Brief • 2 min Read

1: FTX Weathers a Brand Crisis – Case Study

On November 11, 2022, cryptocurrency exchange FTX filed for bankruptcy and announced the resignation of their CEO, Sam Bankman-Fried. At the time, FTX was the second largest crypto exchange in the world with more than a million users. By November 17th, FTX had collapsed.

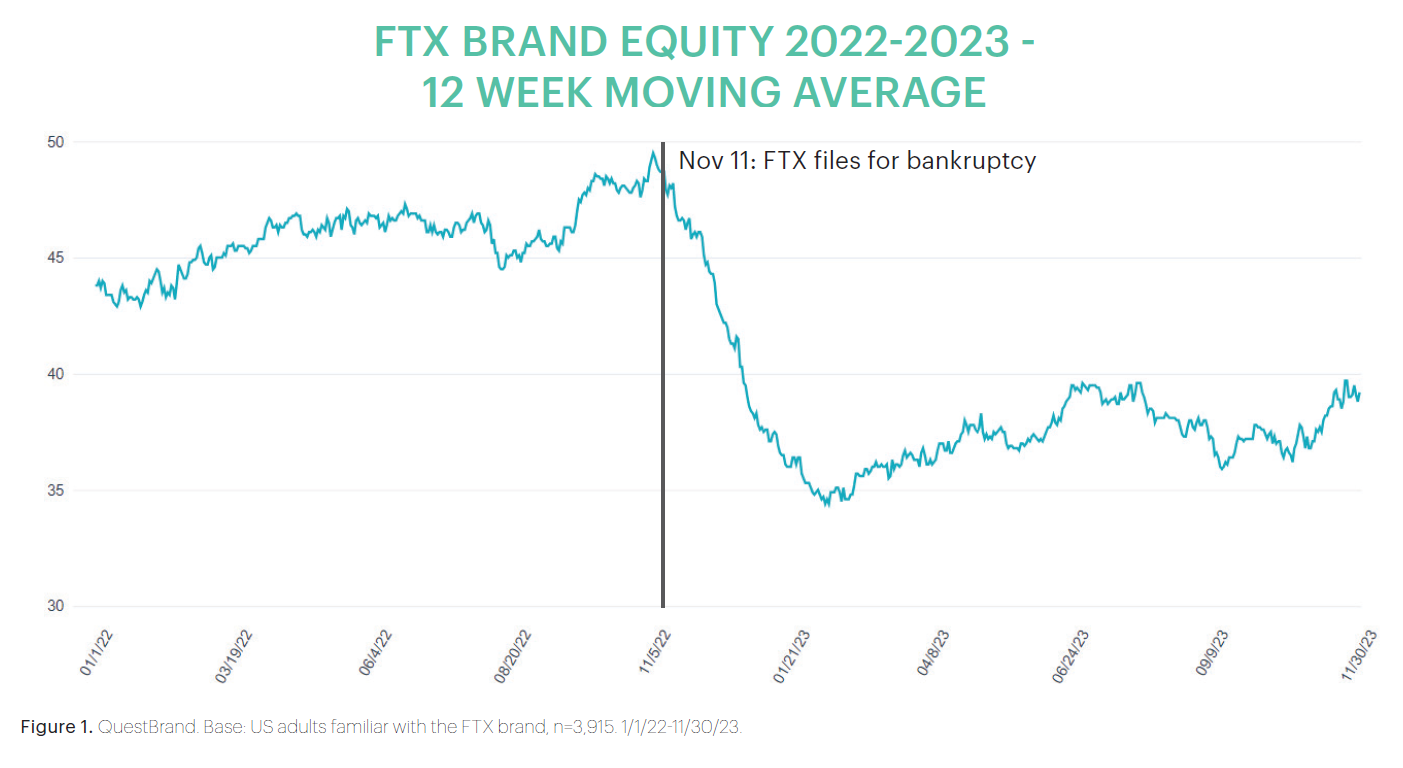

- Using data from QuestBrand by The Harris Poll, we tracked FTX’s brand equity to measure the impact of the company’s collapse and ensuing recovery efforts on consumer brand perception.

- The graph below shows FTX’s brand equity score trended as a 12-week moving average from January 2022-November 2023.

- On November 11, 2022, FTX’s brand equity started to steeply decline as the exchange filed for bankruptcy. Prior to the collapse (10/31/22), FTX’s brand equity stood at 48.4. Post-collapse, FTX’s brand equity hit a low of 34.4 (2/10/23).

- After their collapse, FTX’s brand equity began to gradually recover. While some of this growth can be attributed to consumers’ increased familiarity with the FTX brand due to its prevalence in the media, FTX’s momentum also slowly increased throughout 2023.

- FTX management is currently evaluating whether the exchange could restart by the end of Q2 2024. Could FTX persuade customers to return to their platform?

Read the case study for more data and insights.

2: 3 Strategies to Capitalize on the Subscription Economy – AdAge Op-Ed

In a recent op-ed for AdAge, Harris Poll co-CEO Will Johnson explores the subscription economy, and how brands can appeal to Baby Boomers, Gen X, Millennial, and Gen Z consumers. According to the Harris Poll survey:

- Most Americans subscribe: Six in 10 (60%) US adults subscribe to at least one product subscription service (not including streaming services).

- We want to be entertained: US adults most often reported subscribing to an entertainment subscription service (25%). This was followed closely by apparel and accessories (24%) and health and beauty (24%) subscriptions.

- Don’t let the products go to waste: The majority (61%) of Baby Boomers, but only 45% of Millennials, say they use the products and services they receive from their subscriptions.

- Getting a foot in the door: 61% of subscribers report that they often buy brands they first learned about from subscriptions.

Takeaway: “The subscription industry is a great opportunity for buyers and sellers alike. If you want to expand your market, you should sign up.” – Will Johnson

Want to learn more about the subscription economy? Download our retail industry report for more information.

3: Consumer Food & Health Trends for 2024 – Instacart-Harris Poll

A recent Harris Poll survey conducted on behalf of Instacart forecasts 2024’s food and health trends. According to the survey, we will see shoppers invest in the following types of products:

- Sleep: Half (48%) of Americans say that they want to make changes to their sleep habits and quality in 2024. Instacart saw a +134% jump in the share of carts containing sound machines from the beginning to the end of 2023.

- Protein: Four in 10 (39%) US adults who plan to make dietary changes in the New Year want to eat a higher protein diet.

- Mushrooms: More than half (58%) of Americans say they would be likely to increase their mushroom consumption to help improve brain health and immunity.

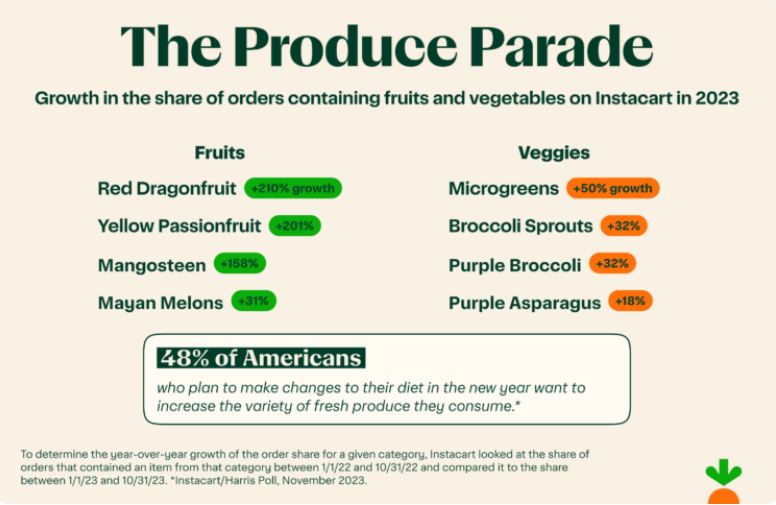

- Produce: 61% of those who plan to improve their diet in 2024 plan to increase their intake of fresh produce. Last year, there was an increase in Instacart orders involving some rather unusual produce:

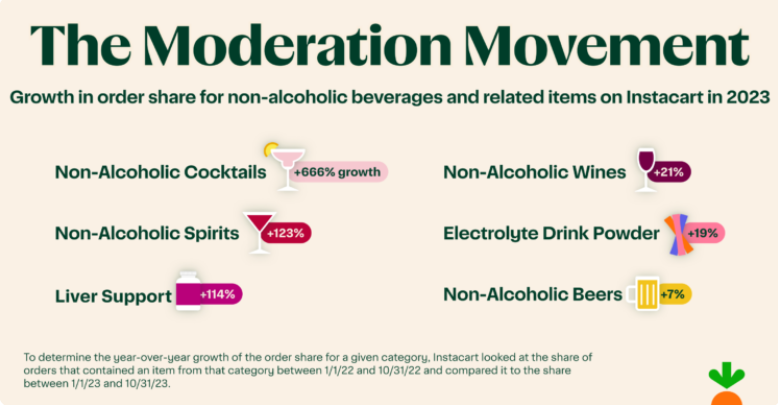

- Mock-alcoholic beverages: According to a 2023 Harris Poll food and beverage industry report, 57% of young adults (ages 18-34) said they had decreased their alcohol consumption in the past year. Interest in mock-alcoholic beverages is expected to continue into 2024:

How many of these food and beverage trends will you incorporate into your 2024 health goals?

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Related Content