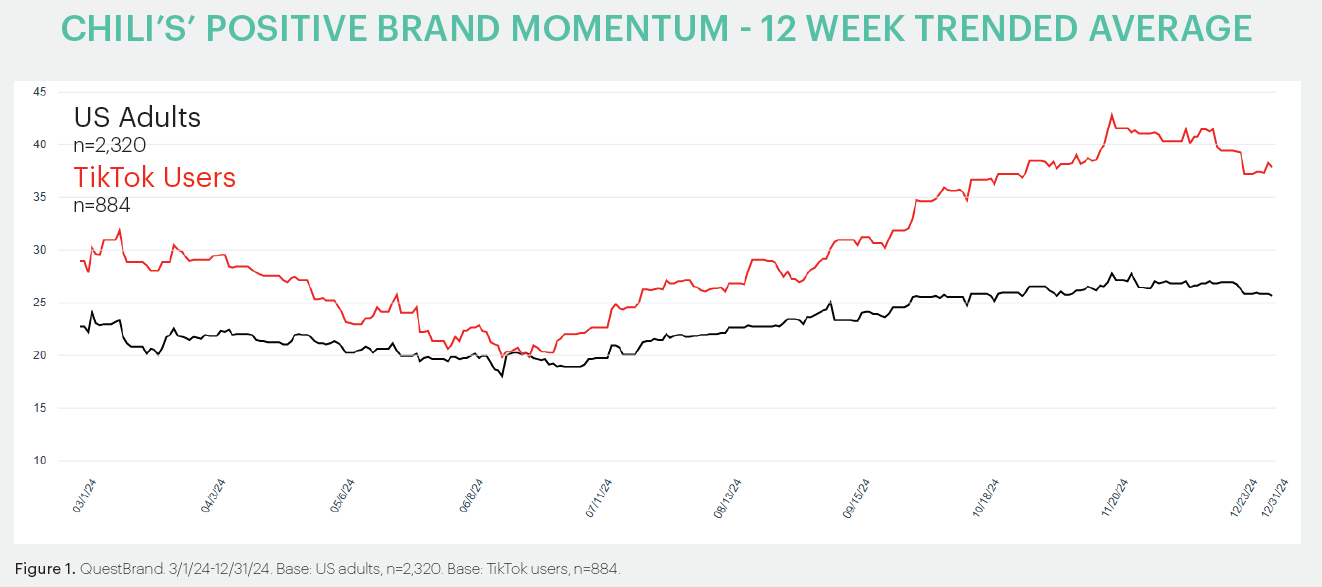

- Looking at data from QuestBrand below, we can see how the Triple Dipper’s burst in TikTok popularity resulted in a positive brand momentum boost among active TikTok users.

Irrelevant To Iconic: UGG Surges In Popularity Among Gen Z – Brand Story

UGG ranked 8th in our latest AdAge-Harris Poll Gen Z brand tracker. This quarterly index uses QuestBrand data to rank the top 20 brands by brand equity growth among Gen Z adults (ages 18-28). Once a 2000’s closet staple, UGGs were the must-have boot before retiring to the back of many closets.

- While UGG appeared to have lost momentum among other fads, the previously popular boot brand made an unexpected comeback in 2024 and captured Gen Z consumers’ attention.

- By introducing celebrity collaborations, creative designs and unique experiences, the nostalgic boot brand has reinvented itself for a new generation.

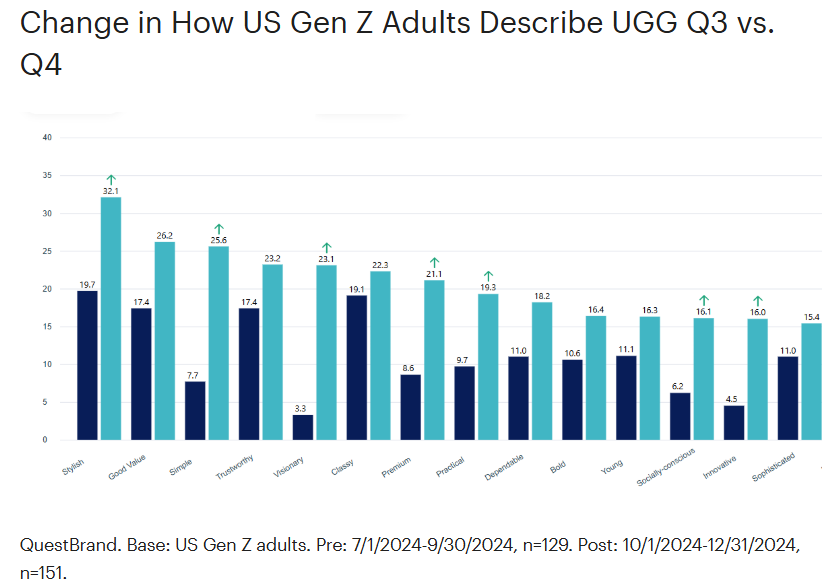

- Throughout Q4, Gen Z consumers more often described UGG as “visionary” (+19.8), “simple” (+17.9), “premium” (+12.5), “stylish” (+12.4), “innovative” (+11.5), “socially-conscious” (+9.9), and “practical” (+9.6) compared to Q3.

Want to learn about the collaborations, designs, and experiences that helped UGG pop in Q4? Read the full brand story now.

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Related Content