Brief • 3 min Read

Good morning. In Wave 11 of The Harris Poll COVID-19 Tracker fielded May 8 to 10, 2020, we look ahead at starting a family in a post-pandemic world and what Americans have learned about homeownership. We’ll study the indefatigable rise of the stock market and lessons from The Northeast in how to reopen the economy. Lastly, our new study shows a renewed appreciation for Big Box retailers.

Our team has curated key insights to help leaders navigate the coronavirus. Full survey results, tables, and weekly summaries can be accessed for free at The Harris Poll COVID-19 Portal. We will continue to actively field on a regular cadence to track the shifts in sentiment and behaviors as the news and guidelines evolve.

Future of Family in COVID-19

Fear holds steady in our data. Eighty percent of Americans say they are afraid to leave their home because of COVID-19. So naturally, the apocalypse can also cause some soul searching. Nearly 6 in 10 (58%) of Americans who said they were planning on being parents in the next five years also say the pandemic has made them less likely to want to have children.

- Gen Z/Millennials and suburbia are less likely to want to have children (65% vs 49% Gen X) and (66% suburban vs 53% urban).

- Parents are tapping the brakes: A majority (83%) say COVID-19 has made them less likely to want to have more children, while only a fifth of parents (17%) say it has made them more likely to want to have more children.

- It’s The Economy, Too: (44%) of Americans who say the pandemic has made them less likely to want to have children, say it is because of the uncertainty of the economy; (37%) say it is because of loss of income during the pandemic.

- A shrinking support network: Nearly 3 in 10 (29%) say they are less likely to have kids due to COVID-19 because they are unsure if childcare will be available or affordable (29%) and want to be able to focus more on their existing family (28%).

- Uncertainty of a future with COVID-19: Over half (55%) of Americans who say COVID-19 has made them less likely to want to have children say it is because they are uncertain about how long the virus will be around; just under half (46%) say it is because they don’t want to bring a child into the world right now.

- Role reversal: Meanwhile, (42%) say the pandemic has made them more likely to want to have children; mostly Gen Xers and urbanites. And interestingly, urbanites are twice as likely to be on real estate websites and thinking about suburbia (43% vs 21% rural). And kids usually tend to come after backyards.

- Here’s a show your future kids might watch: To adapt to set constraints, NBC’s The Blacklist series finale was created in animation.

Takeaway: Family planning always seems to turn down in a crisis and rear its head like a screaming baby. We saw this after 9/11 and the global financial crisis. But how will COVID-19 impact our decision making across other life-changing events like marriage, living closer to family, what kids study in college, do they stay closer to home? Many behaviors will snap back, but others will evolve so we will endeavor to study ‘big life decisions’ in future waves.

The American Dream, Remodeled

After the nation was forced to lie in the bed it made (before, it was a lot easier to overlook aspects of home life Americans may have avoided – relationships, space, neighborhood, attention to décor, yards, etc) ––now we are saying home should be our sanctuary. But who had time to figure that out before COVID-19? As Americans contemplate a W-shaped recovery, home is where space is and it’s time to make it better now if and when the curves go up again.

- Homeowners count blessings: Now twelve weeks into dystopia, (30%) of homeowners say they have felt glad that they bought their home when they did so they can quarantine with their family.

- Also, it’s time to renovate: More than one in five (22%) say “being home so much sparked my interest in renovating my home.” Another (18%) are looking to make improvements to their living situation such as moving to a larger residence or upgrading furniture or (15%) buying better electronics. We also have Pinterest-envy: Almost a quarter (23%) say “I never want to be stuck in a small house or apartment again.”

- Gen Z/Millennials are ready to ‘nest’: One-third (33%) say the pandemic has made them more likely to buy a home in the next six months (vs 29% Gen X), and a quarter (25%) say “I can’t wait to own my own home”. This is likely driven by a high degree of cabin fever which has trended up steadily to encompass nearly fifty percent of all Americans.

- At the moment, luxury means space, not culture: Interestingly, (30%) of Americans say the pandemic has made them rethink their need for space, and (40%) of urbanites last week told us that the COVID-19 crisis has caused them to consider moving to a less densely populated area of the country. We’ve even gone country: Over one-third (37%) say COVID-19 has made them want to live in a rural area more than 21 miles away from a major city (35% in a suburb with 10 miles of a major city). Meanwhile, less than a fifth (19%) say they want to live in a major metropolitan city.

- House hunting goes virtual: Surprisingly, (31%) of Americans have virtually toured homes online since the start of the COVID-19 pandemic: (13%) virtual tours lead by a real estate professional, (13%) virtual open house, (10%) a 3D home tour, (9%) watched a video of a tour. A near equal number (40%) say they are touring virtually because they like checking out new neighborhoods.

- Yet half will wait for the open house: Despite the prospects of virtual home buying, it’s not clear the web will close the sale: (51%) of Americans say they will feel comfortable touring a home in person in 2020, (49%) say they will feel comfortable touring in person in 2021.

- Also, 1 in 4 renters want to be owners: A quarter of renters (25%) say “I never want to be stuck in a small house or apartment again” and “I can’t wait to own my own home” (24%) and (26%) say the pandemic has made them more likely to buy a home in the next six months. An equal number of renters want flexibility: (26%) say “I’m glad I’m renting so I have the flexibility to move when the pandemic ends.”

- Vice details how the pandemic could offer Millennials their best chance to buy a home in their lifetime.

- Maybe your house tour can be done a distance: You can only read this social-distancing ad from 6 feet away.

Takeaway: COVID-19 hasn’t killed the American Dream of homeownership. In fact, if anything it has bolstered it by recognizing the importance of “home” and in doing so reframing its purpose around safety, nurturing, and togetherness. Look for homeownership to spike if there is a setback in reopening. Americans are preppers now and having a good living situation is paramount.

Bearish on COVID-19 but Bullish on Stocks

Despite the fact that the economy is “closed,” unemployment is record high and three-quarters (75%) fear to leave their home for essential errands, Americans have unbridled confidence in the markets.

- Betting on a boom: Nearly 4 in 10 Americans (37%) think the stock market will go up over the next year vs less than a third (32%) who say it will go down. Even though a third are unsure of what will happen (31%), more Americans have put more money in the stock market than have taken out since the start of the COVID-19 pandemic; and (23%) have put more money into the stock market vs (19%) who have taken money out.

- Younger Americans are more bullish: Understandably, Gen Z/Millennials and Gen X are more likely than Boomers and Seniors to say that they have put more money into the stock market than older people who want to avoid volatility (30% and 31% vs 16% and 13%).

- Meanwhile, many are dipping into their retirement savings: Nearly a quarter (22%) have had to because of COVID-19, especially Americans with an annual HHI of $75k+ (26% vs 19% of HHI $50K) as well as urbanites (35% vs 16% suburban and 15% rural).

- Men are the most bullish: Nearly half of men (46%) say the stock market will go up over the next year (vs 29% women) while nearly a third of men (27%) have tapped their retirement savings because of COVID-19 (vs only 17% of women).

- Gen Z/Millennials are strategizing to make ends meet: Gen Z/Millennials are more likely than Boomers and Seniors to have moved investments around but not added or subtracted overall (23% vs 14% each). They’re also more likely than those Boomers and Seniors to say they have had to dip into their retirement savings (28% vs 17% and 8%)

- Meanwhile, the economy has lost 20.5 million jobs, pushing unemployment to 14.7%. To put that, in contrast, the total number of jobs lost in the last recession was 8.7 million and unemployment peaked at 10% in 2009. Moodys does not expect the country to make up all the jobs currently lost until 2023.

Takeaway: The stock market keeps rising amid record unemployment while (so far) a real estate crisis has been averted. Consumerism is an essential link to avoiding a complete crash. So the stock market might ultimately be in the hands of testing and tracing as states reopen. COVID-19 can’t kill capitalism as long as consumers feel safe and confident venturing back out into the marketplace.

What Reopening Can Learn From a Nor’easter

New York City and surrounding urban centers along the northeast coast have been hit the hardest by COVID-19 and business decision-makers in those regions are heeding caution: After restrictions are lifted, business decision-makers in the Northeast and urban regions are most likely to remain closed until the virus is gone, cut hours, and telework versus those in rural regions and those located in the South and Midwest. It is for these reasons, the Northeast might hold the keys for an effective (and safe) reopening.

- First, we see that Northeast business decision-makers are taking the most conservative approach to re-opening: (40%) of Business Decision Makers (“BDMs”) in the Northeast say their business is planning to change to telework options even after stay-at-home are lifted vs only (26%) of BDMs in the Midwest and South, and (24%) in the West. Also (35%) of BDMs in the Northeast plan on reducing staff vs (15%) Midwest, (19%) South, and (24%) in the West.

- Urban and Suburban BDM’s are taking more precautions: (26%) of Urban BDMs (and 20% of Suburban) say their business is planning to remain closed vs only (8%) of Rural BDMs after restrictions are lifted. More than one-third (36%) of Urban BDMs say they plan on limiting capacity vs (27%) Suburban and (11%) of Rural BDMs.

- People Power: Northeast BDMs are most likely to say that the most positive impact a company can have on society is continuing to pay and insure employees (50% vs 40% Midwest, 27% West), BDMs in the South are also heeding the same call to action (49%).

Takeaway: The ravaging effects of COVID-19 on New York City, NJ, CT, and MA have not fallen on deaf ears; business leaders in similar environments recognize they have a duty to protect their employees and society at large in order to reopen. Watching their reopening strategies from test and tracing thresholds, rural to urban rollouts, open streets, etc could be the model playbook for the nation.

Big Box, Big Love

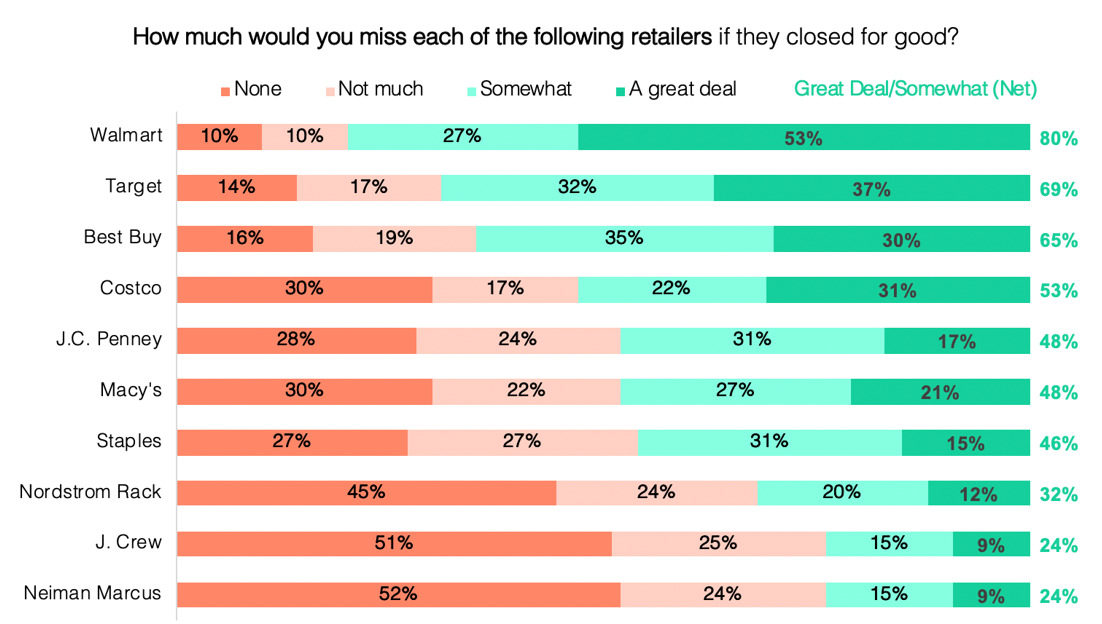

While seventy percent of Americans tell us they miss shopping in stores, what they REALLY MISS is big box retail. Given the recent bankruptcies of iconic retailers, we asked Americans a simple question: Who would you miss if they went away?

As you can see, large retailers like Walmart, Target, Best Buy, and Costco have avid lovers who would greatly miss them. And as Americans have migrated over the past months from Amazon boxes to big bulk buy trips (anyone remembers the ‘90’s?), Big Box reminds us of their big worth.

- Miss You: 8 in 10 say they’d somewhat/greatly miss big box retailers if they closed for good, indicating not only the big box love but the staying power of established brands and the growing attraction to the one-stop shopping trip that consumers quickly came to recognize as the only way during a pandemic.

- Gentle Giants: When it comes to shopping during the pandemic, size does not hinder safety, consumers are just as comfortable shopping at big box retailers (50%) as they are a small boutique store right now during CvOVID-9, presumably because they’re so much space to feel safe.

- Buying online is safer, for now: While two-thirds or more say it is safer to buy big items online right now, there are some products they need to see in-store before they buy: (60%) say they’d prefer to buy appliances in-store to see if before purchasing as well as (57%) TVs, (50%) phones, and (49%) computers.

- Two-thirds of Americans (66%) will return to Big Box stores within three months for consumer electronics. Who will be first to return? Men (68%), Gen Z/Millennials (70%), higher-income households (69% HHI $75K+).

- And wifi problems win over germs: Consumers gladly welcome Geek Squad into their homes during COVID-19; a majority (59%) would be comfortable having an expert professional come to their home during the pandemic to troubleshoot technology issues in-home, with at least some safety precautions. With the number of households turning into home-offices, there is nothing more reassuring than having a personal tech savior arrive in the nostalgic Volkswagen beetle to save us from our tech meltdowns. Good thing Best Buy announced that Geek Squad will soon be back in service.

- Other companies showing their public they’re indispensable: CLEAR will provide coronavirus screening for businesses.

Takeaway: Expect to see Big Box retailers draw big crowds as shopping returns. And big runs to the store might be an enduring buying habit once again. Bulk buying is for now, back in vogue.

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Download the Data

This survey was conducted online within the U.S. by The Harris Poll from May 8 – 10 among a nationally representative sample of 2,030 U.S. adults.

Download

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Download the Data

This survey was conducted online within the U.S. by The Harris Poll from May 8 – 10 among a nationally representative sample of 2,030 U.S. adults.

DownloadRelated Content