Brief • 5 min Read

The latest trends in culture and society from The Harris Poll

Interest rates are likely kitchen table talk in many homes nationwide. As the Fed signals more aggressive hikes to tamp inflation, our new America This Week survey, fielded March 3rd to 5th among 1,996 U.S. adults, finds a panicked spike of concern among employed Americans about losing their job (54%), an (11%-pt) increase from last week. Gen Z employees worry the most (63%, +13%-pts), followed by remote workers (60%, 14%-pts).

Here’s what else you need to know this week:

- Trouble sleeping is damaging relationships and our overall health.

- Many recent home sellers have regrets and can teach us what they did wrong.

- The wage/price spiral plays out in a new survey of American hiring managers signaling pay raises but employees questioning if it’s enough.

- It’s not as bad as France, but more Americans consider putting off their future retirement.

These stories are below. And check out the America This Week monthly summary slide deck and tabs. Download the new report here.

American Insomnia: Idorsia-Harris Poll

We’ve extensively reported the links between economic hardship and stress in America and poor employee mental health and wellness levels. Now our new Wake Up America survey with Idorsia finds the far-reaching effects of insomnia on personal relationships and the compounded overall effects on our health.

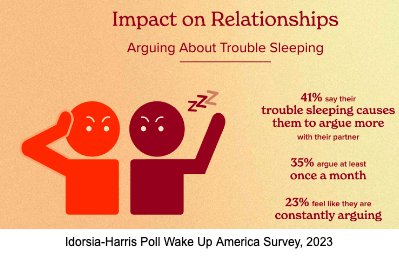

- Four in ten (41%) of people with trouble sleeping (PWTS) say it causes them to argue more with their partner or disrupt their partner’s sleep and their relationship overall.

- And over half (53%) report their trouble sleeping is an added relationship stressor, with (41%) saying their partner has had to pick up the slack with household chores and nearly a third (31%) saying they have slept in a separate bed.

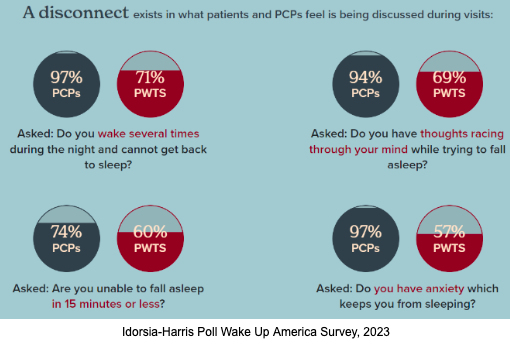

- Diagnosing sleep as a health issue: While two-thirds of primary care physicians (PCPs) say they ask about sleep in routine visits (67%), only (36%) of PWTS report being asked.

Takeaway: The lack of focused conversations between the sleep-deprived and their providers and the myths and stigma tied to the sleep disorder has created a perpetual cycle of misinformation and inadequate treatment outcomes. Trouble sleeping is pervasive and infiltrates quality of life, daily activities, and our families. And it can lead to immobility, as we found with the APA that over a quarter of Americans say they are too stressed on most days to function.

Sellers Now Have Regrets: Zillow-Harris Poll

While we first found buyer’s remorse with Fortune, sellers now stew in regret. In a new Harris Poll with Zillow, we find that despite low inventory, many recent first-time sellers lament over their decisions in the pricing, timing, or marketing of their homes.

- An overwhelming share of Americans (84%) who sold a home for the first time in the past two years wish they had done something differently.

- Regret #1 – Pricing Higher: The most common mistake first-time home sellers wish they had done differently is setting a higher list price (39%).

- Regret #2 – Ignoring Online Curb Appeal: The exact number think better listing photos could have boosted their bottom line, while one-quarter of recent first-time sellers feel a virtual tour could have helped sell their home for more.

- Regret #3 – Bad Timing: One-quarter of recent first-time sellers also wish they had listed their home at a different time (Zillow research says the second half of April is the optimal time to list a house).

- Regret #4 – Skimping on Repairs: Another one-quarter of recent first-time sellers think they could have gotten a higher sale price if they had invested in more home improvements and repairs.

Takeaway: Today’s market is different and is no longer the red-hot housing market we saw during the pandemic, something future home sellers need to keep in mind. According to Zillow senior economist Nicole Bachaud, “The price their neighbor commanded a year ago may no longer be realistic. [Sellers] must adjust their expectations to avoid their home lingering on the market. As a result, it’s more important than ever for sellers to rely on the advice of a great local agent who understands their neighborhood and has a winning pricing strategy.”

The Wage/Price Spiral Explained: Express Employment Professionals-Harris Poll

The Fed keeps raising rates, but business keeps hiring, at least for now: Our latest survey with Express Employment Professionals in Franchising.com finds American hiring managers are forecasting pay bumps and hiring sprees. But the wage/price spiral plays out in vivid detail here as current and future employees wonder if the money is still enough (while businesses struggle with the budget to hire them in the first place).

- Three-quarters (75%) of hiring managers predict employees at their companies will receive a bump in pay this year, up from (58%) in 2020.

- And (60%) of hiring managers say their company plans to increase the number of employees in the first half of 2023, on par with the first and second halves of 2022.

- Also, U.S. hiring managers say recruiting over the next year appears encouraging and positive (75%), with feelings such as optimism, hopefulness, and confidence.

- However, despite the need for many companies to hire to meet increased workloads, nearly one-third say their company needs more money in the budget this year or that their upper management still needs to approve hiring additional staff (29%).

- Our America This Week survey previously found that nearly three-quarters of employed Americans (72%) say their current salary isn’t keeping up with inflation, and over half say they don’t feel like they can live on their salary (53%). Yet, two-thirds (64%) agree they could readily seek a higher-paying job.

Takeaway: “Balancing overall business costs with necessary hires is critical, and it seems like many employers are taking a wait-and-see approach with market conditions before increasing their headcount,” Express Employment International CEO Bill Stoller said. “But overall, this is great news for job seekers. Most businesses need workers, so for those on the sidelines, now is a great time to find the right opportunity.”

Retirement Looks Further Off For More Americans: NerdWallet-Harris Poll

Today France is roiling over Macron’s proposed plan to raise the retirement age from 62 to 64, spawning today’s nationwide protests and strikes. And back here in the states, rising costs over the past year have thwarted some Americans’ savings and delayed retirement plans, according to our latest survey with NerdWallet.

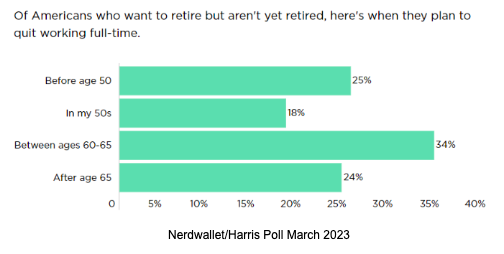

- Retirement plans have altered for many over the past year: Thirty percent of Americans say their planned retirement age has changed over the last year, with some Americans planning to retire later than originally planned (16%), with fewer planning to retire sooner (11%).

- Of Americans who aren’t yet retired, the planned retirement age is 57, on average, or around a decade earlier than 67, the full retirement age to receive Social Security benefits.

- Some prefer to ‘Keep Truckn’: Among Americans who have no plans to retire, the top reason is that they don’t think they’ll ever want to stop working (42%), with (31%) saying it’s because they don’t think they’ll save enough to do so.

- Only some people are saving for retirement: The survey found that (11%) of Americans haven’t started saving for retirement; more than a quarter of Generation Z (27%) say this.

Takeaway: “For some who are getting close to retirement, high inflation, layoffs, or other factors may have impacted their ability to retire on schedule,” says Alana Benson, a NerdWallet investing and retirement writer.

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Download the Data

This survey was conducted online within the U.S. by The Harris Poll from March 3rd to 5th among a nationally representative sample of 1,996 U.S. adults.

Download

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Download the Data

This survey was conducted online within the U.S. by The Harris Poll from March 3rd to 5th among a nationally representative sample of 1,996 U.S. adults.

DownloadRelated Content