Brief • 4 min Read

America Welcomes Stimulus

America supports stimulus, but split on economic recovery; personal checks to individuals and families

As we move into our new normal where three in four Americans are on stay at home orders, approvals are strong for how the federal government (61%) local government (76%) and state government (75%) have handled coronavirus. As reported in our latest Harvard-CAPS Harris Poll, The President’s approval rating is rising at 48% and his favorability rating is now 43%; Governor Cuomo is at 45%. For more see Mark Penn on Fox Business.

Of course, two trillion dollars seems like welcome relief: Americans overwhelmingly support the stimulus bill (85%) especially older adults who have been through a New Deal or two (91% of 65+ vs 79% of 18-34). But Americans are split on whether it will shorten the time it takes for the U.S. economy to recover (yes: 51% vs no: 49%).

Of course, the personal economy is what matters and nearly three quarters (72%) of Americans expect to receive money, which is highest among middle income HH’s of $50-$75k (84%) vs. lower income HH’s (less than $50K) and higher income HH’s of $75k+ (70% respectively). But counting on this to inject life into the economy is uncertain in the near term as the majority of Americans (59%) plan to pay their bills with the economic relief, especially parents (65%) and those making under $75K (63%).

As for whether it will be enough money, Americans are split. Of the up to $1,200 for individuals and $2,400 for families, almost half say this is not enough (46%); exactly equal to those who say it is just the right amount. But with the surge of 3.3 million jobless claims last week, a majority think the amount allocated for unemployment benefits (additional $600 per wk. 4 mos) is just right (56%) vs. not enough (29%) or too much (15%), while a refund for businesses that continue to pay idle workers (up to $5,000 per employee) is just right (59%), not enough (30%) and too much (11%).

Americans are generally more satisfied with the $150 billion for state and local governments with those saying just right (51%) vs. not enough (30%) or too much (19%). Also, Americans feel the $500 billion in loans to struggling industries is just right (58%) vs. not enough (19%), but almost a quarter (23%) feel it is too much. And of $100 billion grant for hospitals, those saying not enough (43%) nearly match those who say just right (49%).

Finally as the virus spreads to new hotspots like Detroit, Miami and New Orleans, two-thirds of Americans (67%) feel that states are being forced to compete against each other to acquire limited resources (Democrats 76% vs Republicans 57%), yet only a slight majority (56%) say the hardest hit states with the most cases of Cv19 should be first in line to get aid, while over 4 in 10 (44%) say “The government stimulus package should be divided equally.”

The takeaway: Government approvals are trending up, but the end of the crisis is nowhere in sight.

No Flattening of The Fear Curve Either

Nearly 7 in 10 say I think the amount of fear is sensible (up from 46% on March 14)

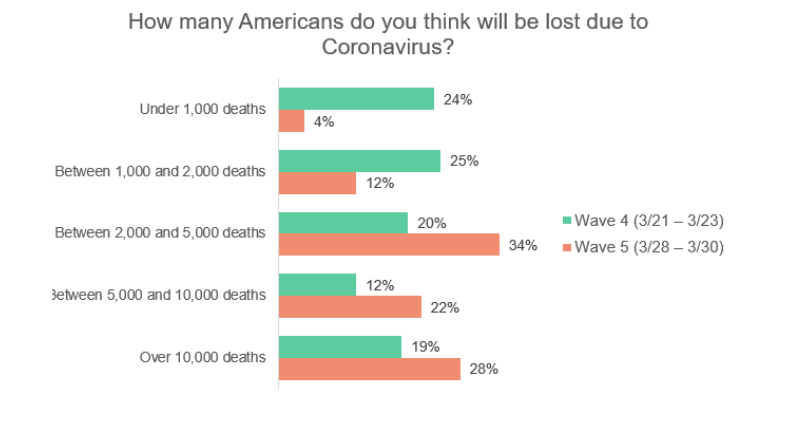

This was the week Cv19 became a clear, present and personal danger; the number of Americans who fear they could die increased 16 percentage points from March 14. Despite actual statistics which have U.S. mortality odds at approximately under 1.4%, still 4 in 10 (43%) surveyed fear they could die, up from 27%. And while American concern and fear about Cv19 is sky high, Americans are swiftly upping their predictions: last week the public expected less than 1,000 deaths (24%), but this week more than a third of Americans (34%) expect between 2,000 and 5,000 deaths.

And our national fear is extending to job security where just over half (56%) of Americans fear they will lose their job due to Cv19, which is especially high among Gen Z/Millennials ages 18-34 (66%), as well as adults with children in the household (64%) and adults in lower income households (63% among HHI <$50K). This suggests a ‘barbell’ effect where income may be bifurcated, but the fear is not.

Our data also shows that fears of global recession have become a reality signaling anxieties around income insecurity: over 8 in 10 Americans (84%) say we are already in a global recession right now due to the coronavirus and 4 in 10 think their income will be lower this year (39%). This is especially high among women (42%) who already face a gender pay gap.

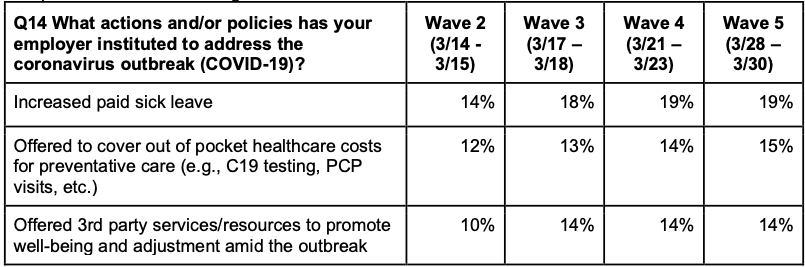

As employees struggle to grapple with this new normal, employer action to support workers through new policies has become stagnant.

The takeaway: The fear of lasting impacts from COVID19 is hitting all aspects of American livelihoods.

As it Turns Out, Pandemics Beat Privacy

Americans are willing to be tracked to help stop the spread of COVID19; tech rep is rising

As new models are released today from The White House showing the future aggressive course of the disease, Americans want policies to cease mobility and containment even at the expense of sacrificing their personal privacy. The majority of Americans (60%) would support government and public health officials having access to anonymous mobile location data so they can monitor which areas are practicing social distancing while (71%) would be willing to share their mobile data location so that they can be alerted if they were to enter an area that posed a health risk.

Furthermore, a strong majority of Americans (84%) would support a required health screening before someone could be allowed to enter certain crowded public spaces and (77%) in businesses like restaurants, offices and cinemas. Americans ages 35+ are more likely than Americans ages 18-34 to support required health screenings (86% vs. 78%) as well as parents but interestingly across these questions largely both the left and right are united. Here the numbers really jump when the word ‘government’ is removed, suggesting that businesses are given a welcome invitation to protect the public health by accessing people’s data.

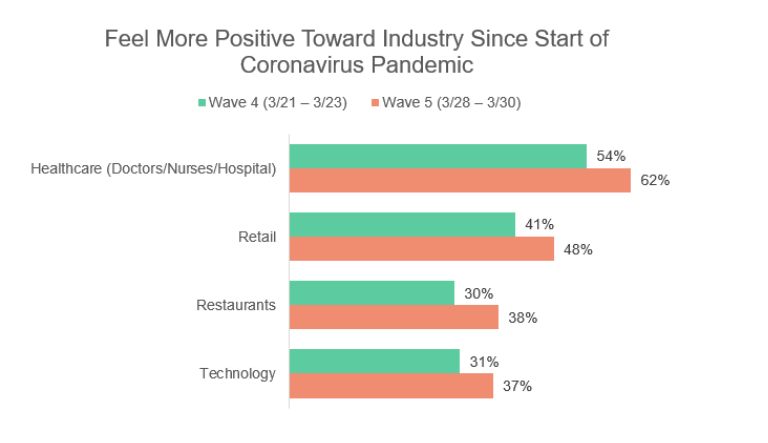

But perhaps the most interesting data point on privacy is how the reputation of the tech industry has risen during the pandemic. As you can see in this chart, almost four in ten people (37%) now have a favorable view of big tech, equal almost to that of restaurants and retail and rose only two percentage points less than healthcare.

This is a stark reversal from our Axios-Harris Poll study in 2019, which found that data privacy was the number one social issue Americans felt needed to be solved by business (69%) and approval of business in solving it was at 17%. The techlash has become the healthlash and we’ll see if this goodwill lasts. Often Americans are given to sacrifice in a crisis and at this moment a little data tracking seems to be in everyone’s self interest.

The takeaway: Major shifts on privacy concerns and tech reputations, but will they last?

Small Businesses are Under Siege

Almost 40% of small businesses could be out of business within a month

We released a special Harris Poll Report on the state of small businesses and Cv19 today and the news is not good for a key engine in our economy: Almost three quarters (71%) say revenue is down since the start of the pandemic; 28% say down by more than 50%.

And while 83% say they are confident their business can last two weeks under current conditions, those numbers drop to (75%) in one month and (58%) in three months. Keep in mind also that in our survey, half of all small businesses say that at least one other small business depends on them.

But with the President’s extension of stay at home orders to April 30th this means potentially 25% of American small businesses will be out of business; add potentially 50% to those who depend on them (13%) and that’s more than one-third (38%) or 11 million American small business employing over 21 million Americans (*using data below); that’s before you factor in the community impact, local commercial real estate, etc.

As you’ve seen appeals from our local businesses for help such as this idea from our neighborhood restaurant offering Frevo bonds (where diners buy $100 bonds that cost only $80 giving the restaurants cash flow now), two-thirds of small business owners (67%) feel responsibility to their community and (60%) feel supported by their community.

The stimulus will help, but a large swath of American small business is on precarious ground and likely the first casualty in an extended stay at home order. Here is a pdf of the full report. *There are 28.8 million small businesses in the United States, according to the U.S. Small Business Administration, and they have 56.8 million employees; and over 99 percent of America’s 28.7 million firms are small businesses (JP Morgan).

The takeaway: America’s economic engine is in crisis, with radiating impacts out onto other businesses and communities.

A Look Out of The Foxhole to ‘Revenge Spending’

It’s not all bad; some green shoots in pent-up demand are appearing

The effects of national social distancing and stay home orders have decimated travel and hospitality. On March 28, the TSA screened 184,027 passengers at U.S. airports, compared with over 2.17 million passengers screened on the same weekday one year earlier. But as the President extends social distancing to April 30, there is a potential hidden indicator of optimism, something we call ‘The Ice Machine Index’, or the point at which hotel occupancy signals a flattening of the ‘fear curve’ and we intend to return to (somewhat) normal behaviors.

Americans predict it will take an average of 6.6 months for things to return back to normal, and as our Harris Poll shows in USA Today, they are cautiously setting limits on when they will resume travel.

But, we are starting to see pent-up demand growing during this lull, a quarter of all Americans (24%) are looking forward to traveling once things return to normal and business reopen.

And, as our Harris Poll shows in Forbes, in the first month most of us (63%) are willing to resume routine activity like going into the office; then (43%) to restaurants and (69%) in three months. But interestingly, one fifth of Americans (21%) say they will stay in a hotel within a month and (44% combined) within three months. By six months, (65%) say they’ll visit a hotel.

Within three months, the fear differential of eating out vs. staying in a hotel narrows. Second, getting to a hotel requires flying, rental cars, etc. Third, warmer months, coupled with leisure travel and ‘revenge spending’ to account for sacrifice and cabin fever could drive us back out there. And finally, extended shelter in place should only amplify these feelings when it’s safe to leave home. Look, it’s terrible on all counts. But watch hotel bookings to see when Americans think we’re through the worst of the pandemic.

And as Americans look to the future, they’re making a commitment to prepare by saving for another crisis; nearly 6 in 10 Americans (59%) say that once things return to normal and businesses reopen they would keep more money in savings to prepare for something like this in the future, and around a third of Americans (32%) would stockpile non-perishable foods.

The takeaway: Start planning now for pent up demand. Plan for cycles of consumer volatility.

Cv19 Marketing: Do More, Say Less

Americans show signs of corona ad fatigue; want to see actions not words

You can’t turn on the television without seeing one, but opinions towards marketers who promote advertisements related to Cv19 are mixed. While 4 in 10 (41%) say it’s a good thing, a third (34%) say marketers should only advertise if they’ve taken action to address Cv19, and a quarter of Americans say of marketers they’re just doing it for publicity and most of them feel contrived/forced. Consider also the pandora’s box of further scrutiny if employees have been furloughed, lacking health insurance or protesting their ‘essentialness’ as Instacart and Amazon have seen. Calculate the risk/reward here because 44% of Americans say they rarely/sometimes engage with Cv19 ads they see and 40% never do at all.

Americans are however increasing consumption across all channels. In our survey (57%) are watching more broadcast TV; (56%) using their smartphone more (especially 70% of Gen Z/Millennials vs 34% of 65+) and (50%) are streaming more TV (67% of Gen Z/Millennials vs 26% of 65+) and a third (35%) are reading more books.

Young adults and parents have also increased their use of social media (60%), news apps (47% of Gen Z/Millennials and 50% of 35-49 vs 41% of gen pop) virtual meetings (44% of Gen Z/Millennials vs 26% 50-64 and 31% of all adults), music apps (53% of Gen Z/Millennials vs 34% of gen pop), gaming (56% of Gen Z/Millennials vs 41% of gen pop and 53% of parents/kids). Finally, 36% of parents report increased usage of wellness apps more than double that of (19%) of adults without children. You try doing a zoom call with three kids on your lap and you’ll see why…

The takeaway: Marketers need to be thinking of how Cv19 will change our behaviors.

The Modern Day Rosie Riveter: Americans and Public Accountability

Americans are doing more now than last week to support their communities

Much has been discussed about the role of civic responsibility and the overwhelming majority of Americans (90%) have taken steps to make sure they leave their residence as little as possible, up from 76% last week. In fact, 90% of Americans feel that the most patriotic thing we can do for our country right now is to make a national sacrifice to stay home for the welfare of others. Other measures Americans are willing take in order to help America through the coronavirus outbreak include 4 in 10 who would donate some of their stimulus economic relief to hospitals; (89%) say they will stop hoarding items like toilet paper, cleaning products, (88%) say they will quarantine indoors and to stop traveling domestically. Even 72% are willing to accept a rations program for certain goods.

This patriotism also goes local: just over half of Americans (51%) say they have checked in with someone they hadn’t reached out to in a while, a 7 point increase since last week. Also, nearly a third of Americans (31%) have purchased something from a small business as a sign of support, up from 26% last week. And overall, around a quarter of Americans have helped an at-risk friend or neighbor with errands (23%), a 4 point increase from last week.

How are we coping in week three? Virtual gatherings, daily walks and setting routine breaks are on the rise for activities Americans are using to cope with social distancing. Overall, around a quarter of Americans have had a virtual gathering” with friends (27%), a 7 point increase from last week. Americans ages 18-34 are more likely than older Americans to have had a virtual “gathering” (40% vs. 29% 35-49; 20% 50-64; 14% 65+) and nearly half of Americans (47%) are virtually connecting with friends and family to cope with social distancing, an increase of 8 points.

And just over 2 in 5 Americans (41%) are going for daily walks to cope with social distancing – an increase of 5 percentage points since last week, while nearly a quarter of Americans (24%) are setting routine breaks in the work day – a 5 point increase since last week.

The takeaway: Americans equate Cv19 responsibility with patriotism and are all in to flatten the curve.

John Gerzema, The Harris Poll

Researchers: Erica Parker, Tawny Saez, Adam Gross and Emily Morton

Methodology

This survey (Wave 5) was fielded online among a nationally representative sample of 2,016 U.S adults from March 28 – 30, 2020. Wave 4 was fielded online among a nationally representative sample of 2,023 U.S adults from March 21-22, 2020. Wave 3 of the survey was fielded online among a nationally representative sample of 2,019 U.S adults from March 17-18, 2020. Wave 2 of the survey was fielded online among a nationally representative sample of 2,050 U.S adults from March14-15, 2020. Wave 1 of this survey was fielded online among a nationally representative sample of 2,019 U.S adults from March 05 – 09, 2020.

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Download the Data

This survey was fielded online among a nationally representative sample of 2,016 U.S adults from March 28-30, 2020.

Download

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Download the Data

This survey was fielded online among a nationally representative sample of 2,016 U.S adults from March 28-30, 2020.

DownloadRelated Content