Brief • 4 min Read

In The Harris Poll Tracker (Week 101) fielded January 28th to 30th, 2022 among 1,998 U.S. adults, we look at the full cost of poor communication for businesses, the importance of data and analytics for customer success, how employers aren’t meeting workers’ expectations for training and development, the pandemic’s impact on the cloud boom, and how investors are pushing Chicago companies to increase ESG.

Tune in for our America This Week: From The Harris Poll audio event this Friday at 10am on LinkedIn for a data driven discussion between our CEO John Gerzema and CSO Libby Rodney. They’ll be covering the latest trends in society, the economy, and the consumer marketplace.

As a public service, our team has curated key insights to help leaders navigate COVID-19. Full survey results, tables, and weekly summaries can be accessed for free at The Harris Poll COVID-19 Portal. We will continue to actively field on a regular cadence to track the shifts in sentiment and behaviors as the news and guidelines evolve.

U.S. Businesses Estimated to Lose $1.2 Trillion Annually to Poor Communication: Grammarly-Harris Poll

In our latest data in partnership with Grammarly and covered by Yahoo! Finance, business leaders illuminate why success in a hybrid landscape hinges on improving communication. Here’s what we found:

- Over 9 in 10 business leaders report that poor communication impacts productivity, morale, and growth, contributing to increased costs, missed or extended deadlines, and reputational erosion.

- While (96%) of business leaders agree effective communication is essential, nearly three-quarters (74%) report their company underestimates the cost of poor communication.

- Three-quarters of business leaders (75%) say they spend too much time and energy resolving miscommunications.

- Employees spend nearly half of a 40-hour workweek on written communication alone (19.93 hours), and business leaders (88%) and employees (63%) alike wish their company had better and more effective communication tools.

- Communication is key: companies that grew revenue in the last year were more likely to say their team communicates effectively (92%, v. 81% whose revenue declined or didn’t change).

Takeaway: “Businesses must stop ignoring the impact of poor communication…It’s time for a reckoning of how we communicate in the digital workplace and empower teams to be successful” says Dorian Stone, Grammarly Head of Organizations Revenue.

Data & Analytics Critical to Business Success: Sisense-Harris Poll

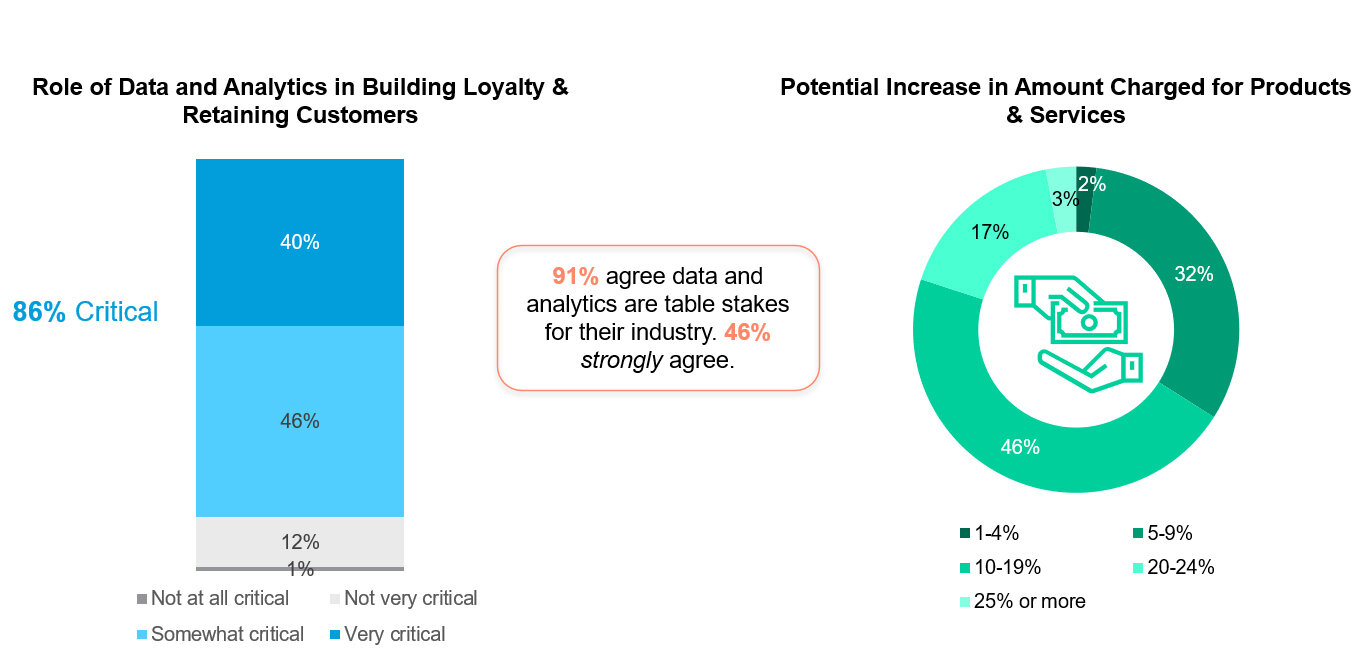

Our recent survey with Sisense found that companies offering data and analytics to their customers have a competitive advantage and reap the benefits of increased revenue and loyalty. Here’s what we found:

- Most (97%) note that customers want analytics more personalized to the specific end user and (57%) believe that customers would find prescriptive analytics most useful.

- Over half (53%) of product decision makers wish their analytics experience was more aligned with user-friendly entertainment applications, such as Netflix and Spotify.

- Nine in 10 (92%) report that data and analytics are critical for business success, and (86%) say that offering data and analytics to their customers plays a critical role in customer satisfaction, engagement, and retainment.

- For a direct tie to the bottom line, (96%) note that an increase in average selling prices would be possible with personalized and customized analytics.

Takeaway: Sisense Chief Product and Marketing Officer, Ashley Kramer, expects “organizations will redefine what it means to build a ‘culture of analytics’ by bringing insights to workers in a more digestible way, such as embedding them into regular processes so no new skills are required.”

Workers Want Training, Development, but Few Say Their Employers Provide It: American Staffing Association-Harris Poll

Workers rank professional development and training opportunities highly among their list of criteria for evaluating prospective employers in our survey with American Staffing Association and covered by HR Dive. Here’s what we found:

- Eight in 10 (80%) consider professional development and training offerings to be important when accepting a new job.

- However, employers are failing to provide these opportunities as only four in ten (39%) said their current employers have these available.

- Lack of career development is a concern for many employees as more than one-third (37%) reported being concerned that automation would cost them their jobs, with Millennials (52%) and Hispanic (49%) the most worried.

Takeaway: A note for employers: the development opportunities need to be accompanied by real career paths, including opportunities for advancement internally, as well as forward-looking conversations between workers and their managers.

The Cloud Boom Isn’t Over Yet: Microsoft-Harris Poll

Our recent survey in partnership with Microsoft and covered in MarketWatch finds that while the pandemic has turned the cloud industry on its ear, top executives believe the cloud boom is far from over. Here’s what else they have to say:

- More than 9 in 10 corporate decision-makers (92%) expect an accelerated acceptance of cloud tech, especially hybrid and multicloud offerings, over the next few years.

- Roughly two in three executives (65%) said their use of hybrid-cloud technology increased significantly over the course of the pandemic, and (60%) said the same about multicloud. Those numbers are expected to jump to (72%) and (67%), respectively, over the next two years.

- Nearly all executives (97%) said they need to be able to adopt cloud technology in some areas of their business.

Takeaway: Microsoft’s Erin Chapple, corporate vice president of Azure Core, says “customers need flexibility and choice,” who calls the survey an “independent validation of what we are seeing in the field.”

Investors Push Chicago Companies to Increase Social Responsibility: Crain’s Chicago Business-Harris Poll

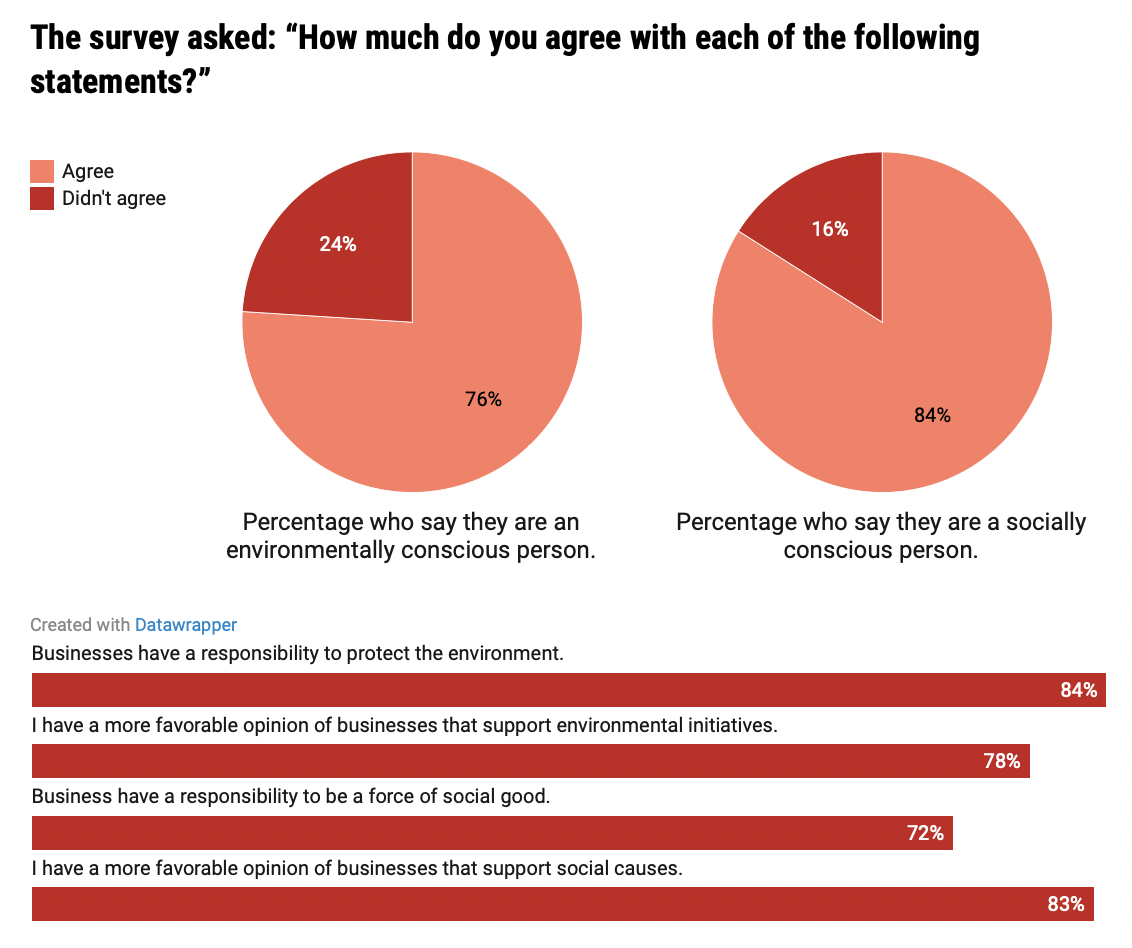

As consumers and shareholders favor socially conscious companies, Chicago organizations are encouraged to strengthen their environmental, social and governance focus according to our latest data in partnership with Crain’s Chicago Business.

- Chicagoans believe local businesses have effectively addressed issues with workforce diversity and inclusion (66%) and improved relationships with employees (59%).

- Yet, many believe company responses to other social initiatives have fallen flat as over half of residents think local businesses have ineffectively addressed climate change (59%) and executive/employee pay disparities (58%).

- It’s not just consumers: Investors care as well about ESG values with (40%) Chicago investors actively considering ESG factors, and (37%) researching a company’s ESG profile before investing.

- Further, (81%) of Millennials and (65%) of Boomers say they are more likely to invest in companies whose policies promote positive social change.

Takeaway: Chicago-area companies should follow the lead of other major companies in strengthening their ESG focus, similar to Walgreens and Boeing’s commitment to utilizing clean and sustainable energy sources in their operations.

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Download the Data

This survey was conducted online within the U.S. by The Harris Poll from January 28 to 30, among a nationally representative sample of 1,998 U.S. adults.

Download

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Download the Data

This survey was conducted online within the U.S. by The Harris Poll from January 28 to 30, among a nationally representative sample of 1,998 U.S. adults.

DownloadRelated Content