Brief • 3 min Read

Consumption of alcohol has increased during the pandemic, and most Americans who drink plan to hold to their current consumption levels after the final COVID-19 restrictions have been lifted.

And with the vaccine rollout in full swing, many Americans will soon return to light/limited socialization. As part of QuestBrand’s research into the trends and brands disrupting industries and defining new ones, we took a closer look at the emergence and popularity of hard seltzer brands.

Overall, alternative and niche alcohol beverages have developed a sizable following with consumers: At least 1 in 5 Americans consume spiked, or hard, versions of soft drinks, such as hard lemonade (22%), hard seltzer (20%), and hard cider (19%).

Profile of the typical hard seltzer drinker:

- Young (<44 yo): 68%

- Female: 54%

- Affluent (HHI >100K+): 49%

Trends & opportunities

1 in 5 alcohol drinkers (21+) say they drink hard seltzer – and among younger adults, the fizzy drinks are especially popular. In fact, younger consumers are more than twice as likely as consumers over the age of 44 to say bottoms up to spiked seltzer.

Hard seltzer is about to have its moment: During the pandemic, spiked seltzer drinkers have increased their alcohol consumption at a higher rate than all alcohol drinkers (39% vs. 24%, respectively). Six in 10 hard seltzer drinkers (61%) expect to maintain their current alcohol consumption level after all COVID-19 restrictions have lifted, and another 15% expect to increase their consumption level – meaning the market is likely to grow even more competitive in the months to come.

Despite skewing younger, hard seltzer drinkers have a refined palette and a taste for the finer things in life: Compared to all alcohol drinkers, when buying alcoholic beverages, they place more value on elements like the taste, flavor, food pairing potential and look and feel of the beverages they buy.

More than half of hard seltzer drinkers (58%) also report consuming “virgin” beverages, which they report drinking primarily to “try something new” (55%), to enjoy a drink without getting drunk (45%) and to taper off with something lighter after they’ve had too much alcohol (43%).

Seltzer Brand Equity

When looking at the major spiked seltzer producers, there are some clear favorites. Brands with a higher lift have successfully built equity and buzz with alcohol drinkers – likely resonating with their preferences for low-key fun, nonchalance and convenience. Our table below shows the lift in consideration between general population adults and alcohol drinkers.

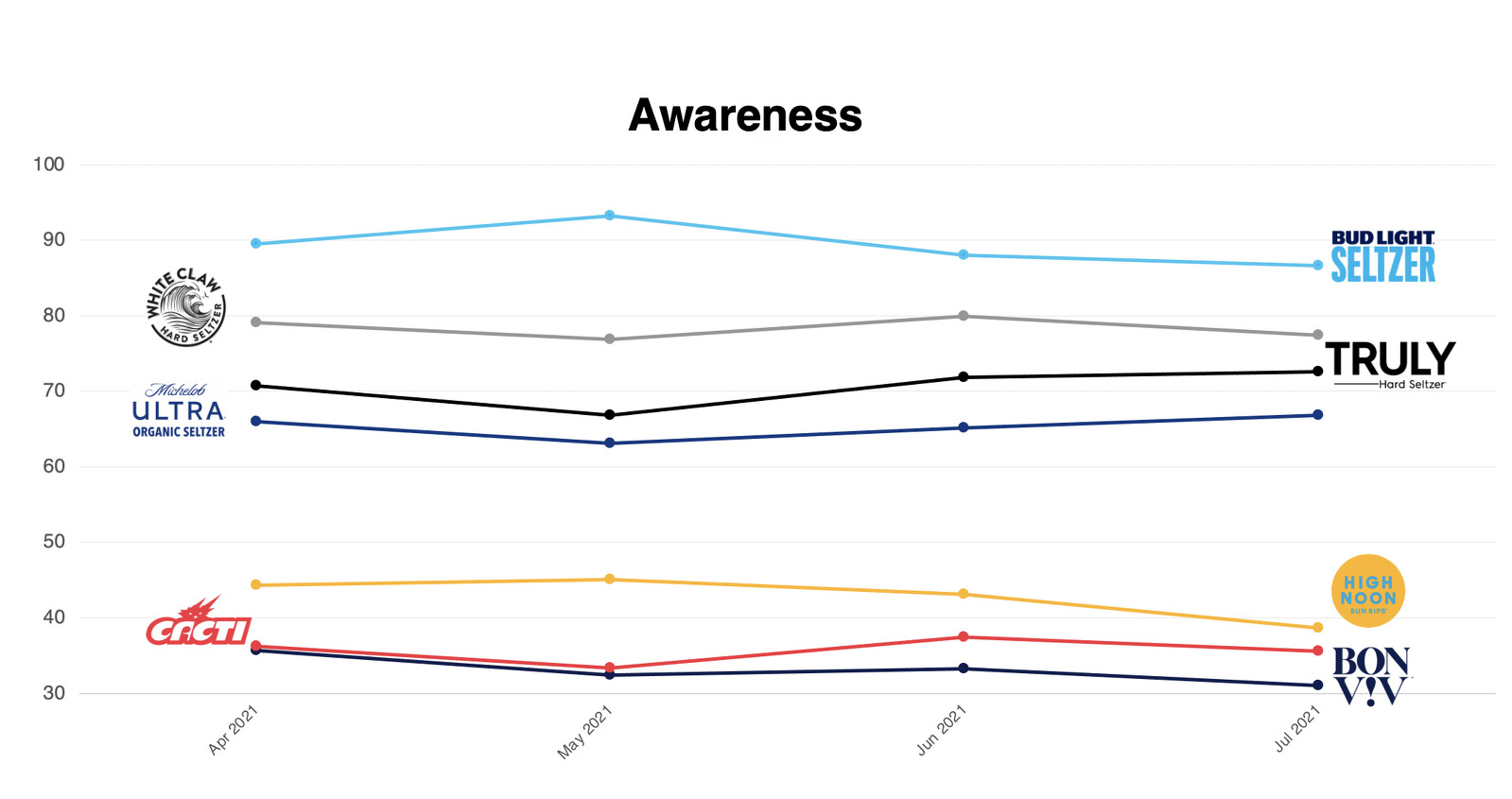

This phenomenon comes into clearer view when looking at the shifting awareness levels of seven spiked seltzer brands. Those with higher awareness either benefit from having a well-known parent brand, such as Michelob Ultra Organic Seltzer and Bud Light Seltzer, or they have successfully built awareness as an early entrant, such as Truly Hard Seltzer and White Claw Hard Seltzer.

New entrants with new and unique offerings – Cacti Hard Seltzer, Bon V!V Spiked Seltzer, and High Noon Hard Seltzer – have been unable to break the ceiling despite significant advertising and marketing investment over the late spring and early summer.

Market begins to Cool: Coors Seltzer is Canned

Although we saw a rush of activity in the spiked seltzer market at the beginning of 2021 as mature beer and spirits multinationals moved to strengthen their new market growth, today the market is cooling off. According to Jim Koch, CEO of the Boston Beer Company and creator of Truly, “hard seltzer category and overall beer industry were softer than we had anticipated,” and the endless arrival of new seltzer brands is causing “consumer confusion,” with fewer people trying the once-hot beverage.

With a myriad of options, consumer consumption is consolidating, with Truly and White Claw capturing nearly 75% of the hard-seltzer market, according to Nielsen. In response, multinationals like Molson Coors are choosing to thin their market offering. On July 12, 2021, Molson Coors announced their decision to discontinue the Coors Seltzer line as “the brand [hadn’t] performed up to [their] high expectations.” Instead, they will channel their efforts into Topo Chico Hard Seltzer and Vizzy.

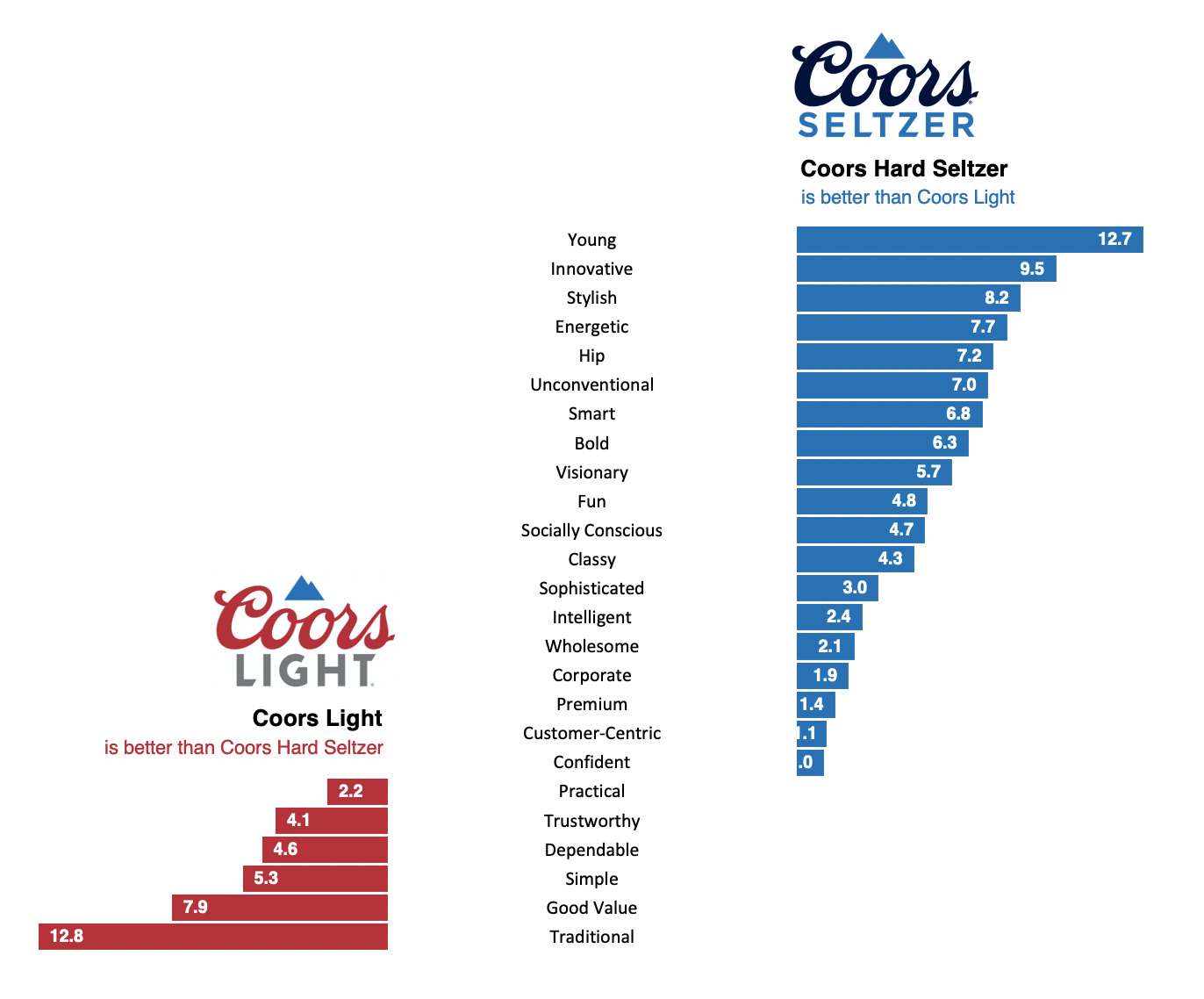

QuestBrand’s emotional imagery data – illustrated below – supports this switch. As it turns out, Coors Hard Seltzer was diametrically opposite to the Coors Light brand’s emotional profile, which consumers value for its tradition, good value and simplicity.

Many would interpret this as a branding misalignment, but more importantly, it shows a lack of lift driven by the mainstay Coors Light brand. Rather than try to define distinct products within the same Coors line, it makes more sense to focus on brands such as Topo Chico and Vizzy that lack identity confusion.

Methodology

The brand index was determined by measuring the change in consideration between alcohol drinkers and the U.S. general population during the beginning and end of the data collection period. Brand equity data for this report were collected from May 7, 2021, to August 4, 2021, using QuestBrand.

Additional consumer insights were derived from a survey conducted online within the United States from March 26, 2021, to March 30, 2021, among 1,111 adults (aged 21 and over) by The Harris Poll. Figures for age, sex, race/ethnicity, education, region and household income were weighted where necessary to bring them into line with their actual proportions in the population. Propensity score weighting was used to adjust for respondents’ propensity to be online.

For more information on methodology or to view full data tables, please contact Dami Rosanwo.

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Related Content