Brief • 2 min Read

Food & Beverage: An Industry Snapshot

Our recent report on the food & beverage industry explores Americans’ healthy eating goals and meal delivery subscription habits. A few key takeaways include:

- A New Year, a new diet: 63% of US adults agree that improving their diet is frequently one of their New Year’s Resolutions.

- Leaning into the label: the following claims would convince US adults that a food is healthier compared to other options – “no added sugar” (43%), “all-natural” (43%), “good source of nutrients” (42%), “low sodium” (38%).

- Cooking is put on the back burner: 52% of US adults ages 18-34 agree that in general, they don’t have time to cook meals during the week.

- Grocery bills looking a little high?: 47% of meal delivery subscribers agree that cooking at home is more expensive than subscribing to a meal delivery service.

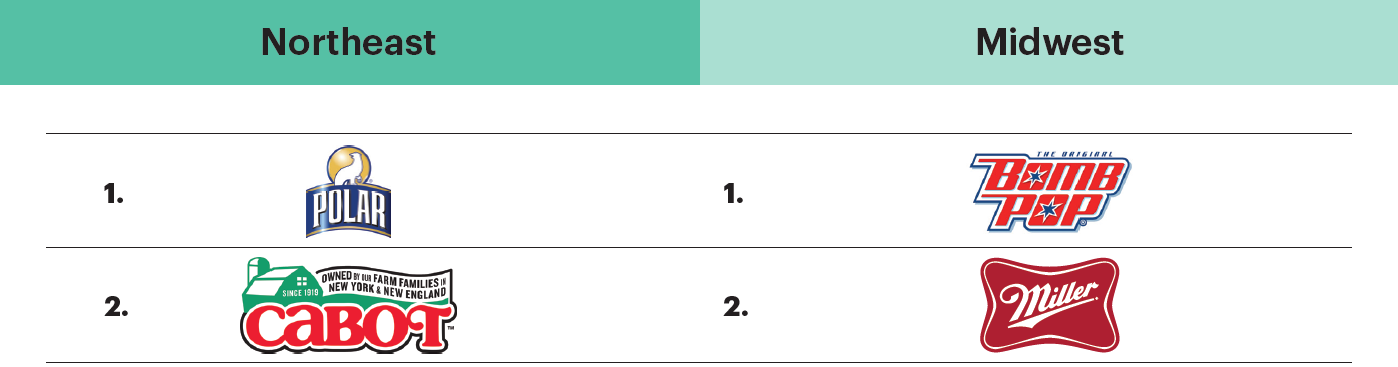

Over-Index Report: This month’s over-index report uses data from QuestBrand by The Harris Poll to capture food and beverage brands that over-index with consumers within each region of the country: Northeast, Midwest, South, and West.

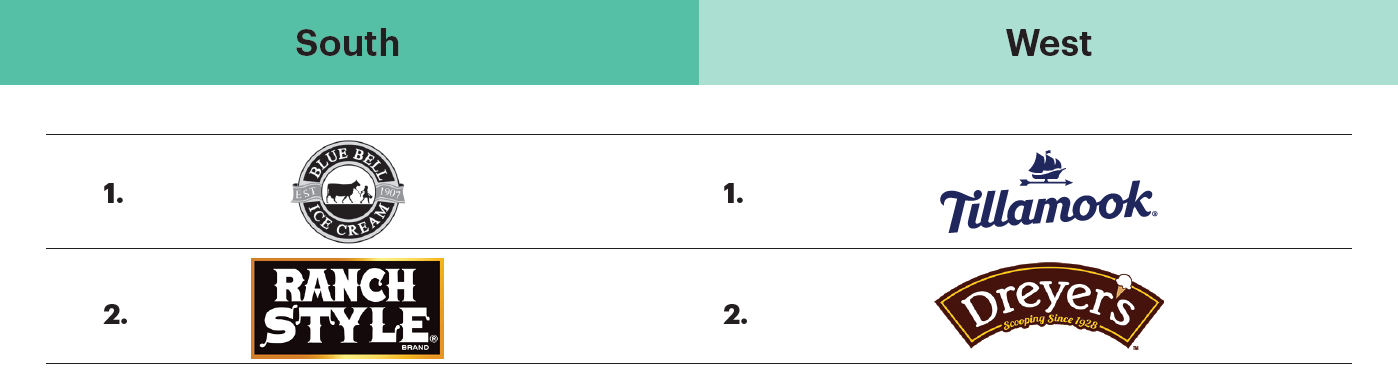

Paddington’s Popularity Surges After New Movie Release – Brand Story

It’s been 65 years since Paddington the teddy bear first appeared on children’s bookshelves. On November 8th, “Paddington in Peru,” the most recent addition to the bear’s franchise, debuted at the UK box office. Since the film’s release, the Paddington brand has increasingly resonated with British adults.

- Following the release of the third film, QuestBrand data shows a rise in brand momentum (+4.5) among adults ages 18+.

- This significant momentum uptick could be due to the recent discussion of a fourth Paddington movie and a new TV series from StudioCanal. Paddington has even gone beyond the big screen with his own immersive experiences in London continuing into 2025.

- Paddington’s popularity surge highlights the brand’s ability to transcend time and appeal to modern audiences despite making his debut several decades ago.

Will the brand see a similar rise in momentum in the US when “Paddington in Peru” comes to US box offices in February? Read the full brand story.

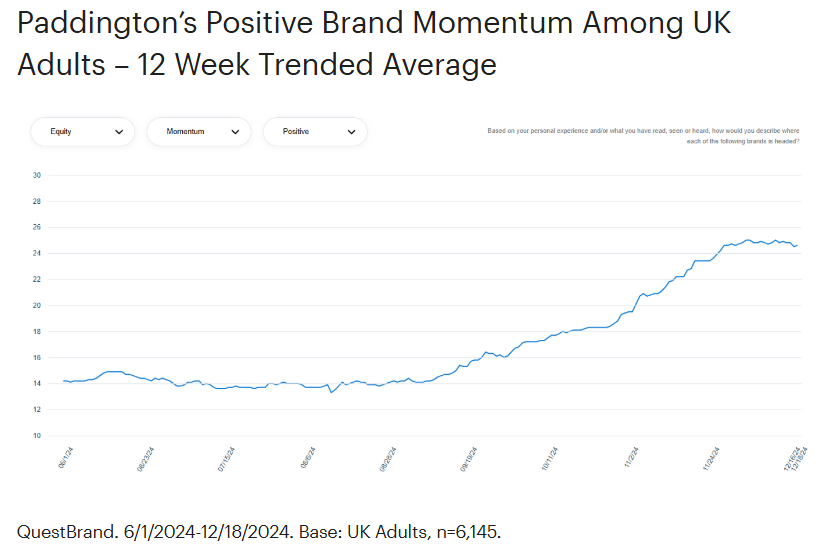

2024 American Household Credit Card Debt Study – NerdWallet-Harris Poll

A recent Harris Poll survey conducted on behalf of NerdWallet explores the state of Americans’ household debt. A few takeaways from NerdWallet’s annual analysis:

- Revolving credit card debt is up 1.5% from 2023. Households with this type of debt owe an average of $10,563.

- Is there room to rein in the spending?: 41% of Americans with revolving credit card debt say shopping for non-necessities (think luxury goods and electronics) contributed to their debt.

- Waiting for the grass to green: 30% of Americans with revolving credit card debt plan to pay off the debt once they make more money.

- Debt keeps hanging on: 35% of Americans with revolving credit card debt say they’ll probably always have some revolving balances.

Takeaway: “It’s hard to feel good about any positive economic news when you’re struggling to afford your expenses. Debt doesn’t just happen because of frivolous spending. For many, credit cards help fill the gaps when your income isn’t enough to afford necessities. Unfortunately, it can be a very expensive way to get by.” – Sara Rathner, NerdWallet credit cards expert

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Related Content