Brief • 4 min Read

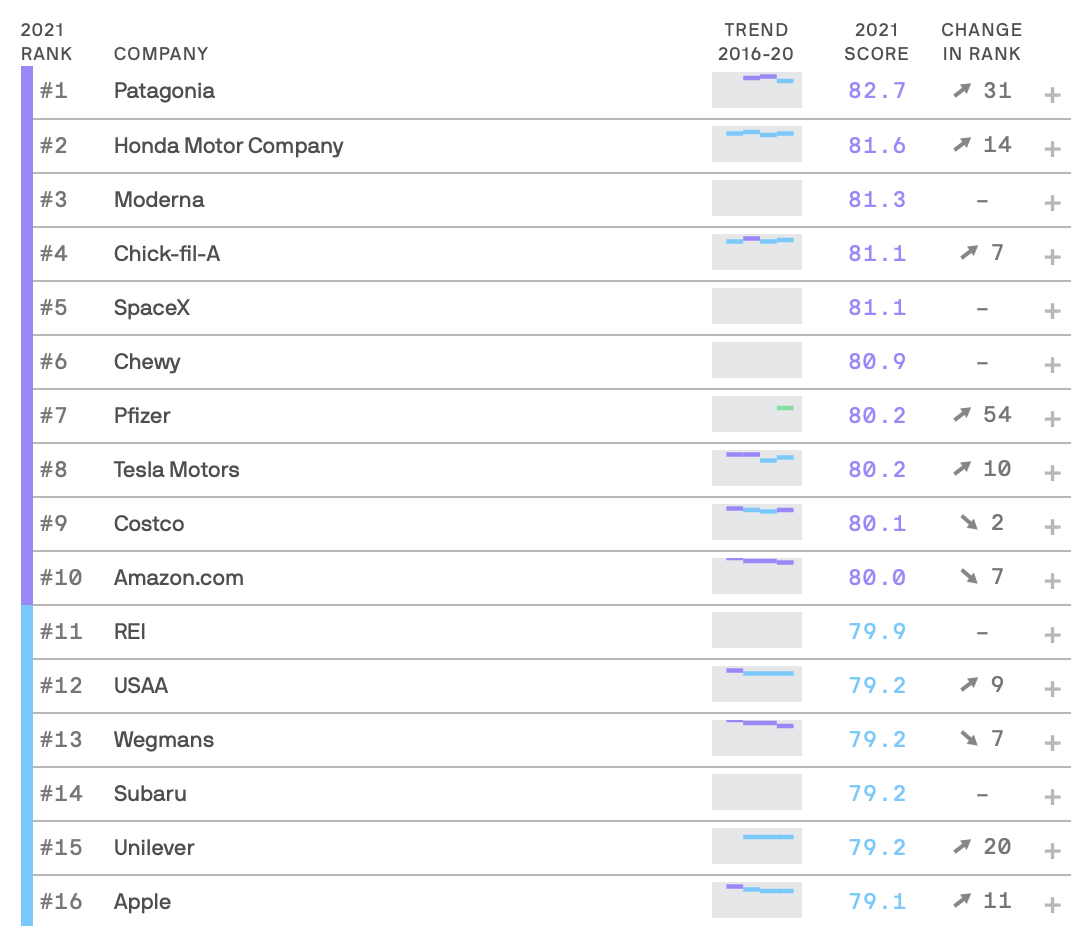

This week, we take a deep dive into the 2021 Axios Harris Poll 100, our annual ranking of corporate reputations. Based on our Reputation Quotient (RQ) framework run annually since 1999, this year’s rankings are based on a survey of 42,935 Americans in a nationally representative sample fielded from April 8th to 21st.

The two-step process begins by surveying the public’s top-of-mind awareness of companies that either excel or falter in society. These 100 “most visible companies” are then rated by a second group of Americans across the seven key dimensions of reputation to arrive at the ranking. If a company is not on the list, it did not reach a critical level of visibility to be measured.

An overarching theme in the data is that some of the most visible companies at the beginning of the pandemic, those whose goals were to get us through unprecedented times, do not break the top 100 this year. Instead, they are being replaced by the companies who are assisting us in pushing us over the finish line of the pandemic and companies that aren’t afraid to take a political stand.

For an interactive list of all companies and their ranking on this year’s Axios Harris Poll 100, click here. This year’s rankings and the full report can be found on the Axios Harris Poll 100.

Most Industries’ Reputations Are Rising, Except Big Tech’s

The financial services, telecom, and pharmaceutical sectors all gained ground with the public this year, while the biggest tech companies saw their reputations erode.

- Financial services companies like JPMorgan Chase & Co., State Farm Insurance, Goldman Sachs, Mastercard, and others saw huge gains in response to the role they helped play in the country’s financial recovery.

- Pharma’s reputation score got a big boost thanks to the addition of Moderna to the reputation 100 list and Pfizer’s improving score. The sector would’ve probably been even higher this year, if it weren’t for Johnson & Johnson’s flat year-over-year performance.

- Media and telecom companies like Comcast, Verizon, and AT&T saw strong gains as people became more reliant on broadband. Streaming firms like Netflix and Hulu saw some declines, in response to streaming fatigue.

Takeaway: This year’s reputation rankings reflect a return to normalcy in the business world. While many of the most polarizing companies are doing better than last year, they aren’t necessarily the most visible companies.

Pfizer, Moderna Reputations Soar Post-Vaccine

2021 is the year for vaccine producers, at least reputationally. Moderna and Pfizer shot up the ranks this year. Moderna is Americans’ third-favorite company this year, and Pfizer came in at 7th — up from #61 a year ago.

- CVS climbed 13 spots since last year but Johnson & Johnson isn’t getting the same bounce from its coronavirus vaccine. It fell four spots, slipping to #72 on this year’s list — considered a “good” but not “excellent” or “very good” corporate reputation.

- Both Pfizer and Moderna scored 10 to 20 points higher across all measures when compared to last year’s results. Pfizer rose 54 places on the list, while Moderna did not make the 2020 top 100 at all.

- Something to keep in mind: A year ago, when Americans were still sanitizing our groceries and figuring out how to live in a state of lockdown, Clorox was America’s favorite company. Instacart, Peloton, and Zoom leapt onto the list for the first time in 2020. None of these companies made the top 100 this year.

Takeaway: America’s affections have shifted away from the companies that helped us manage pandemic life and toward the vaccine manufacturers that are helping to end it.

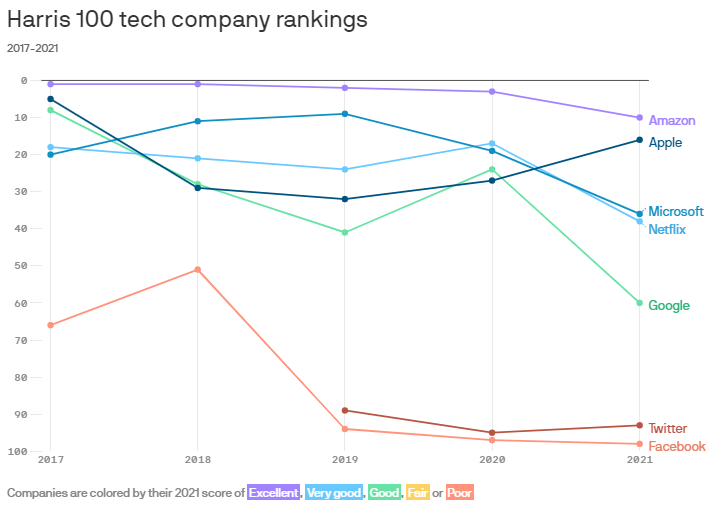

Big Tech’s Reputation Takes A Pandemic Plunge

Despite their role in helping users stay connected through pandemic-era isolation, Americans have fallen further out of love with Big Tech.

- The biggest loser among tech giants was Google, which faced PR headwinds in 2020 as the government sued it for monopolistic practices.

- However, Apple, which spent the last year making record profits and touting its privacy protections, was the only tech giant to substantially improve its reputation score.

- Companies that sell products and services to businesses and individuals — like Microsoft, Apple, Sony, and HP — fared much better than ad-supported social media and information tech companies like Facebook, Google, Twitter, TikTok, and Reddit.

- Social media leaders Facebook and Twitter failed to improve their standing near the bottom of the list. Both social media platforms find themselves in the bottom 10 ranking for every reputation dimension.

Takeaway: Although tech’s reputation does not compare favorably to other industries in our poll, the Big Five still found a way to win the pandemic monetarily – which is probably also why Americans do not view them with a sympathetic lens.

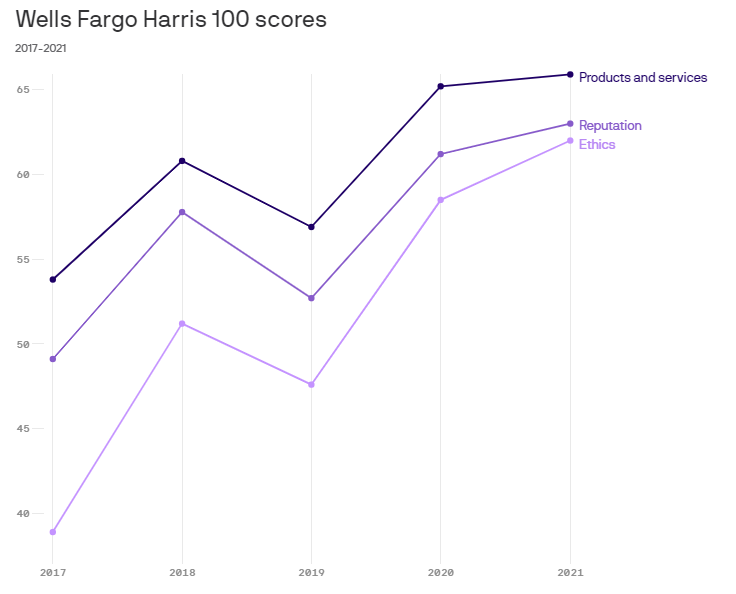

The Rehabilitation of Wells Fargo

The bad news started with the revelation in 2016 that the bank had created millions of fake accounts and opened them without the account holders’ permission or knowledge. It didn’t end there — a series of scandals followed, tarnishing Wells Fargo’s reputation — and that of its former CEO. But now, Wells Fargo is no longer viewed as the least ethical big company in America.

- Overall, Wells Fargo’s reputation score of 63.0 in 2021 puts it well ahead of Facebook, tied with TikTok, and slightly behind Comcast.

- Wells Fargo’s Ethics score of 38.9 in 2017 was by far the lowest in the history of the study. This year, it has recovered to 62.0 — a big jump, even if it’s still in the bottom five.

- Other banks have also been improving. The reputation score for Bank of America, for instance, increased from 59.7 to 70.5 between 2017 and 2021.

- Banks are generally unloved, with the notable exception of USAA, which has outperformed in every year of the survey. And Wells Fargo remains at the bottom of the banking pack. That said, the sector as a whole is improving.

Takeaway: After hitting extreme Axios-Harris lows in 2017, Wells Fargo embarked upon a massive public rehabilitation campaign in 2018. It seems to have worked.

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Download the Data

This survey was conducted online within the U.S. by The Harris Poll from May 14 to 16, among a nationally representative sample of 2,063 U.S. adults.

Download

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Download the Data

This survey was conducted online within the U.S. by The Harris Poll from May 14 to 16, among a nationally representative sample of 2,063 U.S. adults.

DownloadRelated Content