Brief • 2 min Read

1. Costco Soars Despite Inflationary Pressure – Case Study

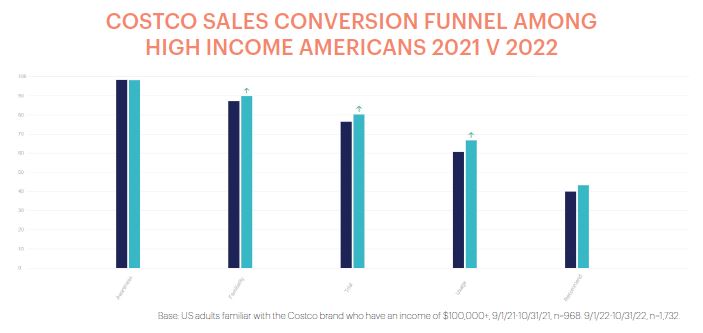

Costco is known for selling high-quality products at low prices, a strong draw for consumers facing tough economic times. Using QuestBrand data, we can see how consumer sentiment towards the wholesale retailer changed as inflation ballooned throughout 2022:

- In August 2022, the consumer-price index was up 8.3% from the same time last year, and the food index had climbed by 11.4%.

- While most Costco members are more affluent than the average American, they are not immune to stress from this year’s inflation.

- Regardless of income level, 60% of US adults (ages 21-62) feel anxious about the state of their personal finances. The promise of saving money at Costco remains a key draw for the retailer.

Download our case study to see how high inflation impacted Costco’s sales conversion funnel and the retailer’s overall brand equity.

2. Ad-Supported Streaming Could Benefit from a Creative Overhaul

In a recent op-ed published in AdAge, Harris Poll CEO Will Johnson explores ad-supported streaming. As heavy hitters Netflix and Disney+ release lower cost, ad-supported subscription plans, Will explains what viewers want to see, and what approaches advertisers should rethink:

- Seventy percent of Americans are not interested in the products they see advertised on streaming platforms.

- Just over half (55%) of viewers say that the ads they see on streaming services are less interesting than those aired on cable and broadcast TV.

- Half (51%) of adults would be willing to interact with an ad (e.g., scanning a QR code, taking a survey), if it would guarantee a show without ad interruptions.

- Three-quarters (77%) of US adults would prefer to watch ads before the start of their show, rather than have their content interrupted.

Takeaway: Less than a third (28%) of subscribers demand an ad-free streaming experience, leaving platforms room for advertising (as long as it is done correctly). Presenting viewers with invasive and lackluster ads will not boost consumer interest in the presented brand or encourage viewers to spend more time on the streaming platform.

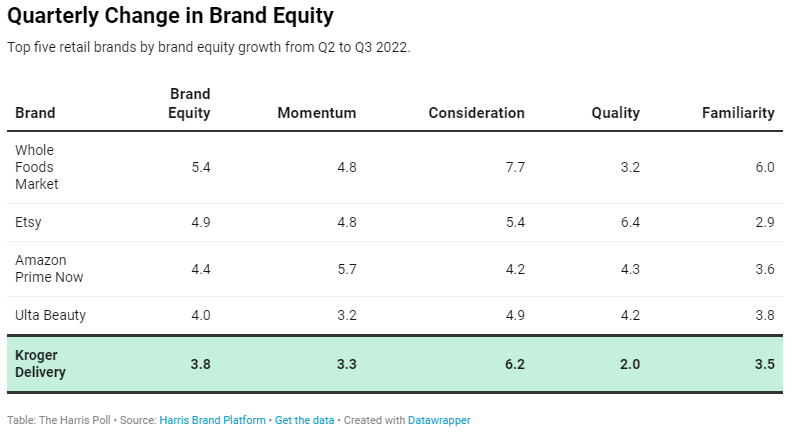

3. Kroger Outgrows its Brick-and-Mortar Stores – Brand Spotlight

Kroger, the largest supermarket chain in the US, is pushing into new markets with Kroger Delivery. This grocery delivery brand operates in many regions of the US that lack Kroger grocery stores, allowing the Kroger brand to penetrate new markets:

- Kroger Delivery uses a spoke-and-hub model that serves consumers within a 90-mile radius of their fulfillment centers.

- Last quarter, Kroger announced the opening of new fulfillment centers in the Chicago, Birmingham, and Nashville metros.

- Using QuestBrand data, Kroger Delivery was named one of the top growth retail/grocery brands from Q2 to Q3 2022 based on brand equity growth.

See how Kroger Delivery’s brand equity grew in Q3 and discover what this could mean for the popular grocery brand in the months ahead.

Want more industry insights? Check out our retail & ecommerce snapshot for compelling retail trends.

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Related Content