Brief • 4 min Read

In The Harris Poll Tracker (Week 89) fielded November 5th to 7th, 2021 among 2,022 U.S. adults, we look at COVID-19 testing trends, Facebook’s rebrand to Meta, music’s influence in branding, the rise of pulling equity out of homes, and how cookies and web tracking may change in the future.

As a public service, our team has curated key insights to help leaders navigate COVID-19. Full survey results, tables, and weekly summaries can be accessed for free at The Harris Poll COVID-19 Portal. We will continue to actively field on a regular cadence to track the shifts in sentiment and behaviors as the news and guidelines evolve.

1. COVID Testing Amid Holiday 2021 Season

With the upcoming holiday season quickly approaching, we checked in with Americans to see if they are more likely to get tested for COVID before they sit down with their families. Here’s what we found:

- Most (50%) of vaccinated Americans are more likely to get tested for COVID as we head into the holiday season, with less than a fifth (19%) who say they are less likely. Meanwhile, nearly a third (32%) are neither more nor less likely.

- Meanwhile, unvaccinated Americans are split on testing with the upcoming holidays: (30%) are more likely to get tested if symptomatic, but a near similar amount (28%) say they are less likely. Meanwhile, (42%) are neither more nor less likely.

- Unvaccinated are unlikely to test because they don’t trust the government or medical system with testing (35%), (vs only 10% of unvaccinated), and another (21%) say “I don’t think it’s necessary to confirm that I have COVID-19 if I get infected” (vs only 10% of unvaccinated).

- New York Times talks to health experts on how to navigate Thanksgiving with unvaccinated friends and family.

Takeaway: Last week, we found (73%) of vaccinated adults aware of rising cases in some states are worried about breakthrough cases. In 2020, Thanksgiving is often regarded as the turning point to the steep rise in cases the country saw last winter. With vaccines and boosters widely available this year, the country may be able to avoid another surge in cases.

2. Will Americans Call it Meta?

Following Facebook’s announcement that they will be changing the parent company’s name to Meta, we checked in with Americans to see what they think about the tech giant’s rebrand. Here’s what we found:

- Three-fifths (58%) of Americans have heard of Facebook’s rebrand to Meta, with Gen Z (48%) having heard the least (vs 60% of Millennials, 58% of Gen X, and 59% of Boomers).

- PR Move or Innovation? When asked why they thought Facebook went ahead with its name change, (51%) of Americans said it was to distance themselves from bad publicity; (48%) said Facebook is hoping to improve their reputation overall from a name change; (25%) said it aligns with the company’s growing focus on AR/VR; and (22%) they’ve been around too long and need a way to refresh their brand.

- Generation see the decision differently: (68%) of Boomers said the name change is due to bad publicity (vs 30% of Gen Z and 38% Millennial), while (40%) of Millennials vs (15%) of Boomers say it means aligns with the company’s growing focus AR/VR.

- So what will Americans call the tech giant? Nearly two-thirds (63%) say they will still call the company Facebook, while only (16%) will use the new name Meta and (21%) aren’t sure yet.

- While only (30%) of Americans are familiar with the metaverse, (73%) are interested in interacting within the metaverse.

- Will they succeed? A majority (60%) of Americans say Meta will pull off building the metaverse, with Millennials (69%) and Gen X (64%) being the most optimistic (vs 46% of Boomers, 54% of Gen Z).

Takeaway: The one-half of Americans saying Facebook changed their name to escape bad publicity may be right. With data from our Harris Brand Platform, as profiled in Business Insider, Facebook changing its name to Meta damaged its already battered reputation. Public trust in the company dropped (5%) after the rebrand and is down (16%) since Frances Haugen leaked internal documents about the company’s practices.

3. Three Ways To Reach The Next Generation Of Consumers With Music: Ad Age-Harris Poll

Music-oriented branding punches through in ways that other kinds of celebrity endorsements do not, Harris Poll CEO Will Johnson writes in this latest Op Ed for Ad Age. Here’s what else he shares:

- A majority (85%) of music-listeners agreed that the music they listen to reflects who they are. This is especially true of Millennials and Gen Z, who are more likely than the middle-aged and elderly to frequently listen to music (85% vs. 72%).

- While (78%) of Gen X, Boomers, and the Silent Generation said that they regularly listen to music on the radio, only (55%) of Millennials and Gen Zers do so.

- Young music listeners (under 40) said that hearing a favorite song in an ad makes them more likely to shop for that brand (49% vs. 41% of older listeners) as would a musician being its spokesperson (46% versus 31%).

- As a result of stress, nearly three-quarters (74%) have experienced various impacts in the last month, such as headaches (34%), feeling overwhelmed (34%), fatigue (32%), or changes in sleeping habits (32%).

- “Gen Zers are still figuring out who they are and the things they like the most,” Mike Dunn, executive vice president of Music and Entertainment at the creative marketing agency Rogers & Cowan said. “The smartest brands are enhancing consumer experiences and authentically engaging fans by aligning with what’s most important to them.”

Takeaway: By acting now, brands can forge enduring links with this rising generation of consumers as their tastes mature and gel.

4. Homeowners Cash in on the Housing Boom: Bloomberg-Harris Poll

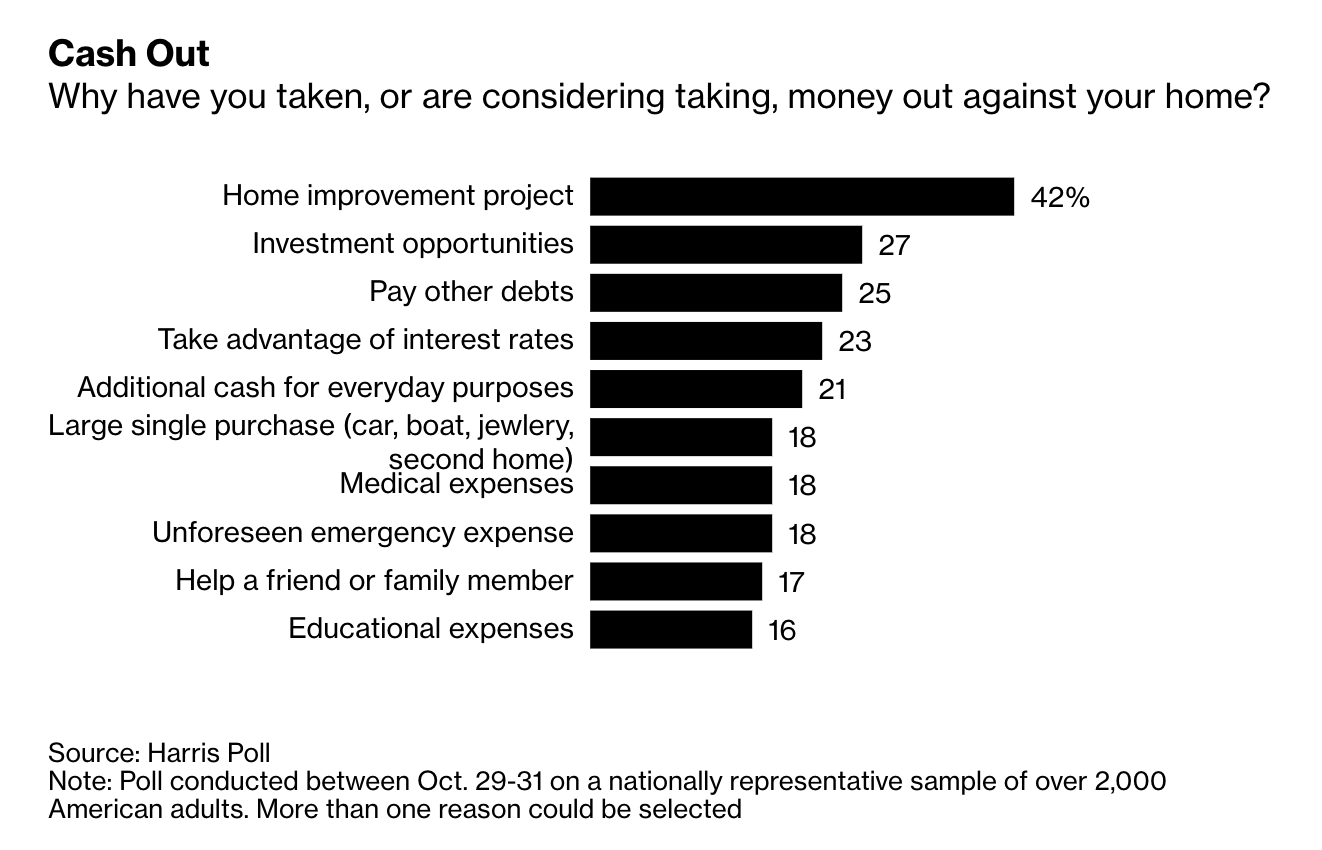

Our latest research featured in Bloomberg Wealth detailed that homeowners are taking advantage of the housing boom by pulling equity out of their homes at the highest volume since the financial crisis. Here’s what else we found:

- Just under one in five (18%) American homeowners pulled money out of their properties in the last year, with the same number (18%) saying they are considering it.

- Home improvement (42%) and investment opportunities (27%) were the leading reasons for accessing cash.

- Millennials (36%) were particularly likely to have taken money out of their homes than older generations (Gen Z adults: 27%, Gen Xers: 17%, Boomers: 6%).

- Boomers have significantly stronger feelings against accessing cash, with more than 8 in 10 (83%) not considering the option. They (7%) are also the least likely to access cash for investment opportunities (Gen Z adults: 22%, Millennials: 39%, Gen Xers: 22%).

- More than one-third of urban homeowners (38%) took out money, higher than their rural (8%) and suburban counterparts (11%).

Takeaway: Many Americans took advantage of the extra cash even though it is far from a risk-free option. If a housing market crash occurs, that could leave them owing more than their property worth or a loan-to-value ratio too high to refinance down the line – a risk that Boomers seem quite uninterested in.

5. Marketers’ Top Five Plans for a Post Third-Party Cookie World

Our recent survey featured in Destination CRM found that the expected eventual elimination of third-party cookies will disrupt marketers’ strategies within the customer experience landscape. However, marketers say they have a plan, and many consumers are willing to go along with it, as long as they get something in return. Here’s what we found:

- Two-thirds (67%) of consumers said they would let select companies use tracking cookies to improve their experience, while (39%) say they will let all companies use tracking cookies to improve their experiences.

- Among their plans, marketers revealed the following top five ideas for navigating in the cookieless world: (57%) plan to offer incentives for consumers to opt-in to tracking; (53%) plan to invest more in first-party data; (51%) will pursue alternative IDs that can be followed and monitored; (47%) will shift ad spend to more effective targeting; and (45%) plan to partner with other companies to fill in the gaps.

- Nearly all marketers (95%) say the pandemic has made it even more important for companies to know their customers’ needs and preferences.

- Transparency from companies matters: nearly 8 in 10 consumers (78%) say companies that were transparent about challenges they experienced during the COVID-19 pandemic retained their loyalty more than companies that did not.

Takeaway: Consumers value privacy when they are online, but they also want a relevant, personal experience. Advertisers will need to find the right balance of privacy and relevance to earn the trust of consumers in a post-cookie world.

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Download the Data

This survey was conducted online within the U.S. by The Harris Poll from November 5 to 7, among a nationally representative sample of 2,022 U.S. adults.

Download

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Download the Data

This survey was conducted online within the U.S. by The Harris Poll from November 5 to 7, among a nationally representative sample of 2,022 U.S. adults.

DownloadRelated Content