Brief • 4 min Read

America This Week: Buy Now Pay Later’s Dark Side, Crypto Is On The Ballot, Forty Years of Student Loans and Parents Vent.

The latest trends in society and culture from The Harris Poll

While Gaza, Inflation, and The Trump Trial dominate headlines, a new COVID-19 variant, cheekily named “FLiRT” makes up over a quarter of new cases, compared to just one percent in mid-March. According to our America This Week Tracker, which fielded May 10th to 12th among 2,119 Americans, new variants still worry almost half (48%) Americans.

This week, we have four new stories: First, in a new Bloomberg-Harris Poll, American consumers are racking up “phantom debt” with Buy Now, Pay Later services. Next, four in ten voters in swing states see crypto as an issue candidates must address. Also, most Americans believe paying off their student loans will take over two decades. Finally, we explore the connection between gaps in childcare coverage and parental mental health with KinderCare.

Americans Are Racking Up ‘Phantom Debt’ That Wall Street Can’t Track: Bloomberg-Harris Poll

With inflation continuing to abate, Buy-Now-Pay-Later schemes are highly popular with American consumers. But a new Bloomberg-Harris Poll suggests that it’s unclear how many of these loans are out there.

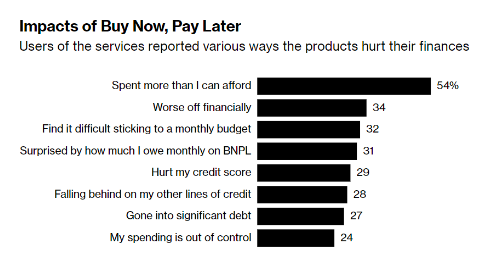

- More than half (54%) of BNPL users say it allows them to purchase more than they can afford. But worryingly, nearly a quarter (24%) also say their BNPL spending is “out of control.”

- Over four in ten (43%) BNPL users who owe money said they were behind on payments, while (28%) said they were delinquent on other debt because of spending on the platforms.

- Almost half (48%) of those using BNPL say they’ve started, or have considered, using it to pay bills or buy essential items, including gas and groceries.

- Listen to our poll in Bloomberg’s Big Take podcast here.

Takeaway: The option to pay in installments using short-term loans has been around for several years but exploded in popularity during the pandemic, especially with younger, digitally savvy consumers who gravitated to the services as an alternative to credit cards. However, “BNPL essentially lets people dig a deeper and deeper hole of credit, which will be harder and harder to climb out of,” said Ed deHaan, a professor of accounting at Stanford Graduate School of Business.

Crypto Craze In Swing States: Digital Currency Group-Harris Poll

If you’re at a campaign stop in a swing state this summer, you might hear someone say, “What’s your position on crypto?” A new Harris survey in Axios finds that (40%) of the registered voters in Michigan, Ohio, Montana, Pennsylvania, Nevada, and Arizona said they wish political candidates talked more about digital currency.

- We want a free market: Nearly half (48%) said they don’t trust candidates who interfere with crypto, while (30%) would be likelier to support a crypto-friendly candidate.

- Swing state voters see crypto as an alternate avenue to wealth: Of those voters who have owned crypto, nearly half (47%) have profited from their investment.

- Digital currencies have working-class values: Four in five registered voters who value crypto as an issue agree that “the current financial system favors elites over regular people.”

Takeaway: “The recent poll conducted by Harris and DCG confirms what many in the industry have suspected: digital assets have emerged as a significant issue in the upcoming election,” said Kristin Smith, CEO of the Blockchain Association. “Additionally, over one quarter (26%) of voters indicate that they actively weigh political candidates’ positions on digital assets when making decisions. These data underscore the increasing relevance of our issues in shaping the electoral landscape of 2024.”

Student Loans Boomerang Back On Parents: Northwestern Mutual-Harris Poll

From campus protests to growing questions over the ROI of a degree, higher education has become a target in American culture. However, according to our new research with Northwestern Mutual in Fortune, one of the most vocal critics is parents, who bear the burden of loans and their children.

- Of American parents saving for their children’s college education, (95%) expect to cover more than half of their children’s costs, while (36%) say they will pay for all the costs.

- As such, one in five adults in America (and 40% of Gen Z) are saving for college for themselves or a family member.

- And they expect the total cost of college to be $77,300 and aim to pay it off by age 45.

- Among those who are saving for college for themselves or a family member, a quarter (23%) are still paying off their student debt.

Takeaway: “For many parents, saving for their kids’ college expenses is priority number one,” Christian Mitchell, chief customer officer at Northwestern Mutual, said. “Each family should determine what feels right but must act intentionally. Otherwise, the window to save for college costs may close – and fate will dictate how much parents and kids must contribute.”

Childcare Coverage Is Weighing On Parental Mental Health: KinderCare-Harris Poll

Every year, we track a Parent Confidence Index with Kindercare. And this year in Yahoo!, parental burnout is rising due to worries over access to child care.

- Out of the 2,000 U.S. parents we surveyed, (71%) admitted they’re constantly thinking about childcare gaps, a (7%-pt) increase from 2023.

- Half (50%) said providing enough childcare coverage causes substantial stress.

- Employers need to “flex”: (61%) said they want their employer to implement flexible start and end times, and (64%) think their employer should offset the cost of childcare.

- Nearly all parents (88%) believe access to consistent, high-quality childcare would improve their mental health.

Takeaway: “When considering how we can reduce parental burnout, an area often overlooked is access to quality child care, which can greatly reduce stress and create peace of mind for parents,” Dr. Marquita Davis, Chief Academic Officer at KinderCare Learning Companies, tells Motherly. “Our Parent Confidence Index reveals the impact this can have on parents’ mental health.”

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Download the Data

This survey was conducted online within the U.S. by The Harris Poll from May 10th to 12th, among a nationally representative sample of 2,119 U.S. adults.

Download

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Download the Data

This survey was conducted online within the U.S. by The Harris Poll from May 10th to 12th, among a nationally representative sample of 2,119 U.S. adults.

DownloadRelated Content