Brief • 2 min Read

1: Personal Care: An Industry Snapshot

Our recent report on the state of the personal care industry explores consumer sentiment towards self-care routines and product purchasing habits. Using QuestBrand data, we rank the leading personal care brands by brand equity and growth. Here are some key takeaways:

- Don’t mess with self-care – 95% of US adults say it’s important to engage in self-care activities.

- When asked why they practice self-care, respondents most often said to improve mental health (69%), to improve physical health (63%), or to reduce stress (56%).

- Many US adults have changed their purchasing habits in the face of inflation – 68% of these shoppers report buying more discounted personal care products now than they did a year ago.

2: Volvo Successfully Captures Gen Z’s Attention

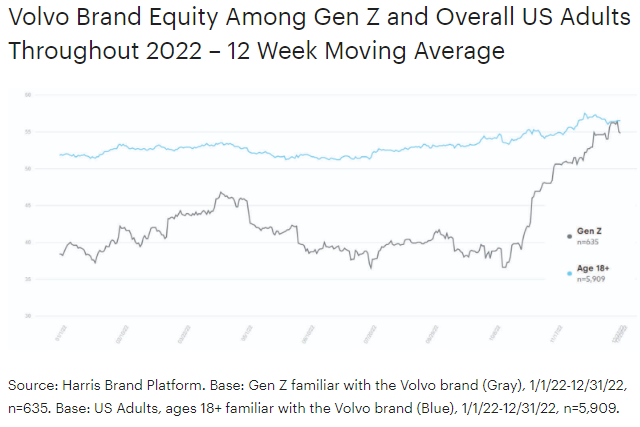

Known for catering to a more mature consumer, Volvo has made a surprising appeal to the youngest adult demographic – Gen Z. Volvo ranked fifth in our quarterly Ad Age-Harris Poll Gen Z brand tracker. This tracker ranks the top 20 brands by brand equity growth among Gen Z adults.

- From Q3 to Q4 2022, Volvo experienced a tremendous +11.6 lift in brand equity among Gen Z, versus only a +2.4 lift in brand equity among the general population of US adults.

- Check out our brand story to discover how Volvo plans to grow a younger consumer base with a new EV, short-term subscription-based ownership, and an online buying experience.

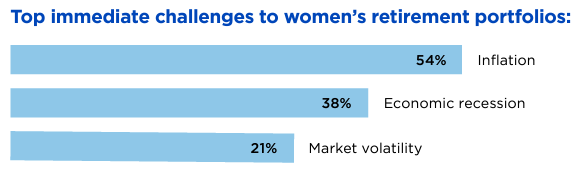

3: Women Feel Financially Unprepared for a Recession

A recent survey conducted by The Harris Poll on behalf of Nationwide found that women investors are more fearful of a recession now than they were in 2022. More than half (64%) of women think we are headed for a financial crisis (or that we are already in one).

- Less than half (45%) of women report having a strategy in place to protect their assets against market risk.

- Non-retired women are adjusting their saving approaches in the face of a potential economic downturn, including: avoiding unnecessary expenses for the next 12 months (31%), managing their investments more conservatively (28%), and moving to a new location with a lower cost of living (12%).

Takeaway: “It’s important to recognize and consider the unique retirement challenges facing women. We live longer and typically need to fund more years in retirement than men. Women also tend to have lower savings due to historical wage gaps and more time out of the workforce. The current economic environment has women feeling stressed about their future, but I’m encouraged to see many are taking proactive steps to seek guidance and create a plan.” – Ann Bair, Senior Vice President of Financial Services Marketing for Nationwide

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Related Content