Brief • 4 min Read

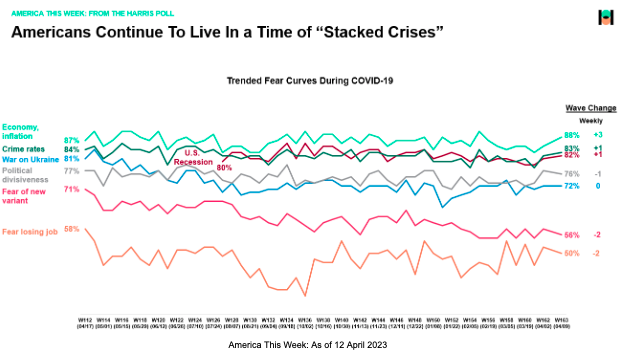

Is inflation cooling? This morning’s report from The Bureau of Labor Statistics shows Consumer prices rose (5%) in the year through March, down significantly from recent months. But in our new America This Week survey, fielded from April 7th to April 9th among 2,048 Americans, concerns about the economy and inflation are still growing (88%, +3%-pts from March 12th). And with new layoffs announced by large companies as diverse as McDonald’s, Meta, and Dell, fears of an impending recession are now felt by (82%) of all Americans (+1%-pt from last week).

Here are our top weekly concerns in America chart:

This week, we have four new polls, including how Americans are letting go of the banking crisis and the new societal role Millennial women feel they have been thrust upon them. And why kids would rather be an influencer than an astronaut, and Millennials chase the ever-elusive dream of home buying. You can download the new ATW monthly summary tabs and deck here.

Americans Are Over The Banking Crisis: Fortune-Harris Poll

The instability in the banking system following the Silicon Valley and Signature Bank collapse shows signs of being over by bankers and most of the general public.

- JPMorgan Chase CEO Jamie Dimon, often seen as the voice of the financial industry, believes the fallout from the crisis is likely over – even if the Fed doesn’t cut rates. Could there be more bank failures? “I don’t know,” Dimon told CNN Thursday. “But if there are, honestly, they’ll be resolved. I think we’re getting near the end of this particular crisis.”

- Most Americans agree that the banking industry is now stable: In a new Harris poll, co-CEO Will Johnson’s latest op-ed writes that more than (90%) of depositors believe their money is safe in U.S. banks, regardless of the bank’s size.

- However, those with the most to lose do worry the most: A majority (55%) of those with household incomes of over $100,000 worry about small banks closing (v. gen pop: 46%), while similar numbers of these high-income households also worry about medium-sized (50% v. 44%) and large-sized banks (48% v. 42%).

Takeaway: “This is not 2008. This is much more limited,” says Dimon. “There are only a handful of banks that had this particular problem. It will eventually be resolved one way or another. So I think people should take a deep breath,” he said, arguing that many banks will turn in “pretty good” earnings over the next few weeks despite the crisis. Yet watch for wealthier Americans (with deposits above the FDIC’s protection of $250,000) to continue to monitor their banks as closely as their stocks.

Women Have A New Title – Chief Worry Officer: theSkimm-Harris Poll

The findings from theSkimm-Harris Poll 2023 State of Women report reported on by Today build on a growing sentiment that progress for women is not where it should be and the prevailing systems, which were not made for women, need to be redesigned to account for the myriad of roles women play today.

- Most Millennial women surveyed (71%) were consumed with worry – tasked with the mental burden of thinking through every single scenario, at home and work, and planning for every contingency – leading them to be the Chief Worry Officer (CWO).

- And nearly 4 in 5 (79%) of these women said they were concerned about the social expectations around this unpaid labor – especially as a similar number (82%) said they handle their worry alone.

- And even more harmful is the gap in meaningful solutions: 4 in 5 (82%) said that while there’s much talk about how overburdened women are, no one is helping them ease the burden, and (72%) are tired of wellness products, and services that expect them to add something more to my day.

- However, women are ready to take control of their lives, as (92%) are now prioritizing their health, and (81%) said they are actively seeking new lifestyles that prioritize their health and well-being.

Takeaway: “An overwhelming majority of the women surveyed feel that progress is not where it needs to be in 2023, and we’re seeing more and more women create their momentum to fuel their purpose,” says Abbey Lunney, Managing Director at The Harris Poll’s Trends and Futures Practice. Co-CEOs and co-founders of theSkimm Carly Zakin and Danielle Weisberg added, “We are hearing stories of small changes women are making that can lead to a bigger impact — like saying ‘no’ more, setting boundaries and focusing on ‘me’ time. We are also seeing them invest long-term, looking for new jobs or positions that offer the support they need (access mental health resources, utilizing paid family leave policies, offering childcare).”

When I Grow Up, I Want To Be An Influencer: Fast Company-Harris Poll

Two new Harris polls find some surprising things about kids and screens: First, they’re not necessarily as bad as you might think, and second, they might factor into your child’s future career choice.

New Harris research with Nemours KidsHealth covered by U.S. News, finds that pre-teen kids are utilizing screen time as a coping mechanism for their worrying:

- Of children who utilize TV, video games, or social media when they are worried, (85%) say playing video games makes them feel better, with a majority saying TV (72%) and social media (59%) do as well.

- And more than nine in ten children, when worried, do something creative — like listen to or play music, draw, paint, etc. — say it makes them feel better (96% and 93%, respectively).

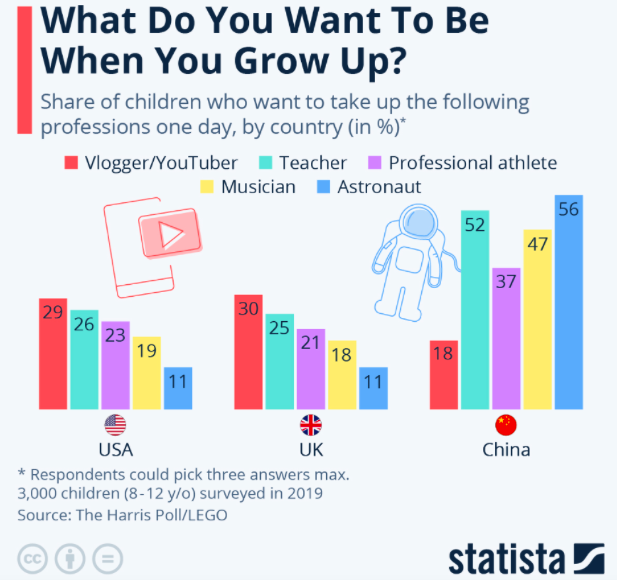

- But is screen time shifting children’s career ambitions?: According to a pre-COVID Harris Poll/Lego survey in FastCompany, covering the United States, Britain, and China, found that 3 in 10 children (29%) aged 8 to 12 want to be a “YouTuber.” That’s three times as many as those who want to be astronauts:

- Meanwhile, platforms like TikTok are career-builders for younger Americans: For Gen Z, TikTok is the “center of gravity” for search and education. As we found, it’s the first platform Gen Z uses to search for culturally relevant content (34%), beating YouTube (24%), Google (19%), and Instagram (17%). It’s also an undercover learning engine, as most Gen Z reports regularly turn to TikTok to learn something (63%).

Takeaway: Other polls suggest that even more teenagers aspire to fame and fortune via YouTube or another social media platform. An eye-grabbing news report indicated that (54%) of Americans aged 13 to 38 would become an “influencer” given a chance, with (12%) already considering themselves influencers. And less we assign a dystopian label to these statistics, believe that younger Americans might be thinking ahead to future jobs: Of those who think “it’s likely that the Metaverse will provide lucrative career paths and money-making opportunities,” most are young people (Gen Z: 64%, Millennials: 73%).

Will Millennials Rent Forever? Fortune-Harris Poll

First, the good news for our beleaguered child-raising, student loan-carrying cohort: More Millennials finally own their homes than rent, a milestone that’s taken longer than previous generations. However, homeownership still feels out of reach for many, according to new Fortune-Harris Poll research.

- The halfway mark: Approximately (52%) of Millennials owned a home by the end of 2022, according to recent research from RentCafe based on Census and survey data from the Integrated Public Use Microdata Series (IPUMS) project, part of the Institute for Social Research and Data Innovation at the University of Minnesota.

- And Millennial renters have an appetite for homeownership, as nearly nine in ten (88%) would like to own a home someday (v. all renters: 76%).

- Despite these gains and interest, many potential homebuyers are struggling in the current market: seven in ten Millennials (69%) feel priced out of the current real estate market, and more than half (56%) of Millennial renters believe the dream of owning a home is dead.

- And these frustrations are only compounded by the three-quarters of Millennials (78%) today that are worried about affording their living expenses (v. Boomers: 63%) and losing their job (60%).

Takeaway: While Millennials have made strides in becoming homeowners, the pace at which they’ve purchased homes over the past five years is not likely to continue. Between debt, rising interest rates, and the housing supply shortages could leave half of this generation still renting, with Gen Z quickly coming up behind.

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Download the Data

This survey was conducted online within the U.S. by The Harris Poll from April 7th to 9th among a nationally representative sample of 2,048 U.S. adults.

Download

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Download the Data

This survey was conducted online within the U.S. by The Harris Poll from April 7th to 9th among a nationally representative sample of 2,048 U.S. adults.

DownloadRelated Content