Brief • 4 min Read

Good morning. In Wave 10 of The Harris Poll COVID-19 Tracker fielded May 1 to 3, 2020, we examine ten waves of data to project where Americans’ lives are changing. We’ll also examine the hoarding of meat while not flying and the expectation of a very different workplace. Our team also explored the shifts in fitness behavior and the rise of gaming. Lastly, we’ll explore the types of aftershocks Americans say they will tolerate in getting back out into the world. (Hint: Everyone of us will trade risk for something).

Our team has curated key insights to help leaders navigate the coronavirus. Full survey results, tables, and weekly summaries can be accessed for free at The Harris Poll COVID-19 Portal. We will continue to actively field on a regular cadence to track the shifts in sentiment and behaviors as the news and guidelines evolve.

What’s Changed and What Hasn’t

It feels like longer, but we are now ten waves into tracking American sentiment since March 5th. And some clarity is emerging as to how American life may be fundamentally altered as well as what might snap back:

- Our national empathy is only growing: Three-quarters of Americans (75%) who say they feel more gratitude toward others and appreciation for what they have is growing — with near equal numbers (73%) feeling more compassionate and forgiving.

- And interestingly, this softer side is also red, white and blue: 8 in 10 Americans (82%) say the most patriotic thing we can do right now is to make a national sacrifice to stay home for the welfare of others; this has slipped only marginally, even as economic pressures mount. In fact, nearly 9 in 10 Americans (89%) have taken steps to make sure they leave their residence as little as possible, up from (76%) on March 15th. The same goes for taking preventative measures such as washing hands frequently.

- We are trying to be better to each other: Despite financial hardship (31% have had to cut back on savings), Americans are nearly twice as likely to be planning major gift purchases when business reopens than they were five weeks ago (21% vs. 12%). Parents especially (25% vs 16%) want to splurge on their families, (43%) of whom feel regret for the emotional toll the crisis has taken their children during stay-home orders.

- Exploring closer to home is another consistent desire. Americans are now nearly twice as likely to be considering a car purchase than five weeks ago (19% vs.11%). And over the same time period, vacation planning is up nearly ten percentage points (33% vs. 24%). We know from consistent fielding that venturing out is correlated with distance and familiarity, suggesting road trips over long haul flights and nature/wilderness over urban destinations may be this summer’s trend.

- We’ve also grown comfortable with telecommuting: On March 30th, (63%) of Americans said they’d be willing to go back to the office immediately or within the first month once the government provides information that the spread of the virus is flattening. Yet today only (49%) say that. In fact, (84%) agree that “If the work is able to be done remotely, employers should not require their employees to return to the office until COVID-19 is no longer a threat.” Looking forward, we want some blend of home and office.

- It’s prime time to rethink the mall: Bricks and mortar retailing was hurting before Cv19, but now Americans are accelerating their online shopping along with their zooming and other digital adaptive behaviors from the bunker. In fact (49%) say they will be doing more online retail shopping for items such as clothing as restrictions lift with only (15%) say they will be doing more in-person shopping than before.

- Speaking of online fashion, virtual catwalks: Is this the future fashion show?

- More takes: The U.S. consumer is nesting. Will that last?

Takeaway: After 9/11, unity and resolve gave way to partisanship and division. But this time a shared national value toward empathy and selflessness is building off climate change, gender inequality, new generational values, and the remarkable sacrifice of our healthcare workers. Critically, it doesn’t require us to be together physically. Could our Zoom distance make us more relatable to one another?

Where’s The Beef?

In recent weeks the demand for meat has spiked during the COVID-19 pandemic and the shortages that were on the horizon are nowhere. Yet as consumers hoard meat, workers continue to work in close-quarters at factories causing virus outbreaks and shutting down plants, further worsening shortages. Our polling asks, when is consumerism a public health danger?

- Eight in 10 Americans (80%) are aware of potential shortages of meat and half (50%) are stocking up on at least one type of meat or fish: (41%) are stocking up on chicken, (37%) on beef, (27%) on pork, and (27%) on fish.

- As a result of the run on meat, Costco now limits customers to 3 meat items per person, when in fact they should say ‘men’: In our survey, men are hoarding chicken (47%) vs. (37%) women as well as beef (43%) vs (31%) women. (Can’t get beef? The newest isolation trend: Flour shaming).

- President Trump has used the Defense Production Act to keep meat companies open to combat shortages, but twenty plants had been closed with over 1,000 exposures and 15 fatalities according to The United Food and Commercial Workers, which represents meat processing workers.

- As WSJ states, “President Trump’s executive order allowing meatpacking plants to continue operating through the coronavirus pandemic is stirring concerns among local officials, wary of new spikes in infection rates if closed plants rush to reopen”.

- Fox News reports “nearly 900 workers at Tyson Foods plant in Indiana test positive for coronavirus.”

- Our Harris Poll special report on Everyday Heroes, those front line workers in factories, grocery stores, and food delivery found one-quarter (25%) say physical distancing from co-workers or their customers/the public is not possible given the nature of their work. Moreover, (42%) of workers are practicing social distancing from family members at home and (23%) are going even further by self-quarantining.

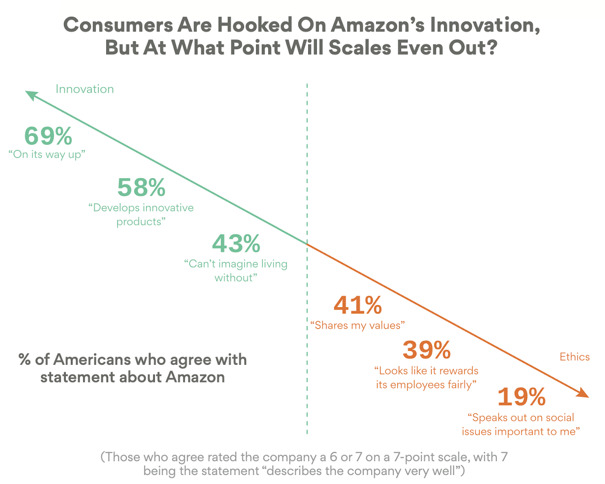

- That’s a steep price for a hamburger. We found similar compartmentalizing of consumer responsibility where (in the same 2019 survey) consumers praised Amazon’s essential role in their lives while simultaneously criticizing their corporate values (see chart):

Takeaway: There is a hidden consumer indifference in binging. Consumers hoard meat without consequence, forcing companies to meet demand and workers to risk unsafe working conditions. Ironically, consumers are the first to call out company supply chains for lapses of integrity, but what about our own spending? WW2-style rationing might be warranted again.

No-Fly Zone

The skies aren’t friendly. Air carriers are expected to lose more than $300 billion of revenue this year and the prospects of getting flyers back are hampered by (in our new survey) passenger reluctance to accept half-measures of hygiene:

- Masks alone don’t fly: Despite new mask policies by JetBlue and others this week, half of Americans (48%) say even given that they will not feel comfortable flying until the pandemic is fully over.

- Airlines need to make safety measures efficient: Almost 8 in 10 Americans (79%) say they are less likely to travel if additional sanitation measures require passengers to arrive up to four hours before their flight If additional sanitation measures require airline passengers to arrive up to 4 hours before their flight.

- Worse, Americans don’t feel the same sympathy towards airlines like other battered industries. Only 1 in 5 (19%) say their opinion of the airline industry has become more positive in the pandemic; less than all other measured industries aside from real estate and about half that of other struggling industries such as small business (42%) and restaurants (38%).

- However, a more holistic safety approach works: (28%) say if the required mask policy is mixed with additional safety and sanitation measures, it would make them feel comfortable to fly again. As we urge, think of safety as a customer journey.

- The airline industry has received $60 billion in relief amid a growing clamor to say no to big company bailouts. In echoing a refrain from the financial crisis, academics argue that larger companies differ from smaller ones in that, among other things, they tend to survive bankruptcy, according to Quartz.

- Thankfully, our data that shows Americans want to get back to flying (41% miss flying on an airplane) and who will do it first: within the first three months, (41%) of men vs (26%) of women; (40%) of Gen Z/Millennial and (37%) of Gen X vs (27%) of Boomers and (25%) of Seniors. One positive motivator? Frequent Flyers lament the loss of their status.

- Axios outlines the difficulties ahead for flying: Air travel will never be the same after coronavirus. Harris Poll and Forbes suggest four ways airlines can get Americans flying sooner.

Takeaway: Airlines need to think about ‘early adopters’ who will come back first and set the tone for others. To woo them back, both safety and efficiency will need to be addressed to meet the needs of men, high-status business travelers (men and women), Gen Z leisure travelers, and higher-income households (those we identify as the first to return to flying).

Death of The Open-Office: A Boon to Real Estate?

Try this logic: Offices of the future will need more space to ensure safety in a post-pandemic world and open floor plans will become a thing of the past. But workers will want six feet at all times so floor plans will actually have to expand, rather than contract.

- Social distancing means less open spaces: (80%) of Americans agree that employers should move towards sectioned-off offices and phase-out open-floor plans to ensure social distancing. And this sentiment runs across all ages of the workforce including (81%) Boomers, (83%) Gen X, and (73%) Gen Z/Millennials.

- A gradual and staggered return: While a majority of Americans are hesitant to return to the office, a third of Gen Z/Millennials office workers will return at least a few days per week when allowed so as to reduce interaction with others. Overall, almost 8 in 10 (78%) agree that employers should stagger when employees are allowed to work from the office to ensure social distancing.

- A zoning code for COVID-19: Also, nearly 9 in 10 American workers (88%) think employers must have clear guidelines outlining safety precautions before they allow employees to return to the office; across (90%) of Boomers; (80%) of Gen Z/Millennials. Some companies are using basketball technology to fight COVID-19 on the factory floor.

- And Americans will just wait until their offices are reconfigured accordingly: (83%) say employees should be allowed to work-from-home during the pandemic until they feel comfortable to return to their office.

- Also, as our polling in Fast Company shows, many consider leaving urban hot spots to suburban and even rural life.

- And with many companies telling their employees to work from home for the rest of the summer (or longer), will they also consider semi or permanent leases for larger floor plans in less expensive zip codes? As we polled for Axios Americans keep wanting to distance themselves from cities and now even suburbs. So should investors short urban commercial real estate and invest in the great plains?

- On that point, Americans are embracing the trappings of a rural lifestyle during the coronavirus pandemic, according to the CEO of Tractor Supply, which has reported a spike in sales as thousands of families take on gardening, soil tilling and chicken breeding for the first time.

Takeaway: American workers demand their safety before returning to the office and employers will have to reconfigure workspaces and floor plans accordingly. Simple math shows that most offices will not be able to host the same amount of employees as before the pandemic. Either a permanent phasing of workers will occur, or will employers want more space so they can see all their employees working?

Fitness Behaviors Shift, Tech Follows

Both online and offline physical activity fuel feelings of hopefulness, relaxation, and a general sense of well-being. Tech-based workouts have the added benefit of also helping to improve participants’ sense of connection more than offline fitness behaviors. Additionally, these workouts are easy to access for most; only 6% report any tech-based issue with doing a virtual workout. But can virtual workouts alone cut it for American’s during the pandemic?

- 45% of Americans are exercising more over the past month; parents and affluent households most likely to be part of this fitness boom.

- Tech-enabled fitness is on the rise and 27% of Americans have increased their usage of virtual fitness tools, but non-fitness results are mixed: while these online classes & services do fuel a sense of well-being and motivation, they come with a potential downside – they are more anxiety-producing than offline fitness.

- However, tech can’t replace the need to get outside: As Americans search for ways to reduce anxiety and feel motivated and productive, they are finding outdoor exercise is one of the best cures – positively impacting mental state more than any tech-enabled behavior examined (video calling, online learning, etc.).

Takeaway: Consumers will be best served by tech in fitness when digital acts to enable the analog. Can you help fuel more mentally rewarding ‘analog’ based activities? If fitness companies can find a way to provide an anxiety-free (or anxiety-limiting) experience, there is a strong opportunity for brands to have a meaningful impact in this moment. Considering only 55% indicate they would go back to the gym within 3 months, there is a window for brands to help users forge new home-based habits and to help make their products and services ‘sticky’.

Gaming on The Rise

In the absence of physical sports, both offline and online gaming is increasing. In fact, puzzles and games have been one of the retail bright spots of the pandemic. But will buying that Nintendo Switch help or hurt Americans? Online gaming is unsurprisingly on the rise, but it’s causing almost as many problems as it is solving.

- 18% of Americans have increased their engagement with online gaming in the past month.

- Gaming-based platforms DO provide a sense of relaxation and reduced anxiety for many, but are equally as likely to increase loneliness as to decrease it. Further, gaming is a top contributor to sleep disturbances and poor dietary habits.

- Given the current restrictions, 20% of sports fans say their top live sports ‘alternative’ would be watching current sports stars play their sport virtually (though the biggest group at 41% would prefer live sports with no fans in the arena).

Takeaway: Though we cannot say when sporting events will be back, there may be an opportunity for gaming companies to step up in the current environment. As consumers look to find both entertainment and connection via gaming-based online interactions, brands stand to gain by enabling authentic connection and messages of wellness and good habits.

Waiting for Aftershocks

As certain parts of America open back up, officials in Georgia and elsewhere will be closely watching coronavirus infection rates as they lift restrictions. The same goes for ordinary Americans weighing the risks for repercussions in resuming their lives. Large majorities say everyday life won’t resume unless the odds to feel safe increase.

- No place like home: With nearly 9 in 10 Americans (89%) saying they leave their residence as little as possible, new Harris Poll data identifies that each of us has certain trigger points where we are more apt to take risks to pursue activities we value or feel compelled to do either for desire, economics or both.

- Take for instance where you live: One-third (34%) of Americans remain very concerned about returning to normal activities, but rural Americans are almost half as risk-averse (25%) as urbanites (44%).

- It also depends on what you need: In our new study, (34%) of Americans have sought out new/additional sources of income, meaning venturing out for gig work, extra hours at essential retail, etc. is not a luxury, but a requirement.

- But it is also a personal choice of what we value: We observed in our Harris surveys that business travelers are willing to take far greater risks for what they deem essential: Among them, (44%) are willing to even fly internationally (right now!) to countries that have ongoing/widespread community transmission (CDC Level 2 and 3 countries) as (82%) for business meetings with prospective clients, regardless of where they are.

- Even Leisure Travelers would risk a lot to see close family members: A quarter (25%) are willing to travel domestically to regions that have ongoing/widespread community transmission and nearly three-quarters (73%) say visits to see close family members is essential for them.

Takeaway: What’s essential is what’s personal. We will all be navigating personal aftershocks of the crisis. In addition to providing a safety net for commercial activity, business must also study society for these inherent and yet urgent desires. Because what seems risky to some, feels essential to others.

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Download the Data

This survey was fielded online among a nationally representative sample of 2,039 U.S adults from May 1–3, 2020.

Download

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Download the Data

This survey was fielded online among a nationally representative sample of 2,039 U.S adults from May 1–3, 2020.

DownloadRelated Content