Brief • 4 min Read

In The Harris Poll Tracker (Week 90) fielded November 12th to 14th, 2021 among 2,043 U.S. adults, we look at how travelers will be getting back to travel 2022, the future of movie theaters, why consumers are shopping early this holiday season, how the pandemic is shaping women’s consumption habits, and the concern over rising inflation.

As a public service, our team has curated key insights to help leaders navigate COVID-19. Full survey results, tables, and weekly summaries can be accessed for free at The Harris Poll COVID-19 Portal. We will continue to actively field on a regular cadence to track the shifts in sentiment and behaviors as the news and guidelines evolve.

1. Nearly Half of American Travelers Are Making 2022 Travel Plans, Regardless of COVID: OAAA-Harris Poll

According to our new report in partnership with The Out of Home Advertising Association of America (OAAA), COVID is no longer standing in the way of most future consumer travel this winter. Here are a few key insights:

- Nearly half of travelers (48%) say they have either already made travel plans for the first half of 2022 (26%) or intend to do so once they decide on a destination(22%). Just (27%) say they are waiting to see how COVID conditions are; one-quarter (25%) aren’t sure yet.

- Confidence in air travel is up: The number of travelers willing to hop on a plane during the first half of 2022 has more than doubled since the 2020 holiday season, up from (24%) to (51%).

- Out of home (OOH) provides a compelling opportunity for brands and marketers: Those who say they notice OOH “much more” is up from September 2020, a 9-point surge. Specifically, consumers find out of home ads about retail (63%), fast food (62%) and food and beverage (60%) to be most relevant to their interests.

- Overall, (85%) of those who say they noticed OOH ads also find them to be useful, including for finding out about special offers and promotions (42%) or learning about a new business or service (29%).

Takeaway: “Not only are Americans ready to travel, they’re ready to consume and learn about new products – but their focus on online advertising is eroding,” said John Gerzema, CEO of The Harris Poll. “That’s why OOH has a big opportunity to take on renewed resonance as people travel, both locally and longer distances, and spend more time outside. Marketers should pay attention to this trend, especially in the leadup to the holiday season.”

2. Will Movie Theaters Survive? That Depends on Millennials: Washington Post-Harris Poll

Millennials are the serial killers of our time – killing home ownership, casual dining, and even wedding traditions. But here’s one thing they might just save: movie theaters. In partnership with The Washington Post, we looked into movie attendance amidst the pandemic:

- Before the pandemic, (18%) of Millennials reported going to the movies weekly, and (27%) reported going monthly, the highest numbers of any generation.

- Since the pandemic, those numbers have dipped: only (8%) of Millennials have gone weekly over the last year, and only (17%) report attending movies monthly. Gen Z (19%) actually polls slightly ahead on the monthly question.

- Numbers are down across the board, however, and the older the age group, the worse they get: The figures for Boomers are particularly striking: whereas (26%) said they “never” went to movies before the pandemic, that number spikes to (71%) over the last year.

- Both Gen Z (42%) and Millennials (43%) think it is more fun to watch a movie in a theater than at home (35% and 39%, respectively).

Takeaway: One could suggest a number of variables influencing these figures. Perhaps there is some confusion as to what’s playing where; we previously found that only (34%) of people knew the blockbuster “Dune” was out on HBO Max and in theaters simultaneously. But it’s hard to look at theater hesitancy among older cohorts as anything other than a reflection of concerns about COVID.

3. Half of Americans Are Shopping Early This Holiday Season

We previously found that Americans are tired of pre-Thanksgiving holiday ads and, yet, the concern of shortages and delivery delays have many consumers shopping early this holiday season to make sure they get what they want on time. Here’s what we found:

- Early Birds: Half (50%) of Americans are shopping early this holiday season due to concern over items arriving late, up from (46%) last year. And just under half (46%) are shopping early in fear of holiday gifts being out-of-stock, a concern that remains from last season (44%).

- Good news for kids: Over half (52%) of Parents are shopping early to avoid missing out on their gifts of choice, compared with only (39%) of Americans without children.

- One-third (34%) of Americans plan to split their holiday shopping equally between online and in-person purchases. Nearly as many, (33%), plan to do their shopping entirely (9%) or mostly online (24%). Just under a quarter (23%) say they are going to do their holiday shopping entirely or mostly in-person this year.

- The New York Times explores the supply chain hurdles for businesses trying to deliver items on time for the holidays.

Takeaway: For the second year in a row, supply chain shocks from the pandemic are contributing to consumer anxiety that holiday gifts will either be late – or not in stock at all. Marketers may need to push ahead their timeline for reaching key consumers this holiday shopping season to meet expectations.

4. COVID Changed Women’s Shopping Behaviors, Desires, And Expectations: Meredith-Harris Poll

The COVID-19 pandemic has created space for women to reprioritize their energy and resources, including re-evaluating what matters most when it comes to retail, according to a new study we conducted in partnership with Meredith Corporation. Here are three key shopping trends accelerated by the pandemic:

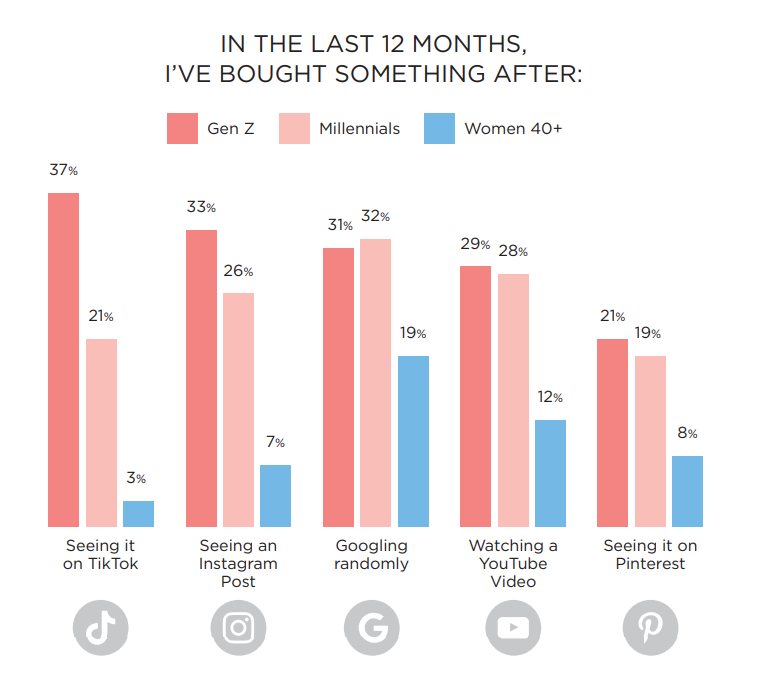

- Digital is the future to cultivating desire: Nearly 6 in 10 Gen Z women (59%) find out about new products from social media advertising and more than half (52%) say email outreach has driven purchases.

- Women are resetting their in-store retail expectations: Women 40 and under are particularly seeking the social experience that comes with shopping in-store, but have heightened expectations and new needs than they did pre-pandemic: nearly half (47%) admit, “everything looks outdated to me now as we exit the pandemic, so I’m looking forward to seeking new experiences.”

- Women are more intentional about buying brands that align with their values: COVID has driven a small business-first mentality as (70%) of women attest, “I witnessed a lot of local businesses struggle or go out of business, so I’m trying to shop locally more often.”

- Sustainability is also an increasing driver for brand preference, as (59%) of women agree that “shopping online is often wasteful with its packaging,” and (56%) agree “I’m staying away from fast fashion because it’s unsustainable.”

Takeaway: “Women are using their time during the pandemic to re-evaluate all aspects of their lives, from everyday routines to deeper evolution around their life goals and health,” said Britta Cleveland, Meredith’s Senior Vice President for Research Solutions. “This means change ahead for retail, as women look to turn their new priorities into action.”

5. Consumers Are Concerned Over Inflation: Bloomberg-Harris Poll

One clear thing is that elevated inflation concerns the general public. Joe Weisenthal at Bloomberg covered our latest data, in which we found that there is pushback in the public’s mindset against the idea that increased inflation is worth the price of rapid growth:

- More than half of Americans (55%) are very concerned about rising inflation; however, younger generations are less fearful than their older counterparts (Gen Z: 28%, Millennials: 44%, Gen X: 61%, Boomers: 68%).

- Large numbers of Americans are concerned about affording groceries (84%), gasoline (83%), home energy costs (78%), and healthcare (75%).

- Close to two-thirds (63%) believe that the prices of goods and services will continue to rise over the next year.

- Even though Gen Z (58%) and Millennials (58%) are not overly concerned with rising inflation, they still prefer an economy with slower job growth if it means lower inflation, a similar feeling of Gen X (68%) and Boomers (79%).

Takeaway: Our data demonstrates the public challenge of implementing a pro-growth agenda when many Americans are concerned about affording necessities in times of increasing inflation. Consumer anxiety over rising prices will have repercussions across the broader economy if Americans become hesitant to open their wallets.

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Download the Data

This survey was conducted online within the U.S. by The Harris Poll from November 12 to 14, among a nationally representative sample of 2,043 U.S. adults.

Download

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Download the Data

This survey was conducted online within the U.S. by The Harris Poll from November 12 to 14, among a nationally representative sample of 2,043 U.S. adults.

DownloadRelated Content