Brief • 2 min Read

1: Apparel & Fashion: An Industry Snapshot

Our recent report on the state of the apparel industry explores consumers’ thoughts about virtual-try-on technology and secondhand clothing. A few key takeaways include:

- Dressing room anxiety?: Half (50%) of young adults (ages 18-34) agree that trying on items in stores in stressful.

- Reimagine online shopping: Three-quarters (72%) of young adults agree they think they would buy more items online if they could try them on virtually first.

- Shopping that feels good: Seven in 10 (68%) young adults agree that buying secondhand clothing makes them feel like more ethical consumers.

- Last year’s clothing is tomorrow’s trend: Eight-in-10 (81%) young adults who purchase fashion items for themselves agree that wearing vintage clothing is trendy.

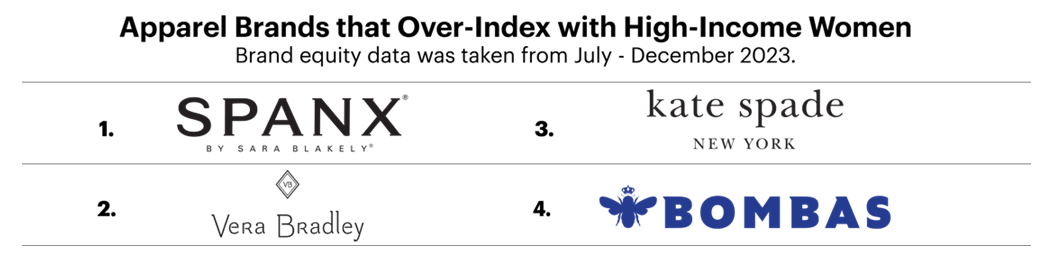

Over-Index Report: This month’s over-index report uses data from QuestBrand by The Harris Poll to list 20 fashion brands that over-index with high-income women (US women with an income of $100K+). See a sneak peek of the brands below:

2: 20 Brands Catching Gen Z’s Attention – AdAge-Harris Poll

A recent AdAge-Harris Poll uses QuestBrand data to rank the top 20 brands by quarter-over-quarter brand equity growth among Gen Z adults. The top five growth brands from Q3 to Q4 2023 are listed below.

Get a sneak peek from the article: “Ugg, the footwear maker known for its cold-weather boots, is hot with Gen Z. The brand tops the latest Ad Age-Harris Poll Gen Z brand tracker, which ranked brands that made significant progress in gaining attention from Gen Z in the fourth quarter of 2023. The poll also shows that Bud Light saw some momentum among Gen Z, a glimmer of hope for the beer brand that is still dealing with a sales backlash after its 2023 promotion with transgender Dylan Mulvaney drew complaints from conservatives.”

Click here to check out all top 20 brands, and for a look at how these brands have successfully connected with Gen Z.

3: Non-Alcoholic Beverages Can Be A Growth Category For Brands – AdAge-Harris Poll

In a recent op-ed for AdAge, Harris Poll co-CEO Will Johnson explores consumers’ growing interest in zero-proof beverages. In 2023, sales of alcohol alternatives increased 30%, and alcohol-free alternatives are expected to grow another 25% by 2026. A few key takeaways:

- Alcohol remains popular: More than 7 in 10 Americans of legal drinking age consume alcoholic beverages.

- Moderation over elimination: More than half (54%) of US adults said that they decreased their alcohol consumption in the past year.

- An emerging market with room to grow: Less than a third (28%) of US adults drink mock alcohol alternatives at least occasionally. Seventy percent of respondents have never tried a mock-alcoholic beverage.

- Why try non-alcoholic options?: A third (33%) of Americans drink non-alcoholic alternatives because they like the taste. Another third (30%) do so to limit their alochol consumption.

- We want to fit in: Half (51%) of people who participate in sober periods (like Dry January) feel uncomfortable abstaining when others around them are drinking alcohol.

Takeaway: “On the whole, millennials and Gen Zers seem to be more concerned about their relationship with alcohol than their older counterparts. Mock alcoholic beverages allow younger adults to participate in the social ritual of drinking, reduce anxieties related to not drinking when others are—and still be mindful of their health. ” – Will Johnson

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Related Content