Brief • 4 min Read

America This Week: Happier Economic Vibes, Streaming Sports Win Big, DEI In Another Name, and Most of Us Don’t Know Our Credit Score.

The latest trends in society and culture from The Harris Poll

It’s good to track our surveys’ first signs of upbeat public economic attitudes in over eighteen months. Our America This Week poll was fielded from January 19th to 21st among 2,047 Americans. While concern hangs over the economy, inflation (86%), and a potential U.S. recession (75%), our new Axios-Harris Poll Vibes survey (below) shows rising confidence in personal finances, housing situation, and job security. Yet as the election crystalizes into a Trump-Biden rematch, over three-quarters (77%) remain concerned about political divisiveness in the country.

This week, we have four new stories: Beginning with that optimistic take on American finances. Next, what lengths would you go to watch an NFL playoff game? We found that many sports fans are begrudgingly purchasing new streaming platforms. And then don’t write off DEI so fast as corporations rush to protect it by dropping the acronym. Lastly, we find that more younger Americans know the cost of their daily coffee than their credit score.

Americans Finally Give Off a Rosy Economic Vibe: Axios-Harris Poll Vibes Survey

When we launched Axios Vibes By The Harris Poll last week, we found American frustration toward the economy and government leaders. Yet, in the latest Vibes feature, we find the first glimpse of optimism in how Americans rate their finances, housing, and job security.

- Nearly two-thirds (63%) of Americans now rate their current financial situation as being “good,” including (19%) who say it’s “very good.”

- Moreover, (85%) of Americans feel they could improve their financial situation this year.

- Over three-quarters (77%) are relatively happy with where they’re living, and for renters, (63%) say they’re not interested in home ownership and having a mortgage.

- And nearly two-thirds (63%) of employed Americans describe their job security as “a sure thing.”

Takeaway: Americans have been in the doldrums, where public sentiment on the economy has diverged from market performance. Could this be the thawing that Biden is looking for? It’s too early to tell, but consider that two-thirds of Americans (66%) think 2024 will be better than 2023. That aligns with Wall Street estimates, which have penciled in continued growth in GDP and real wages for the rest of the year.

NFL Fans Will Pay For Streaming: Front Office Sports-Harris Poll

According to recent Harris Poll research with Front Office Sports featured in Forbes and Bloomberg, despite what sports fans say on social media, they are willing to pay for content.

- About three in five (61%) NFL fans and two in five (45%) U.S. adults said they would be likely to pay for a subscription to a streaming service to watch an NFL playoff game.

- And if the NFL were to make a postseason matchup a pay-per-view event, (57%) of NFL fans and (42%) of U.S. adults surveyed say they would likely pay a one-time fee to watch.

- And of those NFL fans willing to pay a per-game price, more than half (53%) would pay $10 or more, and nearly a fifth (17%) $20 or more.

- Two-thirds (64%) of NFL fans and about half (49%) of U.S. adults would also likely pay for a subscription to watch the Super Bowl.

- According to Paramount, The Chiefs vs. Bills playoff game broadcast peaked at more than 56 million viewers and was the most-streamed live event on Paramount+ in its history.

Takeaway: For now, though, neither the NFL nor Peacock has much reason to worry about sports lovers turning their backs and affecting their bottom lines. However, the biggest threat to this streaming/sports match made in heaven could be Congress, where at least one member has suggested that the NFL’s exclusive streaming deals may violate its antitrust exemption.

Companies Rush To Define DEI: Axios-Harris Poll

Corporate diversity, equity, and inclusion (DEI) efforts are under even more scrutiny in 2024, and while corporate DEI strategies will continue, boasting about them may not, according to recent Harris Poll research featured by Axios.

- According to Black Economic Alliance-Harris Poll research, most adults (81%) believe corporate America should reflect the nation’s diversity.

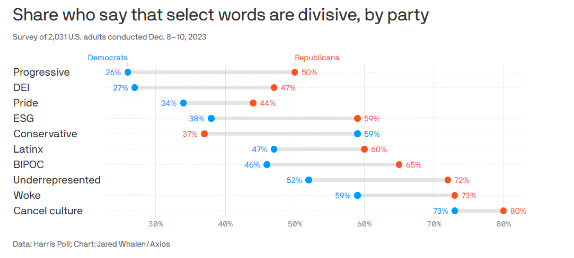

- Yet, roughly half of Republicans view the term “DEI” as divisive – while only (27%) of Democrats agree – as well as the terms “BIPOC,” “Latinx,” and “ESG.”

- This linguistic disconnect also transcends generations, as (75%) of Boomers+ view the term “BIPOC” as divisive, followed by terms like “underrepresented” (70%) and “Latinx” (67%):

Takeaway: “DEI, like many of these acronyms and phrases, has devolved into ideological dog whistles. Americans hear and sort them like voters, instead of consumers. They’re either red or blue,” says Harris Poll CEO John Gerzema. Because of this, DEI branding is now being replaced with terms like “well-being” and “employee experience,” especially as chief human resource officers do not plan to scale back their DEI strategies, according to a recent survey conducted by the Conference Board.

The Credit Card Blind Spot For Young Renters: Zillow-Harris Poll

Gen Z and Millennials are pivotal players in the rental market, making up about a quarter and a third of all renters, respectively. However, in partnership with Zillow, we uncover a concerning trend: a gap in credit score awareness among these younger generations.

- According to the survey, more than half (54%) of Gen Z and Millennial renters who had a rental application denied in the past attributed the rejection to a low credit score.

- Over 9 in 10 younger renters are confident they know their monthly cell phone bill (94%), their streaming service’s subscription costs (93%), and their regular morning beverage order (92%).

- Yet, fewer (79%) are confident they know their current credit score, dropping to less than half (45%) who are very confident they know their score (Gen Z: 36% v. Millennials: 49%).

Takeaway: This lack of knowledge isn’t just a minor oversight for Gen Z and Millennials; it’s a barrier to achieving their financial goals. This disparity in credit awareness is a critical hurdle in their journey toward financial stability and independence. And it only compounds the financial barriers they already face, as we’ve previously found with USA Today that (65%) of Gen Zers and (74%) of millennials say they believe they are starting further behind financially.

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Download the Data

This survey was conducted online within the U.S. by The Harris Poll from January 19th to 21st, among a nationally representative sample of 2,047 U.S. adults.

Download

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Download the Data

This survey was conducted online within the U.S. by The Harris Poll from January 19th to 21st, among a nationally representative sample of 2,047 U.S. adults.

DownloadRelated Content