Brief • 5 min Read

The Harris Poll, America This Week survey fielded November 22nd to 23rd, among 2,149 U.S. adults, finds Americans’ concern over the economy and inflation (88%), and worry over affording living expenses (74%), hasn’t changed much versus mid-April: (87%, 76%) respectively.

Here’s what else you need to know this week:

- In a new TIME/Harris Poll, we find that even three years in and four vaccines later, COVID-19 is still wreaking havoc on holiday plans for some Americans.

- Also, Americans ponder when (or if) a recession is inevitable in our latest Harvard CAPS-Harris Poll.

- And with Grid, we detail the usage and trust gaps in social media between generations.

- And lastly, we examine the secondhand clothing market, as featured in Bloomberg.

To hear about these stories and more, check out our America This Week: From The Harris Poll podcast on Spotify and Apple Podcasts, where our CEO John Gerzema and CSO Libby Rodney dive into the numbers. For any polling ideas, reach out to atw@harrispoll.com.

Lastly, check out the latest America This Week monthly summary slide deck and tabs for more insights into inflation and worker sentiment Download the November report here.

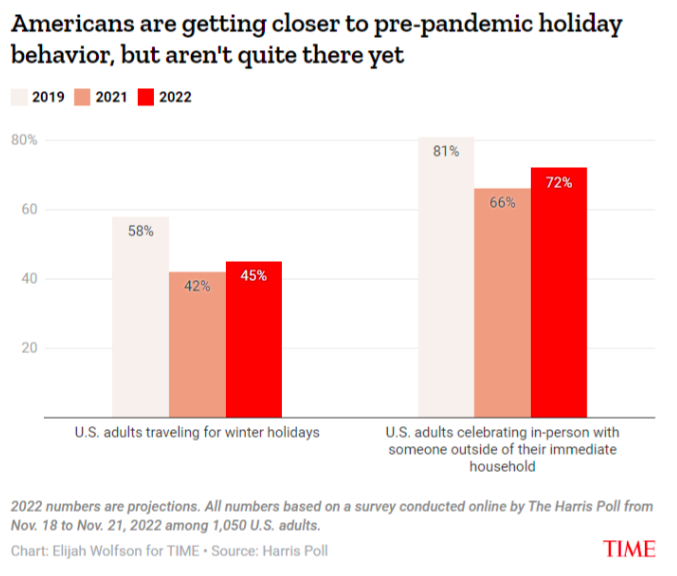

COVID-19’s Continued Upheaval of Holiday Plans: TIME-Harris Poll

It’s beginning to look a lot like social distancing: According to our new survey with TIME, holiday celebrations are inching back toward their pre-pandemic norms. But even as much of the country leans away from pandemic-era policies, many families are still planning to take “a side dish and gift to the holiday dinner, not a virus.”

- Nearly three-quarters of Americans (72%) plan to celebrate the holidays with at least one person outside their household – down from (81%) who did so before the pandemic but up from (66%) last year.

- And close to half of Americans (45%) report plans to travel during this year’s holiday season, compared to (58%) pre-pandemic and (42%) last year.

- But COVID isn’t entirely forgotten: Over half of Americans (55%) report that COVID-19 will affect their holiday plans. Even for those gathering in person, about a third plan to limit the size of their celebrations (35%), a quarter will maintain social distancing (23%), and nearly a fifth (17%) will require attendees to be vaccinated.

Takeaway: While a sour economy is partly to blame that more than half of Americans say that COVID-19 would affect their holiday plans, it is more about how Americans pay attention to the 6.2 million flu cases reported across the country, according to the CDC.

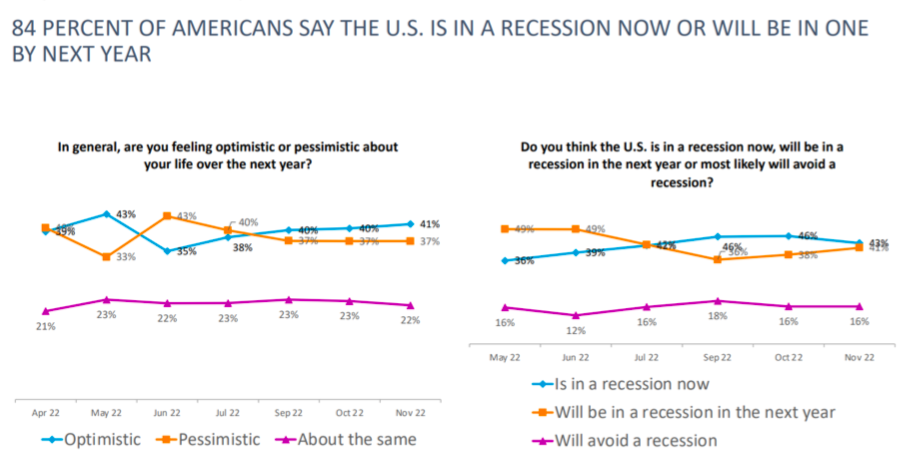

Economic Pessimism Holds Post Election: Harvard CAPS-Harris Poll

According to the November Harvard CAPS-Harris Poll findings featured in The Hill, our Harris Poll Chairman (and Stagwell Chairman/CEO) Mark Penn reports on an exhausted electorate burdened by economic malaise and wondering when, or if a recession is on the horizon:

- Just a third of U.S. voters (32%) believe the country is on the right track compared to the wrong track (60%; unsure: 8%).

- Further, U.S. voters identified inflation and economy/jobs as the two most important issues facing the country today (39%, 27%).

- And voters share similar feelings about the economy, with a quarter (28%) thinking it’s on the right track (v. wrong track: 64%, unsure: 8%).

- In part, nearly two-thirds of voters (64%) feel the U.S. economy is weak (v. strong: 36%).

- And nearly half (41%) of Americans think a recession is coming, while the other half (43%) think it’s already here:

- There is a financial bright spot: Compared to June, there has been an (11%-pt) decrease in voters reporting their financial situation worsening (64% to 53%). But still, that’s a majority of Americans.

Takeaway: With this economic pessimism felt by American voters, Penn details how the electorate may be looking to different leaders: “There’s so much animosity in the country against [Trump], and there’s much animosity against Biden, too. Neither is the leadership this country is looking for for the future. The question is whether the party regulars will get that message.”

The Social Media Generation Gap: Grid-Harris Poll

As social media platforms have evolved and faced new disruptors, two new surveys with Grid and Yahoo! Finance identifies a generational gap among which sites users prefer and why:

- YouTube, Instagram, & Facebook are still on top: Three-quarters of Americans have used Facebook in the last six months, with (71%) using YouTube and (51%) using Instagram. Just a third (34%) reported using Twitter or TikTok.

- Those sites are also the most trusted: 3 in 4 (75%) view Facebook as trustworthy, while 6 in 10 (62%) trust YouTube and Twitter.

- But those figures obscure differences in how Generation Z interacts with social media. For these younger Americans, YouTube is king (83 percent), followed by Instagram (74 percent) and TikTok (64 percent).

- And this younger group is also more likely to see TikTok as more trustworthy (65% v. Gen X: 50%, Boomers: 26%) and Twitter as well (64% v. 52%, 29%).

- Gen Z aren’t looking for friend updates; they are leaning into the algorithm: Gen Z doesn’t turn to social to see updates from their friends; instead, they turn to social to be informed, entertained, and direct messages. Gen Z says their feed is filled mainly with personalized content that the platform thinks they’ll like (62%), and a majority agree that ‘algorithms have increased the content they like to consume and be entertained by’ (65%). This is in contrast to older people, like Boomers and Gen X, who say most of their feeds consist of ‘updates from friends/people I follow’ (66% and 57%, respectively).

Takeaway: “If you think TikTok is just about viral dances, you’d be mistaken. Young people are turning to it for deeper purposes, like gathering information, building community, and cultivating equity,” said Abbey Lunney, co-founder of The Harris Poll Thought Leadership Practice. “We see a giant shift in social media away from surface-level likes, hyper-edited photos towards spaces for authenticity and discovery.”

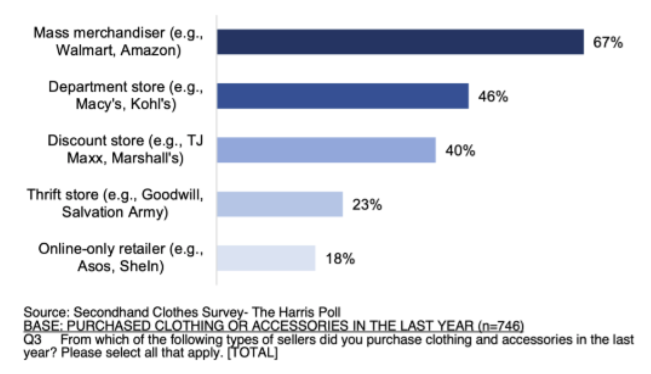

The Rising Secondhand Market: Bloomberg-Harris Poll

From rapidly reproducing designs to cutting down manufacturing costs (sometimes at the expense of working conditions), fast fashion and big-box retailers have an outsized influence on the clothing industry’s impact on the broader economy. However, according to our latest survey in Bloomberg, there is an alternative (resellers) that could gain traction among shoppers.

- Currently, secondhand retailers (e.g., thrift stores) lag behind mass-market stores in terms of popularity, with just a quarter of consumers (23%) purchasing from one in the last year (v. mass-market retailers: 63%):

- Secondhand clothing has the potential to become a staple for shoppers: The resale market is primarily seen as established; four in five U.S. adults (84%) think it’s on its way up or holding steady and two-thirds (62%) agree that wearing vintage clothes is trendy.

- Cost and excitement are worth the shop: Seven in ten (70%) secondhand clothing shoppers say that they purchase thrift clothing to save money, and over a third (37%) do so because it helps give them the biggest bang for their buck. Beyond that, (31%) are drawn to the market because of the excitement they feel when searching for unique items.

- However, convenience is a big challenge that could stand in the way of secondhand clothing retailers: One-fifth (19%) of people who haven’t bought secondhand clothes in the last year say that it’s too much work to search for them, and a slightly smaller number (14%) say it’s more convenient to buy new clothes.

Takeaway: While most consumers aren’t currently looking to thrift stores to find their next favorite outfit, they have plenty of reasons to shop secondhand. Resellers are often seen as offering unique, eco-friendly items for shoppers on a budget – considerations that may help the broader resale clothing market enter the mainstream.

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Download the Data

This survey was conducted online within the U.S. by The Harris Poll from November 22nd to November 23rd, among a nationally representative sample of 2,149 U.S. adults.

Download

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Download the Data

This survey was conducted online within the U.S. by The Harris Poll from November 22nd to November 23rd, among a nationally representative sample of 2,149 U.S. adults.

DownloadRelated Content