Brief • 4 min Read

In Week 24 of The Harris Poll COVID-19 Tracker fielded August 7th – August 9th, 2020, we examine America’s strong support for restoring full unemployment benefits. And we recap our recent webinar with MDC on the rising stress in America and a chance to reinvent healthcare for the better.

In a new partnership with Fast Company, our polling finds risks of another public health crisis running parallel to the pandemic fueled by the difficulties of scheduling doctors appointments during COVID-19. These include missed vaccinations, routine appointments like physicals and other essential care.

We continue our look at Big Tech with Fast Company as well and find some good news for Silicon Valley. Our AD AGE Small Agency Summit presentation is also covered here as is the hidden story of the COVID generation gap emerging.

As a public service, our team has curated key insights to help leaders navigate COVID-19. Full survey results, tables, and weekly summaries can be accessed for free at The Harris Poll COVID-19 Portal. We will continue to actively field on a regular cadence to track the shifts in sentiment and behaviors as the news and guidelines evolve.

America to Congress: Fix Unemployment Benefits

Our recent USA TODAY/Harris Poll survey demonstrates the stark pain that millions of out-of-work Americans are facing over the renewal of Unemployment Insurance. Now that Trump’s Executive Order over the weekend promises a $400 unemployment extension, Americans still say more is needed to be done.

- Over eight in ten (82%) Americans believe the expiration of the $600 unemployment bonus will have an adverse effect on the U.S. economy, and nearly three-fourths (72%) think economic growth will be a lot worse in the months to come. And economists agree.

- The majority of Americans feel kinship to the more than 25 million out-of-work, fearing that they might be next. About half (56%) fear they may lose their job due to the coronavirus outbreak.

- Overall, nearly half (48%) expect their personal finances to be generally worse off in the coming months, while (39%) say the expiring unemployment benefits will have an impact on their personal finances (45% men vs 34% women).

- To put this worry into context, American voters in our Harvard CAPS/Harris Poll found last month that over two-thirds of voters say the economy is weak, which is a stunning four month symmetrical flip in attitudes. (61% now say the economy is weak; 39% say it is strong).

- Despite some improvement in unemployment numbers and the Nasdaq hitting a record high, the New York Times says joblessness remains “alarmingly high.”

- We also asked, do you think your income in 2020 will be lower, higher or about the same as it was in 2019? More than one-third (34%) say it will be lower, but (43%) said the same and (23%) said their income would be higher.

- There is a silver lining to these stimulus programs: consumer credit-card debt is declining.

- Those who are hurting economically tend to skew younger, people of color, and those making under $50K annually. We asked, as a result of the pandemic have you sought out new/additional sources of income? And (35%) of Americans said yes, including (46%) of Gen Z/Millennials, (47%) Black Americans, and (43%) Hispanics.

Takeaway: It’s important to understand that there are two economies in this crisis. Those who tend to be holding equities and have other sources of revenue coming in are faring better than those who are relying on cash flow from their salaries. But the extent of the Americans who perceive their plight in our data makes us think they are worrying about their own. Leaders take note.

Reinvent Healthcare Amid COVID

Since the start of the COVID-19 pandemic, we have been actively tracking American sentiment toward their healthcare. In our latest Curated Conversation with MDC Partners, we dove into findings around consumer perception of telehealth alternatives and the resiliency of these emerging trends.

- Set against the backdrop of COVID-19, the future of America is stressing people out. Our recent study with the American Psychological Association found that a record (83%) of Americans say the future of our nation is a significant source of stress (+17 points since 2019).

- As The New York Times further analyzed, (46%) of parents with children under 18 said their stress level was high, compared with only (28%) of adults without children. This resulted in (69%) of parents looking forward to a new school year.

- It’s not just about COVID-19, but also systemic inequality and injustice. Over half (55%) of Black Americans say discrimination is significant source of stress (+13 points from May 2020 to June 2020).

- Teens are also feeling the pressure, and believe it will last after COVID-19. Eight in 10 (81%) U.S. Teens say mental health is a significant issue for young Americans according to research conducted with the National 4-H Council. A majority (64%) of U.S. Teens believe that COVID-19 will have a lasting impact on their generation’s mental health.

- As stress builds, employer sponsored healthcare has taken center stage. According to our most recent wave, over half (56%) of Americans are afraid to lose their job as a result of COVID-19. Unless unemployment figures improve significantly, which looks unlikely, many Americans are at risk of losing coverage. Already, according to Families USA, 5.4 million workers have lost access between February and May of 2020.

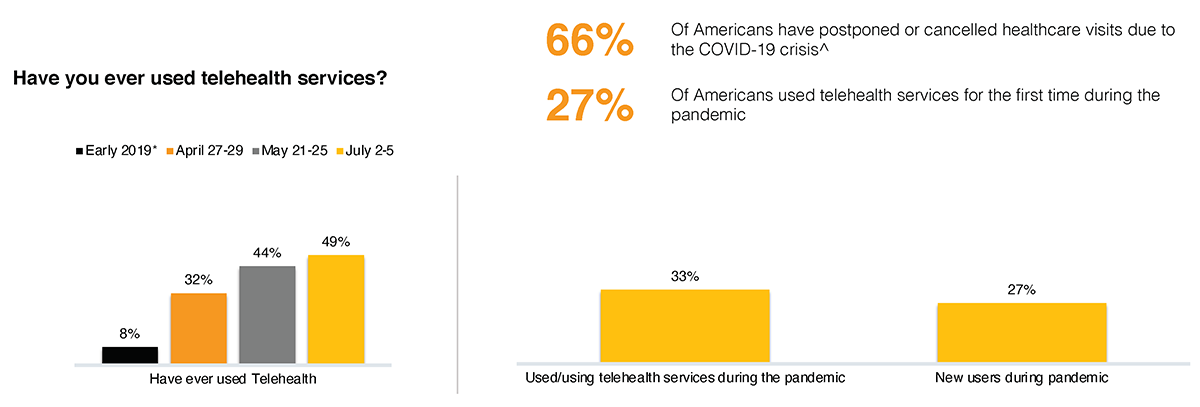

- What are the ramifications? Two-thirds (66%) of Americans have postponed or cancelled healthcare visits due to COVID-19 crisis.

- Where is the glass half-full? (27%) of Americans have used telehealth services for the first time during the pandemic, with almost half (49%) of Americans having ever used telehealth services.

- And people are now leveraging telehealth across a wide spectrum of services. Ongoing management of chronic conditions has grown 3.5x during the pandemic, compared to 2x for mental therapy sessions.

- Telehealth is here to stay. A vast majority (91%) believe telehealth services should be covered by insurance after the pandemic, with (77%) claiming they will continue to leverage these offerings.

Takeaway: The healthcare system is poised for a “reimagining.” The pandemic has allowed people to see that change is possible. Over 9 in 10 (91%) agree that the pandemic has revealed the need for everyone to have access to affordable healthcare, and a vast majority (88%) now feel that the focus of healthcare needs to shift to preventative care and wellness. Americans are even willing to give up a certain level of privacy for health and safety.

Hidden Health Consequences of COVID-19

Last week, The Harris Poll announced an exclusive polling partnership with Fast Company to conduct ongoing surveys to deepen Fast Company’s coverage of tech, work life, design, innovation, and the big ideas that are changing the world. In a recent study we conducted with Fast Company, our team unveiled the risks of another public health crisis running parallel to the pandemic fueled by the difficulties of scheduling doctors appointments during COVID-19. Here are some key findings:

- Nearly a fifth (16%) of parents are claiming their children haven’t received all of the recommended vaccinations because COVID-19 has made scheduling inconvenient or impossible.

- Before the outbreak, a majority (64%) of parents claimed their children received all or most of their vaccines on schedule with an additional (17%) slightly off schedule.

- In light of these risks, over half (52%) of parents said they would consider taking their kids out of school if vaccination rates drop significantly at their kids’ school, while only (22%) said they’d let them continue attending school.

- In May, the Centers for Disease Control and Prevention released a study showing that routine pediatric vaccinations had gone down after a national state of emergency was declared on March 13.

- Too freaked out to go: the number of parents opposing vaccines due to concerns about health risks has increased since COVID-19 began as well. Before the pandemic, it was (7%) and now it’s up to (9%).

- “It’s a potential public health crisis,” Dr. Megan Tschudy, assistant professor of pediatrics at the Johns Hopkins University School of Medicine, says of the findings. “It’s another layer of unintended consequences of COVID. There are so many levels. People are not taking care of routine things, too. It’s a concern many of us have.”

- What about a COVID Vaccine? Americans are very split on a potential COVID-19 vaccine being successfully developed in the next 6-12 months.

Takeaway: Although pediatricians are working to make their offices feel safe for parents by doing more frequent deep cleans, scheduling healthy patients and sick patients at different times of the day, and more, parents still seem hesitant to leave the house. With so many questions around the return to school and vaccinations, it will be interesting to see what the Fall will bring.

Big Tech: Thriving or Surviving?

Last week, we dove into the divide in sentiment around different tech companies and began to look at the effect COVID has had in the industry. Despite the scrutiny, Big Tech continues to thrive amidst the pandemic with a combined $28.6 billion in profits in Q2. And we found that Big Tech may be experiencing a PR boost among younger people, according to our latest survey conducted with Fast Company.

- Nearly half (43%) of 18-34 year-olds said their perception of tech giants improved due to news about the antitrust hearing and (63%) said that their usage of the companies’ products and services increased. This quite a jump from what the rest of the overall population reported last week.

- The country is divided on whether big tech companies should be broken up: (41%) believe the government should break up some or all of these firms. However, the majority of Americans are either unsure (30%) or think the government should not break-up Big Tech (29%).

- However, Americans are still extremely uncomfortable with their business models’ reliance on user data. Though nearly all Americans (86%) use services like Amazon.com and Instagram, and three-quarters (75%) access them daily, only (9%) feel that it is “completely worth it” to allow sale of their personal demographic and preferences to marketers.

- Not only are business models in question, but also brands’ equity. Ad Age recently featured an Op-Ed from our Co-CEO Will Johnson that highlights how the Facebook boycott’s power lies less in its financial might than its PR profile.

- The New York Times crunches the numbers and finds “it may have caused more damage to the company’s reputation than to its bottom line.”

- Americans are in favor of companies that punish for hate speech: (47%) of Americans said they would have a more positive view of brands that suspend their social media advertising because of hate speech.

- Over a quarter of Americans (27%) said they would be more likely to buy products from companies that have stopped advertising on social media in order to protest hate speech; in contrast, (23%) said they would be less likely to do so.

Takeaway: Big Tech has never been more in the hot seat. Almost all aspects of the companies are in question, from business models to their brands, yet we still see them continue to thrive. We’ve seen consistently that Americans will trade convenience and simplicity for criticism that leads to the type of change some lawmakers seek. Watch public opinion to see how America governs on this issue––especially young Americans.

Small Agencies Bounce Back

Our small agency partners have been especially hit by the economic fallout as corporations slash their marketing and advertising budgets. In order to better understand the effects and recovery efforts, our Co-CEO Will Johnson surveyed small agency leaders and presented his findings at the Ad Age Small Agency Conference & Awards last week. Here are some highlights:

- Unsurprisingly, most (54%) are struggling to meet pre-COVID sales targets. However, nearly a fifth (19%) of small agencies claim to have hustled and are therefore ahead of pre-COVID targets.

- Though Diversity & Inclusion initiatives are a top concern for leaders, there is a mismatch in results and efforts. While (58%) strongly feel their hiring practices and policies promote diversity in the workplace, only (17%) of agencies strongly feel they are diverse.

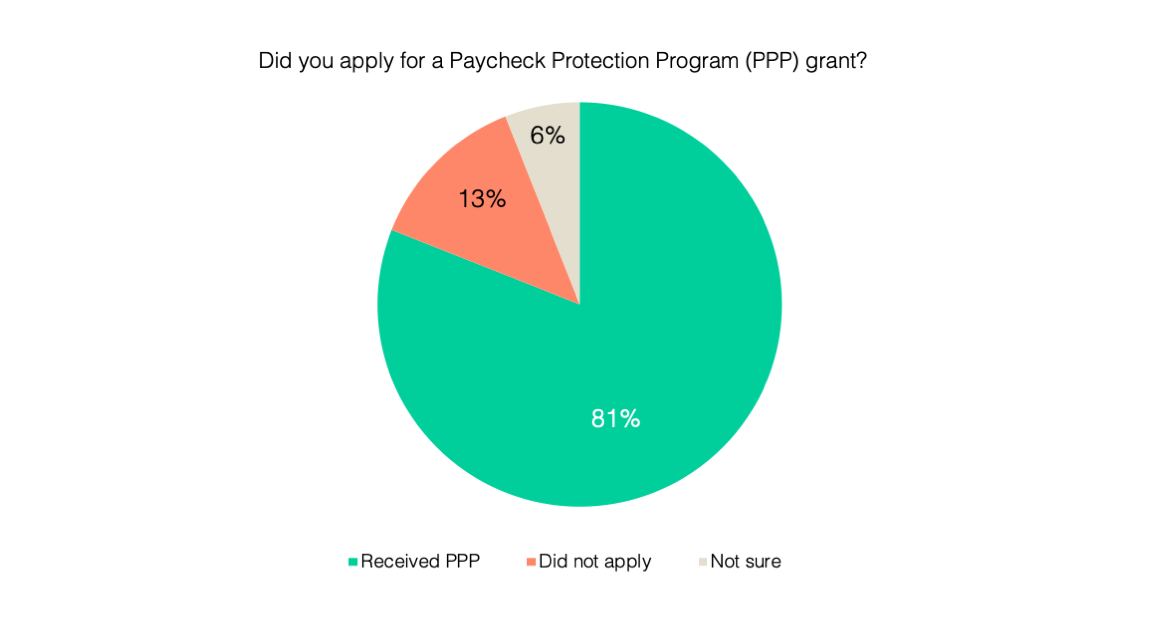

- A common theme among all companies is a focus on retention and many have been able to avoid layoffs: 8 in 10 (81%) of small agencies surveyed received a PPP grant, and a large majority (77%) have been able to avoid any layoffs and/or furloughs.

- For the 23% of agencies that did conduct layoffs and/or furloughs, they estimated both figures at an average of 19.5% and 3.25% respectively. Most (57%) are actually recruiting, in comparison to (36%) of agencies on a hiring freeze.

Takeaway: As go small businesses, go small agency partners. Given that small businesses are the backbone of America, small agencies join that community. But they must move past cost cutting to find new inventive ways to serve their clients and differentiate their offerings. Now is the time to stand out.

The COVID Generation Gap

Over the past 23 waves, we have seen the ramifications of the pandemic reach far and wide into unexpected parts of our lives. In our most recent Edward Jones and Age Wave study, we dug deeper into how COVID has accentuated the stark contrast of the financial pressures that face the old generation versus the young.

- Retirees are half as likely to worry about financial security. As reported by CNBC, roughly one-third of Millennials (32%) and Gen Z (31%) say that COVID-19 has had an extreme or very negative impact on their financial security. They are nearly twice as likely to say this as their parents.

- Roughly 68 million Americans are changing their retirement plans: nearly 3 in 10 (29%) will retire later than planned due to COVID-19, in comparison to (10%) who claim they will retire earlier.

- Generational generosity: One-fourth of all parents with adult children, approximately 24 million Americans, have provided financial support to adult children due to COVID-19, and a large majority (71%) of retirees said they would offer financial support to their family even if it could jeopardize their own financial future.

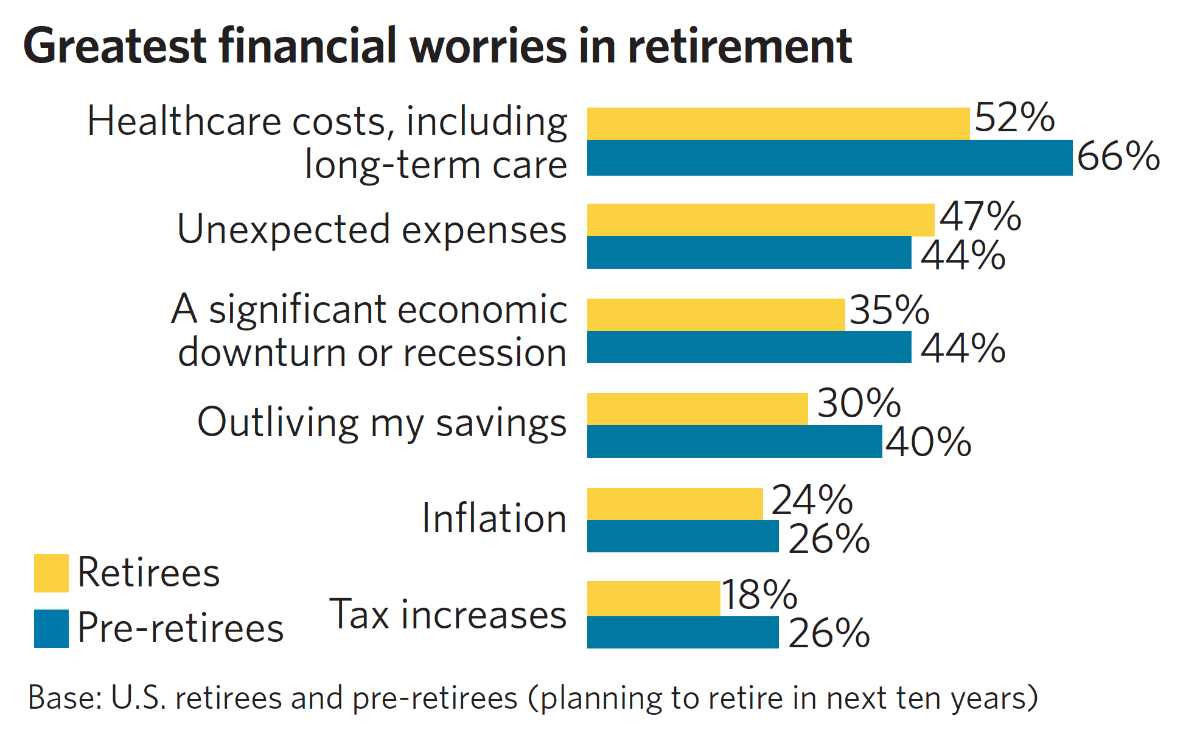

- A gap in financial concerns: the younger generations are much more concerned with healthcare & long-term care costs (66%), whereas those who have already retired report their biggest financial worries in retirement focus around unexpected expenses (47%).

- But will the younger generations be able to retire? Roughly 20 million Americans stopped making retirement savings contributions during COVID-19, and only a quarter were on track with their retirement savings pre-COVID.

- Look on the bright side: (67%) of Americans said the pandemic has brought their families closer together, despite financial hardships due to COVID.

- And, a vast majority (84%) of those working with a financial advisor said this relationship gave them a much greater sense of comfort regarding their finances during the pandemic.

Takeaway: Retirement is yet another aspect of American life that is drastically changing due to COVID-19. The only similar feeling among the older generation and the younger is uncertainty, uncertainty about what the future will bring. For the young, fear of another recession and long term health-care costs are the most pressing issues, as a result of a pandemic occurring in the earlier years of their life. Whereas for the old, the uncertainty that has come about as a result of COVID has them feeling concerned about the unexpected expenses that are yet to come.

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Download the Data

This survey was conducted online within the U.S. by The Harris Poll from August 7-9 among a nationally representative sample of 1,995 US. adults.

Download

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Download the Data

This survey was conducted online within the U.S. by The Harris Poll from August 7-9 among a nationally representative sample of 1,995 US. adults.

DownloadRelated Content