Brief • 4 min Read

Gen Z Working Class Struggles, Is Social Security Collapsing? The Student Loans Hangover and Our National Hate of Anchovies

The latest trends in society and culture from The Harris Poll

Does age affect how you look at today’s challenges? In our America This Week survey, fielded September 1st to 3rd, among 2,055 Americans, more Boomers+ are worried about the economy (88%), crime (88%), and political divisiveness (82%) than Gen Z (78%, 69%, 64%). Yet Gen Z is more worried about affording their living expenses (75% v. Boomers+: 65%), losing their job (62% v. 34%), and even the security of their financial deposits (62% v. 54%).

This week, four new Harris Polls of note: First, Harris finds that for Gen Z hourly workers, financial and health stress go hand-in-hand. Also, as America rapidly ages, the potential longevity of Social Security is suddenly top-of-mind with the public (mostly younger people). Next, as student loan payments return online, Americans struggle to add this expense to their already stretched household budget. And lastly, we rank America’s most loved and hated foods (hint: it’s fishy).

You can download the new ATW monthly summary tabs and ppt deck here.

Gen Z Hourly Workers In The Red: Funding Our Future-DailyPay-Harris Poll

We know younger Americans are finding today’s economy tough. But in our new survey with Funding Our Future and DailyPay in Essence, most Gen Z hourly workers find it nearly impossible to manage their finances.

- (85%) Gen Z hourly workers say inflation has negatively impacted their finances in the past year.

- And (96%) find managing their finances stressful, which has hurt their physical and/or mental health (75%).

- Over four in ten saved less than a year ago, and a fifth (19%) are forced to rely on payday loans to pay bills when cash is low.

- No relief: Nearly nine in ten (86%) Gen Z hourly workers believe the economy will stay the same or decline in the next year.

Takeaway: “The youngest members of our labor market are experiencing significant financial stress, which has a detrimental impact on their health and the opportunity for a secure future,” said Lettie Nocera, Senior Manager of Funding Our Future. “We must continue to advance innovative solutions that meet the evolving needs of all American workers.”

Americans Ask, Will Social Security Be Around For Us? Nationwide-Harris Poll

Social Security just turned 88 this past year. Yet Americans are growing less confident that the program isn’t headed for demise, according to new Harris research with Nationwide in Fortune.

- Nearly half of younger Americans don’t think they’ll “get a dime” of the Social Security benefits they’ve earned (Gen Z: 45%, Millennials: 49%).

- Three-quarters (76%) of both Gen Z and Millennials anticipate they will need to work in some form during their retirement as Social Security will not be enough support.

- But even Boomers+ worry: (75%) of Americans over 50 fear Social Security will run out during their lifetime. (In 2014, it was 66%).

- And without Social Security, some are without a lifeline: (21%) of 50+ say they have no source of retirement income in addition to Social Security, up from (13%) in 2014.

Takeaway: “Retirement has become even more expensive of late, as many experts say that living comfortably into your golden years now requires more than $1 million as people live longer and the cost of living remains relatively high. That makes the endangered program all the more important. A 2022 Social Security Trustees report signaled that this generation’s worries are not outlandish – estimating that in 2034, retirees will only receive (77%) of their benefits if Congress does not update the program” (Fortune).

The Looming Cloud of Student Loans: Credit Karma-Harris Poll

The Supreme Court’s decision to strike down President Biden’s plan to forgive a portion of federal student loan debt means those borrowers will be resuming payments after a three+ year hiatus. According to a new Harris survey with Credit Karma on CNET and Yahoo!, this is grim news for borrowers who don’t feel confident being able to juggle student loan payments.

- Even while they have not been making student loan payments, most (53%) of federal student loan borrowers say they struggle to pay other bills (e.g., auto loans, mortgages, credit cards, etc.).

- Also, more than half (56%) of these borrowers say they must choose between making their student loan payments or paying for necessities (e.g., rent, bills, groceries, etc.), but they cannot afford both.

- And nearly half (45%) expect to go delinquent on their student loan payments once forbearance ends, leaving (44%) to think the return on investment for higher education in America isn’t worth the expense.

Takeaway: “Federal student loan borrowers will face a new normal as payments are set to resume after a 3+ year hiatus,” said Courtney Alev, consumer financial advocate at Credit Karma. “While many borrowers were able to get ahead in other areas of their finances during forbearance, others struggled to stay on top of other bills and expenses, likely due to inflation and today’s high cost of living.”

Love It Or Loathe It – America’s Most Polarizing Foods: Instacart-Harris Poll

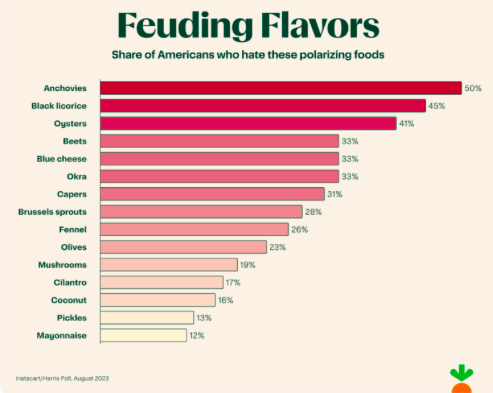

What’s worse, okra or olives? We partnered with Instacart to find America’s most hated ( anchovies) to least hated (mayo) foods:

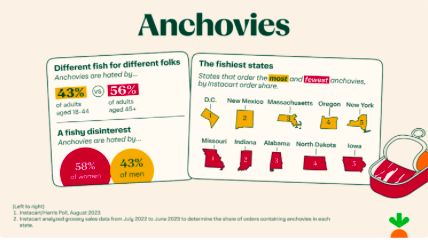

- Hold the anchovies: Our survey found that half of Americans hate anchovies, making the small, oily fish the most hated polarizing food on our list.

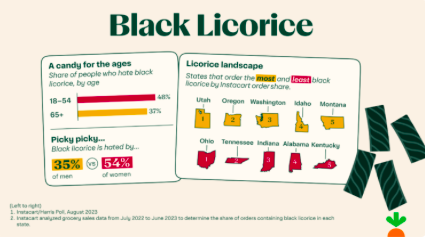

- Licorice’s dark secret: This may not come as a surprise, but there’s a generational and gender divide when it comes to this candy – more below:

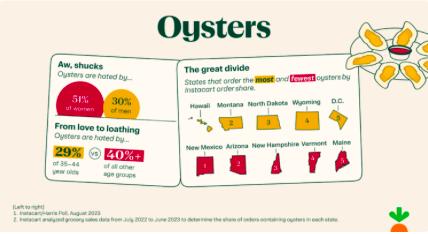

- The world is your oyster: What’s also curious is that three of the five top states that order the most oysters are entirely landlocked, while three of the five states that order the fewest oysters are located in New England:

- What are the top reasons Americans think a food could be polarizing or controversial? Smell (66%), strong flavor (57%), texture (57%), visual appearance (47%), type of flavor (47%), and even how it makes one feel after eating it (32%).

Takeaway: It’s surprising to see Americans giving the most love to mayonnaise. Some, however, take the white stuff to the extreme: Titan’s rookie quarterback Will Levis parlayed his viral love for mayo into a lifetime deal with Hellmann’s after he was captured stirring mayo into a cup of coffee. To each his own…

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Download the Data

This survey was conducted online within the U.S. by The Harris Poll from September 1st to 3rd among a nationally representative sample of 2,055 U.S. adults.

Download

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Download the Data

This survey was conducted online within the U.S. by The Harris Poll from September 1st to 3rd among a nationally representative sample of 2,055 U.S. adults.

DownloadRelated Content