Brief • 5 min Read

Younger Voters Are Election Liars, Middle-Class Blues, Investors Try to Game the Election, and The Great Streaming Ad Backlash.

The latest trends in society and culture from The Harris Poll

Good afternoon from New York.

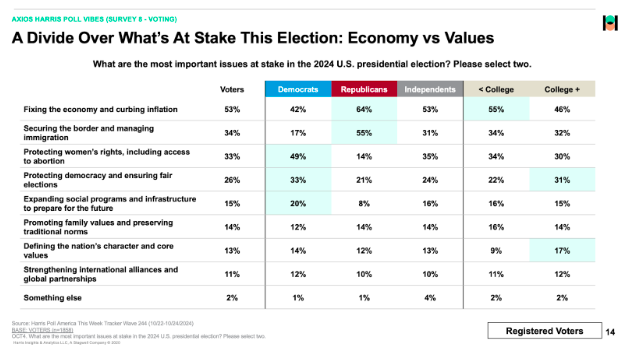

Four days until the election, the economy remains the singular issue among voters in our new Axios Vibes By The Harris Poll. Yet, as the chart shows below, economic concerns among Democrats take a back seat to women’s rights, while the economy and immigration matter most to Republicans. Independents look more like the GOP but side with DEMS on women’s rights.

This week, we have four new stories:

- Turns out, America’s youngest voters are major election liars. (with Axios)

- Breaking into the middle class has become more challenging. (with Bloomberg)

- Some panicked investors are changing their portfolios to hedge the election outcome (with USA TODAY).

- Streaming audiences fight back against repetitious ads that interrupt the vibe.

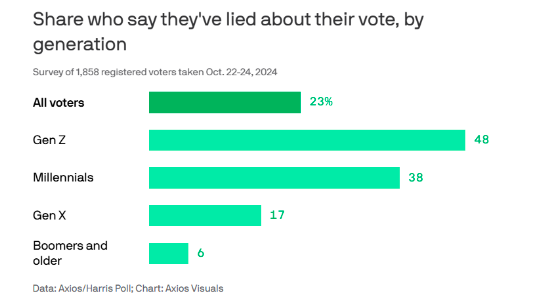

Younger Voters Are Election Liars: Axios Vibes By The Harris Poll

In our latest Axios Harris Poll Vibes research, voters may not always be truthful when asked, “Who did you vote for?”

- By the numbers: (23%) of voters said they’ve lied to people close to them about who they’ve voted for – jumping to nearly half of Gen Z (48%) and even (38%) of Millennials (v. Gen X: 17%, Boomers+: 6%).

- That’s not all: Voters across the political spectrum said they’ve lied about their voting (D: 27%, R: 24%, I: 20%), while more men have compared to women (30% v. 17%).

- Potential family backlash may be driving lying: Overall, (33%) of voters said they aren’t close to some family members because of differing political beliefs (Gen Z: 44%, Millennials: 47%).

- Zoom in: The survey captured two concurrent trends: Polarization has become so toxic that it’s driving self-censoring to preserve relationships, and conflict-averse younger people want to avoid the interaction altogether.

Takeaway: Younger voters who came of age during the hyper-polarized Trump era appear to be among the most sensitive to perceived social pressure and judgment from friends or loved ones. One reason might be that more of them are predisposed to breaking ties with loved ones (and potential love interests) over politics. Also, they are already more likely to be disenfranchised with family over political views in our survey.

Middle-Class Life Is Getting Harder to Protect Today: Bloomberg-Harris Poll

The economy is driving this election; it’s significantly more challenging for middle-class Americans to hold their purchasing power amid higher rents, sticky prices, and borrowing costs, according to our new research with Bloomberg:

- Middle-class Americans aren’t feeling the economy: Just (42%) of middle-class Americans said the U.S. economy was working for them (2%-pts) lower from October 2023.

- Housing is dragging down financial health: More than (60%) said higher living costs such as rent or mortgages hurt their economic well-being.

- And despite the Fed’s recent rate cut, it’s unlikely to spur immediate action: Among those middle-class Americans planning to make a significant purchase if interest rates come down, more than (80%) said they are waiting for rates to fall below 5%, and a third saying below 3%.

Takeaway: Inflation is primarily tamed, and wage gains have lifted incomes. Yet the economy remains the most pressing issue in the presidential race for one big reason: Increasingly, for many Americans, the long-standing building blocks of middle-class life feel frustratingly unattainable. According to Bloomberg calculations, the standard 20% down payment on a median-priced home now costs 83% of a year’s income for the typical family ready to buy a house, up from 65% on the eve of the 2016 election.

Investors Are Rushing to Game The Election: Nationwide-Harris Poll

Our latest research with Nationwide in USA Today shows that many Americans believe the election outcome will profoundly impact their financial lives,

- Over half (55%) of investors believe the results of next week’s presidential and congressional races will significantly impact their retirement plans more than the market’s performance – up (10%-pts) from a year ago.

- And if the political party they least align with gains more power in the 2024 federal elections, (34%) of investors believe the economy will plunge into a recession within 12 months.

- As (61%) believe the outcome of a presidential election has a direct, immediate, and lasting impact on the stock market’s performance.

- They aren’t just wringing their hands: More than a quarter (26%) of investors who aren’t retired planned to invest more conservatively ahead of the election, and a fifth (18%) looked to diversify their portfolios.

Takeaway: The most popular line of thinking is: “If my candidates win, I’ll be richer and can retire earlier and spend more freely. If they lose, I’ll have to be more frugal, work longer, and sock away more cash for crises.” Are they right? “Election results have between no and little impact on future investment returns,” said Kevin Jestice, SVP of Nationwide. Investors will “likely get less return” on their money over the long term if they suddenly turn cautious based on election fears.

More Streaming, Less Ads Please! AD-ID-Harris Poll

In our research with AD-ID in Digiday and Media Post, we find a point of diminishing returns for advertisements that interrupt consumer viewing and streaming – especially with the same advertising message.

- Half (49%) have skipped a purchase from a brand due to repetitive ads during their viewing, with (61%) less likely overall to buy products when inundated with advertisements.

- Ad unit overexposure ruins the experience: Similar numbers (59%) cite that repeatedly seeing the same ads hurts their viewing experience.

- You need to know your viewers: Three-quarters of consumers say they would like to see ads targeted at their interests, as (33%) don’t mind watching relevant ads.

- Read the room: Our CEO John Gerzema and CSO Libby shared in our talk at The Forbes CMO Summit that a strong vibe makes consumers pay attention to brands and that younger consumers especially want marketers to create a vibe more than anything else.

Takeaway: “Not only are consumers getting fatigued, but the investment could also be detrimental to what you’re trying to accomplish,” said AD-ID CEO Nada Bradbury. “That will be the next step — knowing how many times is too many. You can’t keep showing the same ad and expect a positive response. They must be interspersed, and I think we are failing our clients if we can’t control that.”

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Related Content