Brief • 4 min Read

In Wave 15 of The Harris Poll Cv19, Tracker fielded June 6 and 7, 2020, American consciousness rises out of protest, suggesting (possibly) this time might be different. The broad response in Harris data for change seems to mirror the multi-racial, multi-generational, and intersectional protests in America and even beyond. Our specific take here will be to assess the adequate corporate response in new data with our partner Just Capital.

We’ll also look at the state of small and medium sized businesses through the lens of The Cares Act and SMB’s perceptions of Uncle Sam’s support and the well-being of their employees.

As a public service, our team has curated key insights to help leaders navigate Cv19. Full survey results, tables, and weekly summaries can be accessed for free at The Harris Poll Cv19 Portal. We will continue to actively field on a regular cadence to track the shifts in sentiment and behaviors as the news and guidelines evolve.

The Great Reset

As reported in by the New York Times’ Dealbook yesterday, The Harris Poll and JUST Capital found that many Americans are demanding a fundamental shift in our economic system post-COVID:

- An overwhelming majority of Americans (89%) believe this pandemic has exposed underlying structural problems and big business must “reset” their priorities. A quarter (25%) of Americans go as far as to argue that capitalism is no longer good for society.

- Three-quarters (76%) of Americans claimed they would remember the missteps businesses made during the pandemic “long after it is over.” Already consumers are shifting their demand: Amazon was forced to spend an additional $4 billion on it’s COVID-19 response as it lost 8 points of market share in April according to Rakuten Intelligence. Main Street to Wall Street: We have long memories: (80%) of Americans say they will remember the companies that “did the right thing by their workers.”

- This is part of a growing broad based movement for inclusivity: As our data showed last week, the coronavirus pandemic has exacerbated racial inequality and this week we saw broad support for black people, the recognition of systemic racism and need for change: more than three quarters of Americans (77%) believe there is systematic racism in America with nearly 9 in 10 (88%) of Americans saying racial equality will be an important issue to them personally moving forward – up from (77%) just three weeks ago (May 22).

- Young people are leading the charge: Gen Z/Millennials and Gen X are more likely than Boomers and Seniors to believe there is systematic racism in America (82% and 81% vs. 73% and 68%, respectively) and while racial equality is an equally important issue across generations (86% Gen Z/Millennial; 90% Gen X; 87% Boomers; 89% Seniors). Also, younger Americans have more conviction to fight racial injustice: (70%) of Gen Z/Millennials and (64%) of Gen X say racial equality will be very important moving forward vs (59%) of Boomers, (53%) of Seniors.

- Companies have a role to play in the movement for racial equality: A majority of Americans (57%) say companies should provide a public statement on the black lives matter movement and racial inequality in America. And half of Americans (53%) say their place of employment has made meaningful efforts to acknowledge and address racial inequality. Is it enough? A near equal number (one percentage point difference) of Americans worry if the protests will go on indefinitely, or if they will dissipate and lose the ground seemingly gained over the past two weeks.

- Read more: Is America leaning in this time? Historic Oakland black book store sells out of books on racial discrimination.

- Read more: 180 CEOs from the Business Roundtable pledged to prioritize the needs of all stakeholders – employees, vendors, the environment, and their communities. Although others like The Economist, disagree, saying it is clear that capitalism needs to be reworked.

- What shape will the recovery take? U-shape, checkmark, square root symbol, and swoosh are all on the table, say economists.

Takeaway: The public has demanded big business change to better meet society needs. And encouragingly, Corporate America has been seen as part of the solution to this crisis, the problem. The widespread lift in corporate reputation we see in our Harris data reinforces the opportunity for business to lead social change.

The Impact of the CARES Act

As the money from the CARES Act and the Paycheck Protection Program (PPP) dries up, lawmakers are now arguing over the limitations of extending deadlines and plugging gaps in an unprepared system while simultaneously promoting their re-election campaigns. Rather than track the political horse race, The Harris Poll and TriNet – a comprehensive HR solutions provider – partnered to understand the extent of the impact for those who matter most – America’s small businesses.

After initial confusion on how these programs worked, small business owners began to apply for funding. By April 6th, 4 in 10 had tried to apply for funding; however, 1 in 5 of those were unable to complete the process, and 6 in 10 feel that the loans are ‘difficult to access’. This sentiment has been reflected in the operational changes:

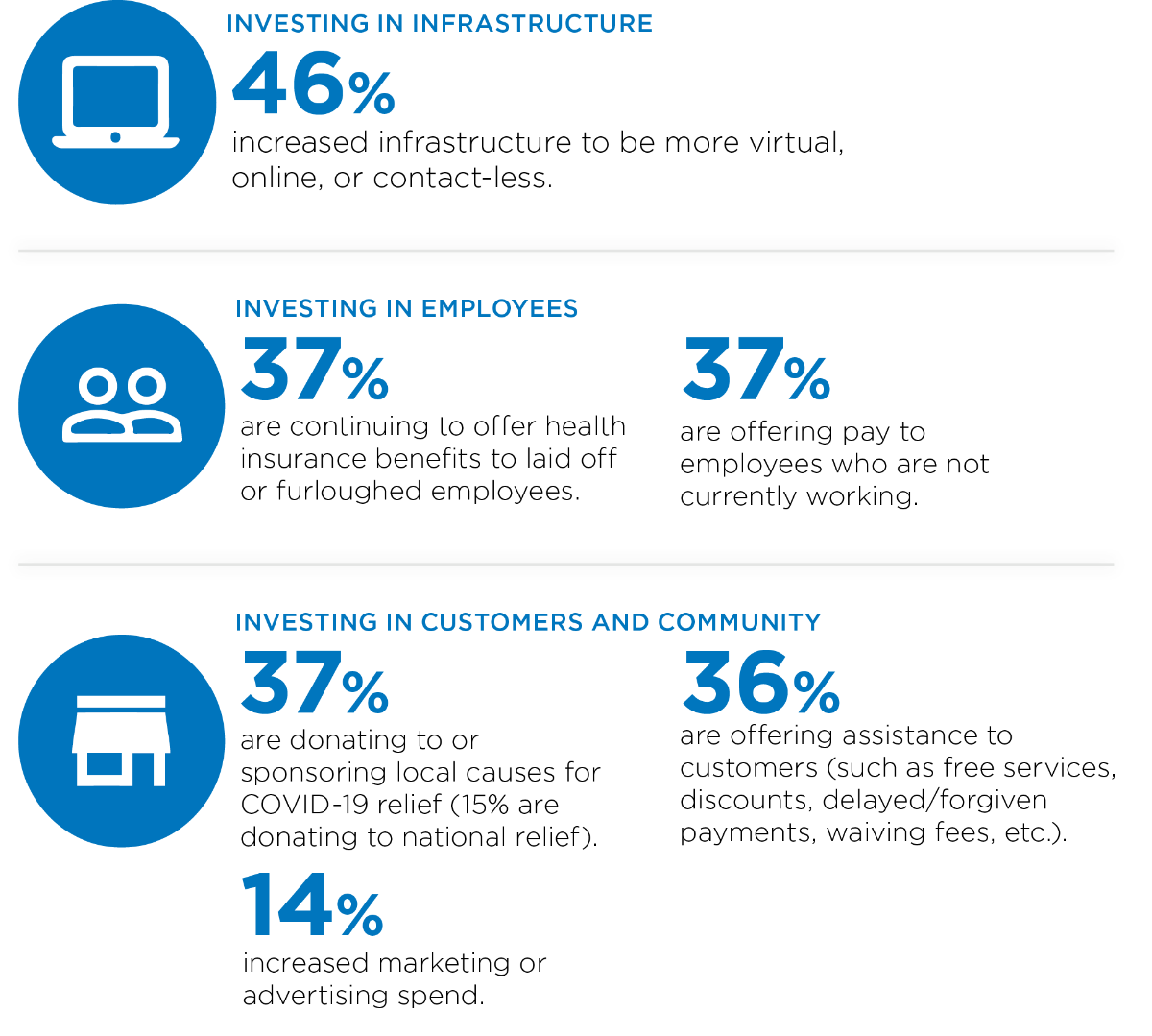

- (46%) have reduced employee hours

- (40%) of business leaders have taken a lower salary for themselves

- (34%) have reduced marketing/advertising spend

- (32%) have worked with creditors to reduce obligations

- (29%) have cancelled services

- (26%) have laid off employees

- (19%) have reduced inventory

- (13%) have furloughed employees

Although these changes will likely have long-term negative impacts for the US economy, (78%) of small business owners are making strategic investments:

Takeaway: Politicians in Washington need to take a page out of a Marketing 101 textbook and develop clear customer education. Small business owners are understandably confused and worried about the future of their business, and more importantly their livelihood.

Cars Are The New Planes

Americans miss gathering with close family/friends and are eager to reconnect through in-person events as restrictions begin to lift, but how will they get there? Personal vehicles will be the choice for movement in a post-COVID world, as they are overwhelmingly seen as the safest means of transportation now and in the future.

- The majority of Americans (65%) consider visits to see close family members as essential travel, while over half (53%) feel the same about travel for weddings, graduations, etc. of immediate family and close friends, and (46%) consider visits to see close friends essential.

- Almost one in five Americans (18%) say they are in the market for a new car once restrictions lift, up from (11%) in March.

- But (65%) say they’ll substitute vacation travel and (67%) short distance business travel with driving (although this is down 8 and 12 points respectively from last week).

- Cars are overwhelmingly viewed as the safest means of transportation right now with (90%) of Americans viewing them as very safe or somewhat safe, they are also anticipated to be the safest 3 months from now by a wide margin (89%).

Takeaway: Americans feel their car envelops them in a level of safety that other transportation choices cannot offer. The urge to get out and reconnect as restrictions lift while maintaining the feeling of safety should drive more personal vehicle usage, oil and gas and purchase intent (as well as the associated service and maintenance) at least through the remainder of the year.

SMB Government Support and Workforce Impacts

While SMB resiliency has remained strong, confidence in government support is an area that has waxed and waned throughout the pandemic. The Harris Poll TriNet survey also set about to monitor the level of support SMBs felt they were getting from the government over the past couple of months as well as the impact the pandemic has had on SMBs’ workforce.

- Is the government doing enough to support SMBs? In early April, over half (58%) initially said yes. Since then, this sentiment has been very volatile, dropping to a low between April 28 – May 1 (38%), and then rising to (46%) between May 5-8.

- As of early May, six in ten SMB leaders (60%) have reduced their workforce in some way including reducing employee hours (47%), furloughing employees (26%), or laying off employees (22%).

- How else are businesses adapting? As of early May, over half (57%) of SMB leaders have made one or more of the following types of changes to their business: shifted business model to be more online/virtual (40%), changed product/service offering to address pandemic (20%), changed product/service offering to keep revenue coming in (18%).

Takeaway: SMBs are continuing to prove quite resilient and nimble throughout this time, despite the blow that the pandemic had dealt them. As things begin to open up, it will become apparent whether or not the level of government support and measures SMBs have taken will have been enough to get them through these troubled times.

Employee Investment

As we have seen, the pandemic has had a hefty impact on the SMB workforce. Not only does this include workforce reductions, but also how they are supporting their workers from investing in the health of their employees (58%), and making shifts to a remote workforce (92%). The Harris Poll TriNet survey found:

- (82%) of SMBs take concrete actions to enhance employee well-being, with the single most effective action being increasing flexibility to balance work/home life (44%), followed by virtual gatherings (10%) and increased visibility of leadership/management team (10%).

- Overall, (74%) of SMBs say that most or all of their employees have taken advantage of the new employee well-being offerings. In fact, more than half (57%) of SMB leaders say their workforce remains optimistic in light of the current circumstances.

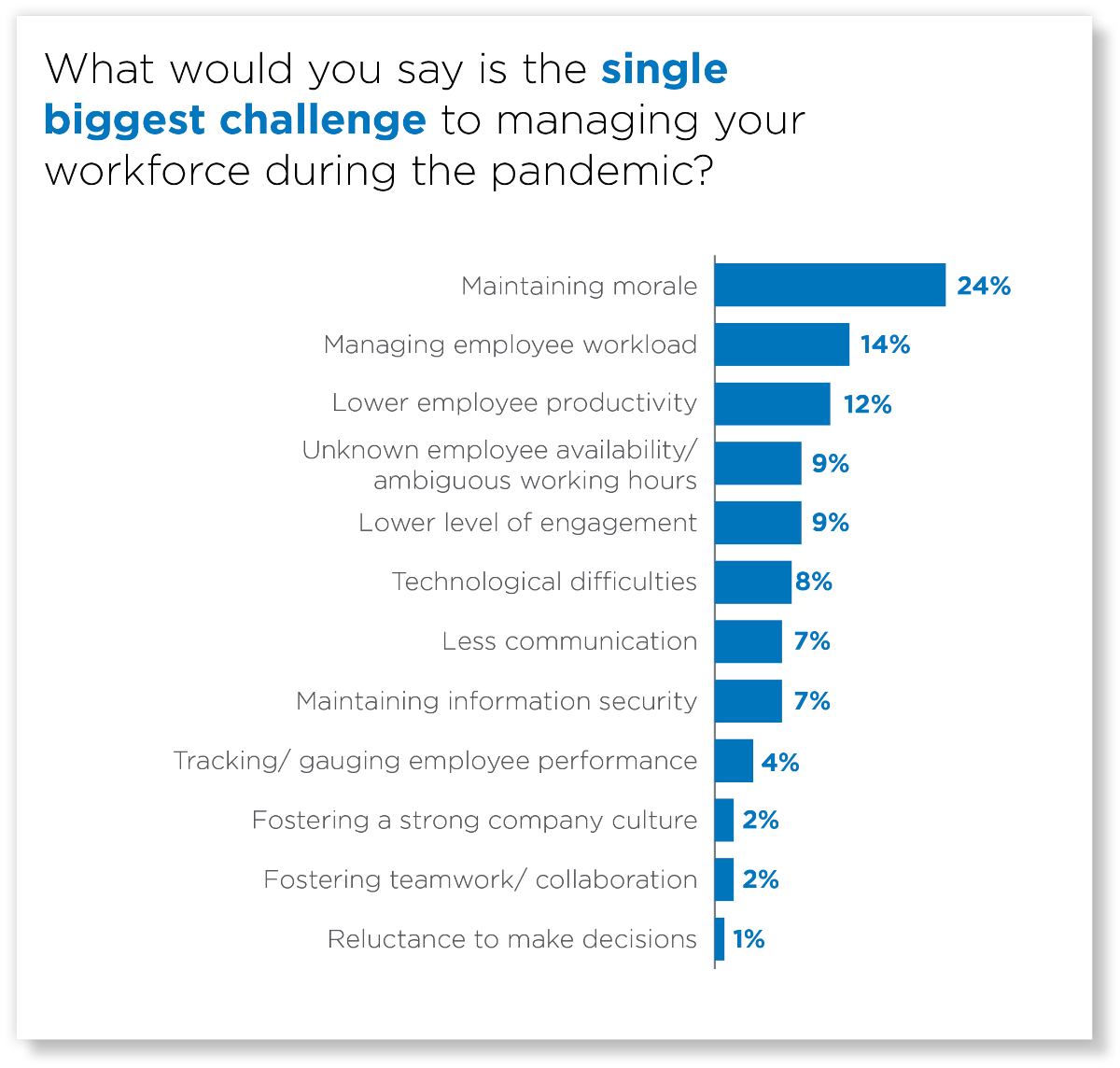

- The majority of SMB leaders (62%) indicated a downtick in productivity. However, when identifying the single greatest challenge in workforce management during the pandemic, lower employee productivity ranked third on the list for SMBs (12%).

Takeaway: What will be the impact of this change in behavior? The current state of the remote workplace has SMB leaders planning for the future once the pandemic subsides. Fifteen percent of SMBs expect that all of their employees will remain working remotely, (52%) of those for whom remote working is a possibility expect that some will remain remote, and (33%) say none of their employees will stay working remotely when the crisis is over.

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Download the Data

This survey was conducted online within the U.S. by The Harris Poll from June 6 to 8 among a nationally representative sample of 1,969 U.S. adults.

Download

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Download the Data

This survey was conducted online within the U.S. by The Harris Poll from June 6 to 8 among a nationally representative sample of 1,969 U.S. adults.

DownloadRelated Content