Brief • 4 min Read

We hope you had a good long Memorial Day Weekend! In Wave 13 of The Harris Poll Cv19 Tracker fielded May 23 to 24, 2020, we examine the escalating battle between American fear and desire and predicting the travel industry as its battleground. And we wonder/worry if social issues will take a back seat to CV19?

We also explore race, income and reopening; also the rise of sign up subscription services. And we asked America why suddenly everyone is into running. And as restaurants reopen, tipping is on the menu as Americans open their wallets to save their favorite spots. Lastly, we asked America what’s better to do on-line versus in-person. The results might surprise you.

As a public service, our team has curated key insights to help leaders navigate Cv19. Full survey results, tables, and weekly summaries can be accessed for free at The Harris Poll Cv19 Portal. We will continue to actively field on a regular cadence to track the shifts in sentiment and behaviors as the news and guidelines evolve.

The Summer of Our Discontent

Memorial Day weekend signifies the beginning of Summer. And with it, an unleashing of pent up demand––be it lines outside luxury stores in China or throngs of people drinking White Claw at non-CDC endorsed pool parties in the Ozarks. Mask usage is declining in certain states, despite Harvard Public Health Institute warning that up to 70,000 deaths could still occur this year. We are at a critical moment as fear gives way to desire. But will America manage its coming out party responsibly?

- Summer comes in like a lamb… Our Harris Poll featured on the CBS EVENING NEWS found that (95%) of Americans chose to stay home because of the pandemic. Given this, AAA did not issue a travel forecast this past holiday weekend. Our data also shows that in the next three months only a small percentage of Americans will fly on a plane (31%), stay in hotels (40%), attend a sporting event (37%) or take a cruise (28%).

- …But out like a lion? Americans miss dining out at restaurants and bars (71%), shopping in stores (66%), attending concerts, theatre and sporting events (50%), hitting their local coffee shop (48%) and going out to the movies (46%). Meanwhile, data from OpenTable shows diners are beginning to return in several states. However, new data also shows that one-fourth of all restaurants won’t reopen.

- Pent up demand (extreme edition): Is your stadium shuttered? No problem, you can rent your field of dreams on Airbnb.

Takeaway: America’s consumerism (which drives 70% of GDP) is about to go on a tear. With (64%) saying their income is the same or will even rise this year, there is plenty of economic impetus to overcome our loneliness (46%), claustrophobia (31%), and stress trying to balance it all (32%). Like Shakespear’s play, will our collective attempt to regain our status and wealth be our own undoing? We predict fear will abate and desire will win over the long hot Summer. How will corporate responsibility evolve to serve the public’s health and its demand? Ask us in August.

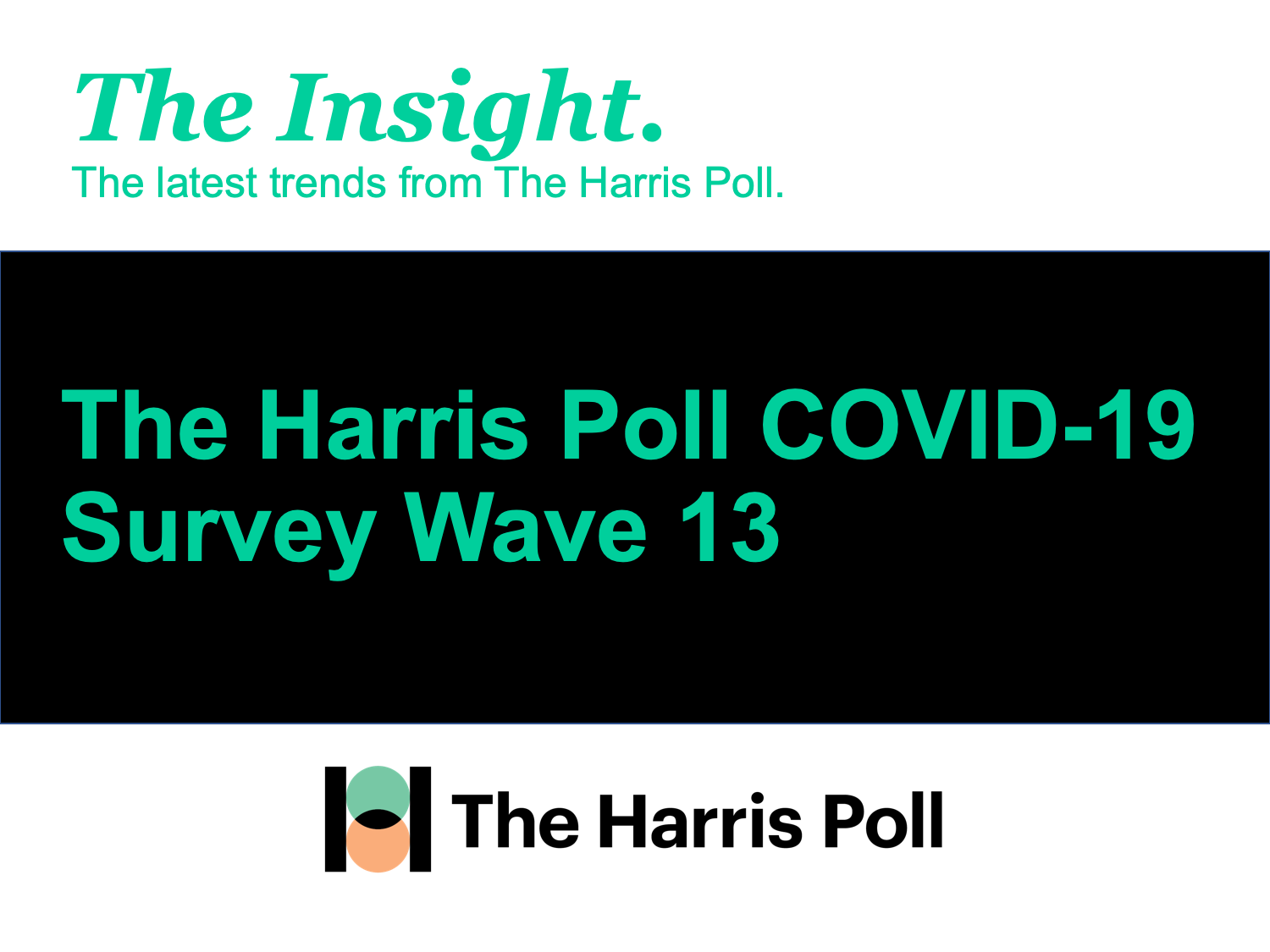

A Battleground Industry: Travel & Leisure

As we’ve tracked in for nearly twelve weeks America is locked in a battle between fear and desire. Let’s take one industry and debate an optimist’s (and a cynic’s) viewpoint:

- The argument for revenge travel is real: As sheltering in place orders have extended, pent up demand for major purchases, such as vacations and traveling, have only been increasing over time (24%) are planning a vacation once things return to normal on March 30; which bumped up to (29%) on May 17. The FT reports there is a race to book vacations in reopened states:

- And while the number of travelers passing through TSA checkpoints fell to 87,534 on April 14, (96%) below the same day a year earlier. But by May 24, the figure had more than tripled to 267,451, although that is still down (87%) from the same day a year earlier.

- This trend is even further compounded by the severity of the CV19 outbreak: Residents of states with the highest level of confirmed cases per capita are the most likely to travel within the next 4 months (25% vs. 20% in the medium and low states). They have a strong need to connect with family and friends (57%), get a change of scenery (48%) as well as the desire to support a destination’s local economy (39%). These individuals are most comfortable with the prospect of traveling domestically (60%), renting a car (53%), and staying in a hotel (50%) more so than flying (36%) or taking Uber/Lyft/cab (37%).

- Pressure to avoid non-essential travel from family and friends could derail their plans (26% say it might alter or block their 2020 leisure travel) even more so than those in less impacted states (20% among low or medium states).

- Consider these tensions: The NY Auto show has been cancelled as our data shows that (over 50%) of respondents say they don’t feel safe using any transportation that isn’t their own car. But that doesn’t mean we won’t spend on cars: (17%) of Americans say buying a new car is a major purchase they are planning for once things return to normal. And over half (54%) plan to purchase a vehicle in the next six months or at least sooner than they expected. See our special automotive report here.

Takeaway: The longer and more severe the impact of CV19, the greater the demand to get back to normal activities such as travel. We see travel as the battleground between fear and desire in America. Watch for travel to be a key indicator that Americans think normal life resumes in earnest.

Want to read the cynic’s viewpoint?

Will Social Issues Take a Back Seat to CV19?

It was January and we were talking about Harvey Weinstein, carbon credits and income inequality. The Business Roundtable had just redefined the purpose of a corporation to promote ‘An Economy That Serves All Americans‘. Now we wonder if in the age of CV19, would these issues still matter to Americans?

- CV19 has exacerbated society’s most devastating inequalities: Many have described the pandemic as the “great equalizer,” including well respected leaders like Governor Cuomo (and even Madonna from her luxury bathtub) but as every day goes by, it becomes clearer the virus isn’t an equalizer at all, as Vox recently reported. In fact in our latest poll found majorities of Americans say CV19 has exacerbated Poverty (65%), Job Creation (64%), Hunger (62%), Education (60%) and Domestic Violence (55%).

- Reinforced urgency on issues core to thriving livelihoods: We asked Americans what issues will be more important to them personally moving forward after CV19 and overwhelming majorities said access to healthcare (91%), good health and well being (91%), education (85%), job creation (85%), hunger (84%), poverty (82%), gun violence (77%), and domestic violence (76%). As a result, philanthropy is being called upon to redefine efforts around urgency and even the head of the United Nations Economic and Social Council (ECOSOC) proposed plans to further postpone or cancel all UN ECOSOC meetings in the coming eight weeks.

- Will corporate America keep its promise? In the new FORTUNE 500 Survey, CEO’s were asked if they agree with the BRT’s new statement and (63%) said ‘I agree and believe most good companies have always operated that way. Nothing changed.’ However (25%) said ‘I agree, and I believe it represents a significant change in corporate thinking from a decade or two ago. And (50%) of CEO’s said it will ‘accelerate the move toward stakeholder capitalism in order to address the human suffering caused by the crisis,’ whereas (18%) said it will ‘slow the move… as companies focus on shoring up their bottom lines’. The public will be watching, nearly 8 in 10 (78%) say taking action for the greater social good is very important for corporate America today.

- There’s also a ‘full-blown she-cession’: (69%) of women feel the economic impacts of the coronavirus pandemic will have a bigger effect on their lives than the virus itself (vs 63% of men), a third (33%) have lost income partially and (29%) have stopped or cut back on savings. NBC reports how CV19 is economically hurting women, minorities the most: Women accounted for (55%) of the 20.5 million jobs lost in April, with especially high unemployment rates for those ages 20–24 and over 50, as well as for women of color. And women are heavily represented in industries hardest hit by the virus, including travel, restaurants, and childcare, and they make up more than (60%) of low-wage workers. We see the aftershocks of this in our data as a third of women (33%) are seeking new or additional sources of income and nearly 9 in 10 women (86%) say job creation and poverty (85%) will be important to them personally moving forward (vs 84% and 78% of men respectively).

- The environment was spared by default as the nation halted movement: Nearly 4 in 10 (37%) say CV19 has improved climate change and over a third say (35%) it has improved environmental efforts (35%). We’ve all seen the photos of blue skies in LA and Delhi. But the biggest percentage drop in co2 emissions has come from the aviation industry, with a (60%) decline, or 1.7 million metric tons and from surface transportation (vehicles, trucks and domestic and international shipping) which fell by (36%), or 7.5 million metric tons. And let’s be honest, the restrictions on mobility that shrunk our personal carbon footprint can’t be sustained long-term. McGill University associate professor and epidemiologist Jill Baumgartner warned in an interview with The New York Times “This really shouldn’t be seen as a silver lining”

- And given social distancing until 2022 may be necessary, according to Harvard coronavirus researchers, which may explain why Americans are throwing data privacy caution to the wind to ensure safe distance: (71%) support remote AI patient monitoring to allow healthcare professionals to maintain social distance.

- Ultimately will we live out the message in this photo? This hotel uses empty rooms to illuminate messages of hope for commuters.

Takeaway: Many leaders we’ve spoken with privately in the c-level marketing and communications ranks worry that companies in pursuit of recovery will give back ground that was won on diversity, inclusion and climate awareness. Great leaders will connect the pandemic to our shared national vulnerability and need to rely on one another again if CV19 returns en masse.

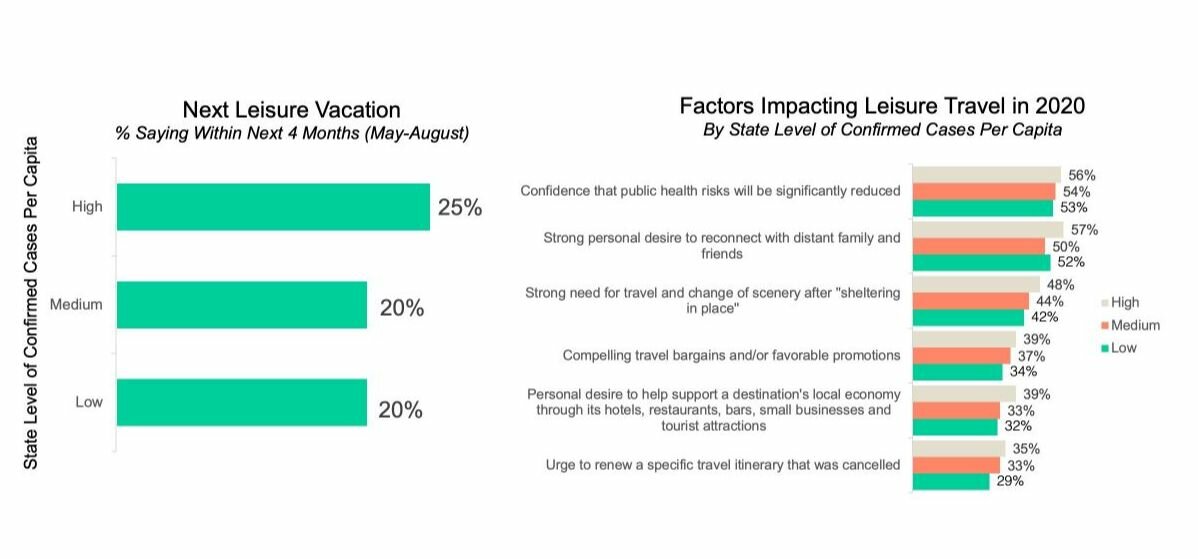

Race, Income and Reopening

If you were worried about social issues in the previous story, here’s one playing out in real time: While everyone wants the economy to reopen and people to get back to work, there’s a large gap between what Americans believe is safe and what they can afford.

- In data we reported with the NY Post, more than half of Americans don’t feel safe getting around in anything other than their own vehicle during the coronavirus pandemic. We found (79%) don’t consider subways safe; (72%) said that of airplanes, (70%) of taxis and (65%) of ridesharing services. Even (58%) feel ride sharing bikes aren’t safe). By comparison, (91%) felt it was safe or somewhat safe to take a car.

- But there are economic disparities in affording a car, because while (43%) said they would go back to work within thirty days, only (20%) said they would take public transportation.

- Then consider that among those who are most likely to take public transportation (against their fear of doing so) are Americans with HHI of $50K, people of color and younger people who have been hit disproportionately in terms of losing jobs and income.

- Taken together, (43%) of Americans want to return to work within 30 days but (80%) say it’s too dangerous to take public transportation. Yet one-in-ten Americans take public transportation daily or weekly (and people of color are three times as likely to do so).

- Soon you might see this on your commute: A Chicago artist fills pesky potholes with pandemic art.

Takeaway: We often bifurcate social issues from economic ones. However, here you can clearly see a blockage in reopening the economy that is based on color, income and equal access to a safe workplace. Testing, contract tracing and on-site thermal testing are all means to alleviate fear for employees. But if most workers are afraid to work, the recovery will be slower.

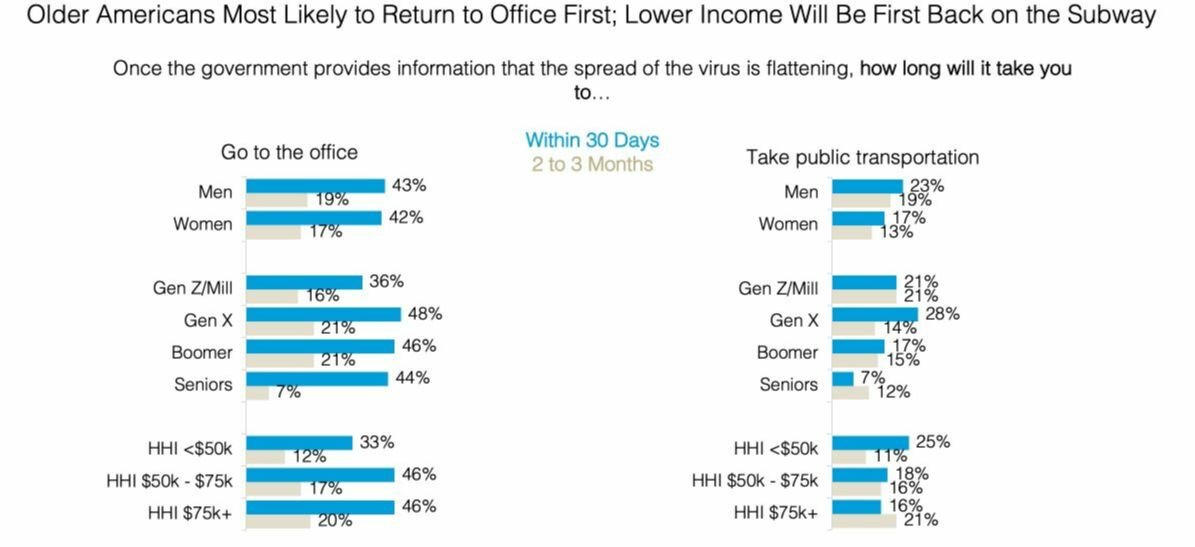

Sign Me Up

The news is filled with data points about the pandemic-related rise of streaming services in America. But what about other services? Are Americans also streaming more music? More self-improvement services? What about online learning or news options? And, importantly for these companies, do these new users plan to keep the services long term?

- During March/April 2020, (35%) of Americans accessed a free trial or activated a new subscription for music, news, fitness, or online learning service.

- Do these new subscribers plan to stick around as the crisis abates? Music seems sticky: Music subscribers are the most likely to say that they plan to keep the subscription post-pandemic (72%). Nearly two-thirds (64%) plan to keep their new fitness service subscription. Over half plan to keep news or online learning services.

- However, some accessed the services solely as a stopgap. One-third of new online learning or news subscribers and one in five new fitness service subscribers say they do not plan to keep the service/access to content after the pandemic.

Takeaway: Yes, we’ve gone app happy in part because there’s little in the physical world to buy. The challenge for subscription services is two-fold – providing an experience that new subscribers expect and value, while demonstrating benefits to those who are either on the fence or don’t plan to need/want the service in the future. Both of these jobs may be made more difficult by the increasing financial pressure many Americans are facing. As such, optimizing the user experience critical during this ‘trial’ period amounts to ‘shock and awe’.

America on the Run

Nearly one-in-five (17%) Americans count themselves as one of the ‘new’ runners in the 2020 CV19-driven running boom. Most of them are looking for both physical and mental benefits from their new running habit. They want to improve physical health, sure, but they are also looking for ways to relieve anxiety/stress and to take their mind off the pandemic. And like body-weight exercises, running is something you can do without fancy equipment found at your (closed) gym:

- These new runners are a mix of Gen Z, Millennials and Gen Xers, a large percentage are parents, and many are affluent (20% of those with HHI over $100K are part of this new runner cohort.) In fact, nearly half (47%) of all ‘runners’ classify themselves as ‘new’ vs ‘experienced’.

- New runners are struggling with staying motivated (47%), battling muscle fatigue and soreness (36%), and lack training knowledge and information (33%).

- Despite these challenges, most new runners are committed to running in the long term. (42%) of new runners are feeling excited to keep running, while (49%) are feeling challenged.

Takeaway: These are gaps that fitness brands are well-poised to address, offering an opportunity to capture this new audience of potential customers. Americans are willing to spend more on the things they want during the pandemic – and a large portion of these runners have disposable income. In fact, 1-in-5 new runners who make $100K+ say they don’t have appropriate shoes.

Tip Like There’s No Tomorrow

We anxiously await our favorite dining spots to open back up. In our Harris survey we found Americans fear of losing their local mainstays and support price increases to keep them in business:

- Americans are overwhelmingly (78%) concerned about local restaurants going out of business and it shows: (66%) support restaurants increasing prices to help recover losses as a result of the pandemic.

- Most encouragingly, nearly a third are willing to pay (8%) surcharge to their tab and say it should apply to food and alcohol: Nearly three-quarters (72%) are willing to pay at least a surcharge of at least (1%) of their total bill, and 27% would be willing to pay as high as (8%). And a majority (54%) say the surcharge should apply to both food and alcohol.

- What is the appropriate way for restaurants to raise prices? (41%) say notification before ordering that all menu items have increased in price, with (25%) suggesting an optional surcharge on the bill and (24%) encouraging higher than normal tips.

Takeaway: A bottle of red, a bottle of white… 71% of Americans say they miss dining out and it shows in their desire to keep their favorite spots reopen. This data reminds us of Panera’s experiment to pay what you can. Here perhaps credit card issuers could assign a line on the restaurant tab asking for a restaurant reopening tip on a sliding percentage of 1 to 10%. This would be not unlike a resort fee or state tax. Restaurants should capitalize on our collective goodwill and our cabin fever.

Virtual or IRL?

A lot has been made of trying to understand whether pandemic behaviors and routines will become lasting. To understand this more clearly this weekend we asked Americans to consider some of their favorite activities and whether they’d do them online or in-person:

- Retail IRL: Americans are twice more likely to shop in-store for household products (69%) vs shop online for household products (31%) post CV19. Also, more than three-quarters of Americans (76%) say they are more likely to shop for groceries in-store while (24%) are more likely to order groceries online for delivery). Hard to see green from yellow bananas through the www.

- No more doomsday bulk shopping: Americans are twice as likely to buy only what they need (64%) vs buying in bulk (36%) post CV19. Here we posit that cupboards are overflowing and there’s no more freezer room left for the ice cream.

- Some are holding out for traditional date night and happy hours: More than 2 in 5 (43%) are more likely to dine in a restaurant post CV19, especially men (47% vs 39% women) and more than 2 in 5 Americans (41%) are more likely to do happy hour at bars/restaurants.

Takeaway: Rapid distress purchased tech like Instacart, Peloton and Zoom promise to capture long term share, as will bricks and mortar for online ordering and pick-up. But as you can see here when things are more intimate and involved, be it a closing date, a business deal, or sniffing the basil, IRL is AOK. Your physical presence is relevant in so far as you are an emotional brand or providing an essential, tactile experience.

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Download the Data

This survey was conducted online within the U.S. by The Harris Poll from May 20 – 22 among a nationally representative sample of 2,032 U.S. adults.

Download

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Download the Data

This survey was conducted online within the U.S. by The Harris Poll from May 20 – 22 among a nationally representative sample of 2,032 U.S. adults.

DownloadRelated Content