Brief • 4 min Read

The Harris Poll COVID-19 Tracker (Week 26) fielded August 21-23, 2020 marks six months since we began tracking public sentiment on the pandemic. At this milestone, we are taking a look back to examine 1.) how the American lifestyle has adapted, 2.) how opinion and attitudes have shifted and 3.) how this might impact the way we live, moving forward.

This report is also a special new presentation that can be shared or presented as requested.

As a public service, our team has curated key insights to help leaders navigate COVID-19. Full survey results, tables, and weekly summaries can be accessed for free at The Harris Poll COVID-19 Portal. We will continue to actively field on a regular cadence to track the shifts in sentiment and behaviors as the news and guidelines evolve.

The Curtain of Fear

When we turned our attention to COVID mid-March, America was in shock and disbelief. Two days earlier President Trump had declared a national emergency and states were shutting down. The mysterious virus offered no clues on how it spread, witnessed in the fact that The CDC issued its first guidance to limit congregations of more than fifty people. But then Rudy Gobert, who had playfully touched all the microphones in a post-game interview, became the first NBA player to contract coronavirus. In turn, the NBA, then the NHL, MLB were suspended as most other rituals and routines of Spring in America.

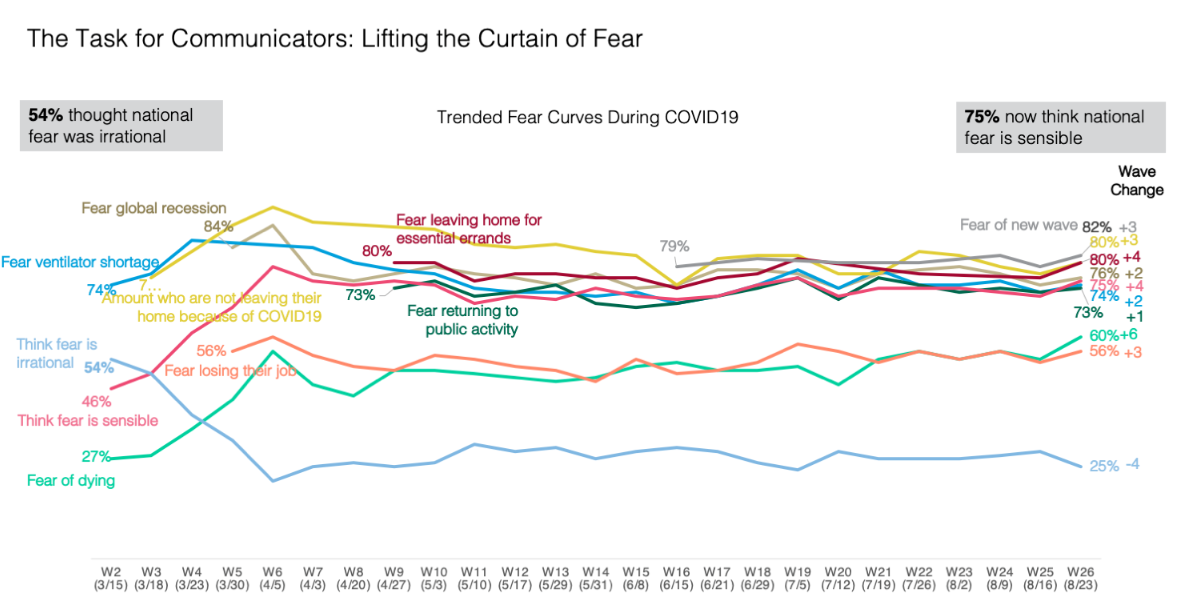

Over that cold weekend (March 14th and 15th) we first went into the field to gauge America’s reaction. At the time, there was yet to be a widespread infection. The novel coronavirus was just taking hold in Washington state and New York. This explains why, as the chart below shows, fear was initially mixed with confusion and incredulity. That weekend, (54%) of Americans thought the national fear was irrational. America’s main concern was for hospitals, PPE, and ventilators. In fact (84%) that weekend feared a global recession more than (27%) the virus itself.

That soon changed. As Axios highlighted, Americans began losing their sense of invincibility toward the coronavirus and anxiety very quickly escalated in late March and early-April. The USNS Comfort arrived in New York to relieve distressed area hospitals. Boris Johnson was hospitalized in the U.K. By April 2nd, the pandemic had sickened more than one million people in 171 countries across six continents, killing over 50,000. And by mid-April (95%) of Americans were afraid to leave their homes because of Cv-19. Opinions quickly changed: (79%) now felt the fear was sensible while the naysayers declined precipitously.

By mid-April (56%) feared dying of the virus, only to be eclipsed by (60%) feared losing their job. As the chart shows, these first two stats would coil together like snakes to symbolize a forced choice between your job or your life, which persists to this day. As of this weekend, fears of both dying (60%) and losing one’s job (56%) are up six and three percentage points respectively. According to our data in USA Today, 3 in 10 Americans had also already lost income due to COVID at this point.

As the virus spread and fear grew, Americans moved to become more cautious and comfortable with necessary efforts to control the virus. Our Harris data in Wall Street Journal’s article, Americans Favor Aggressive Coronavirus Measures, Poll Finds, “The poll also finds that (71%) of Americans would be willing to share their own mobile location data with authorities to receive alerts about their potential exposure to the virus—for example, if they were near a suspected or known coronavirus carrier.”

We would soon learn this fear that blanked the country would not subside. Amid shortages, contradictory messaging and leadership largely left to the states, confusion reigned. As the global death toll surpassed 200,000 by the end of April, only then airlines first announced mask requirements. With no spring break, Americans were working and learning from home and getting used to the idea that life was going to be anything but normal, anytime soon.

Life Interrupted

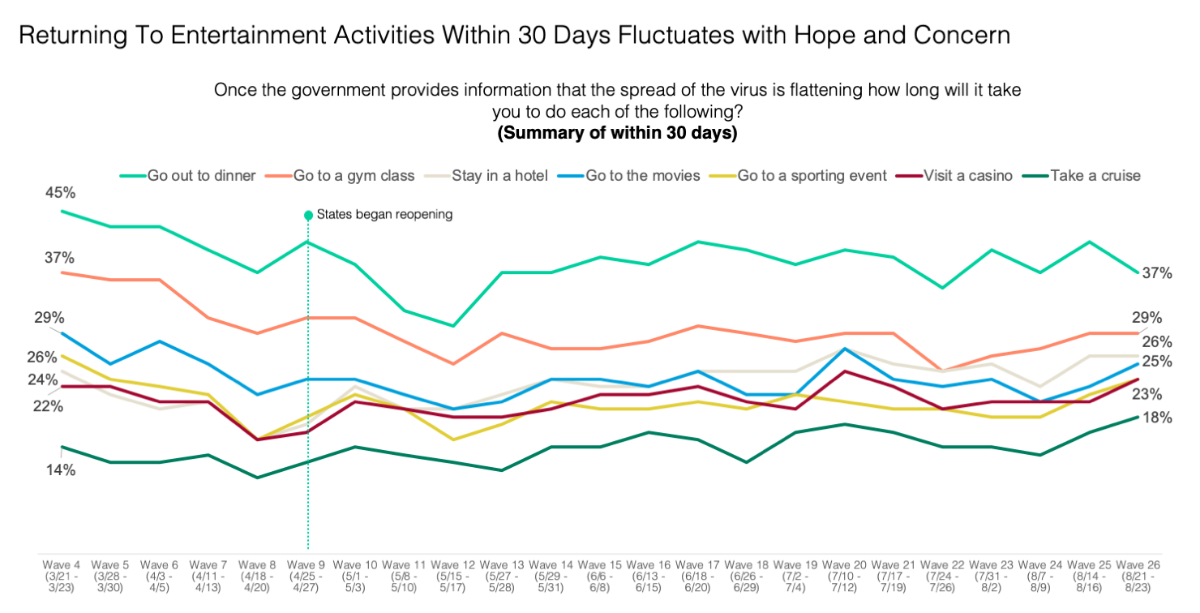

The composite picture of activities the nation thought it would resume soon shows a roller coaster of expectation and frustration. March despair followed by a bounce in hope as states re-opened in late April. Then again as the virus followed the path of the reopening, despair returned again in May. On May 27th, coronavirus deaths in the U.S. passed 100,000 sending many Americans back home again.

Venturing back out soon into daily life was largely underestimated. When asked what they would resume within a month, Americans said dining out (45%) which is only (37%) today. Worse off were gyms, movie theaters, hotels, and sporting events. The activities of the last resort were casinos and cruise ships. In mid-March (14%) of Americans said they would take a cruise within 30 days of the curve flattening while (22%) felt the same way about visiting a casino. Today that’s (18%) and (23%) respectively. As mentioned by Forbes, a record-shattering 95% of Americans said they were staying home for Memorial Day in 2020.

Travel and leisure was decimated with most Americans saying it would take six months or longer to go back to resuming these activities. In the height of summer travel season, only 3 in 10 (29%) planned a leisure trip between June and September. Cruise lines are already canceling sailings into 2021.

Risky Business

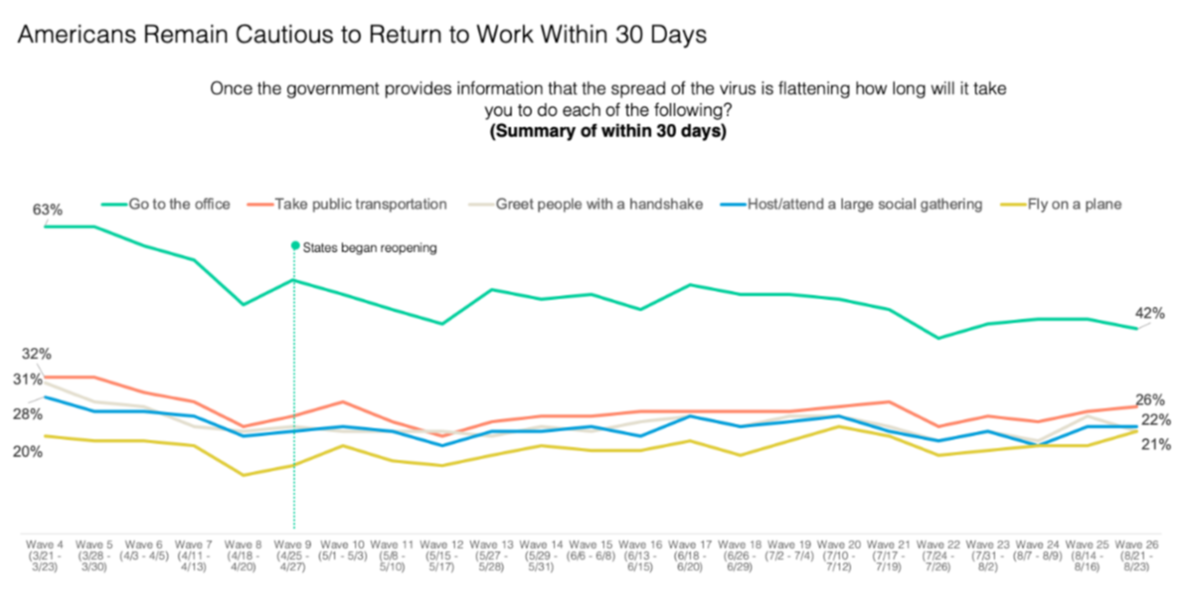

If life at home was tedious, Americans felt safe. The same could not be said for office life, however. Initially, almost two-thirds of Americans (63%) were bullish on getting back to work within a month, but it’s (42%) today. And the knock-on effect on both the rituals of business and its supporting industries were, and remain battered. One in five Americans (20%) said they’d fly on a plane in March and that’s up only one percentage point six months later. Roughly one third (31%) said they’d take public transportation and now it’s one quarter (26%).

Handshakes, conferences, and meetings have been digitally disrupted and zoomed into distress. But what this chart also conveys is a rebalancing of office and #wfh life that may become permanent. This was reflected in a May 24th Forbes article “Fast-Moving Trends Will Radically Reshape The Way Americans Work And Where We Live.” Since the beginning of the pandemic, Jack Kelly wrote, “According to a new Harris Poll, over (30%) of Americans are considering moving to more suburban, less densely populated areas to escape the pandemic. This move foreshadows falling real estate sales and declining home prices.”

While newer Harris data shows some of that fear to have abided, Americans say they will not return to work until they feel safe. (83%) say they should be allowed to work from home during the pandemic until they feel comfortable to return. And this insistence makes sense. A recent survey by Korn Ferry found that 64% of workers feel that they’re more productive at home. This has also led Americans to rethink the traditional workweek, and the New York Post reported that a vast majority (82%) of employed Americans would prefer a 4-day workweek even if it meant working longer hours.

Home (Not) Alone

As Americans fled into their homes, routines changed, relationships formed and were renewed. Notably, a mixture of anxiety and appreciation emerged. On one hand, claustrophobia, annoyance, and feeling overwhelmed dominated many Americans who were trying to work from home (these feelings were especially pronounced with parents dealing with on-line education and kids interrupting their conference calls).

Two archetypes of habits emerged, half the nation (49%) resumed their normal morning routines, with (52%) showering and (49%) getting properly dressed, while (48%) skipped showering, (51%) jumped out of bed and worked in their PJ’s or sweatpants throughout most of the day. Over time, sweats beat out slacks and dresses as the new ‘business casual’.

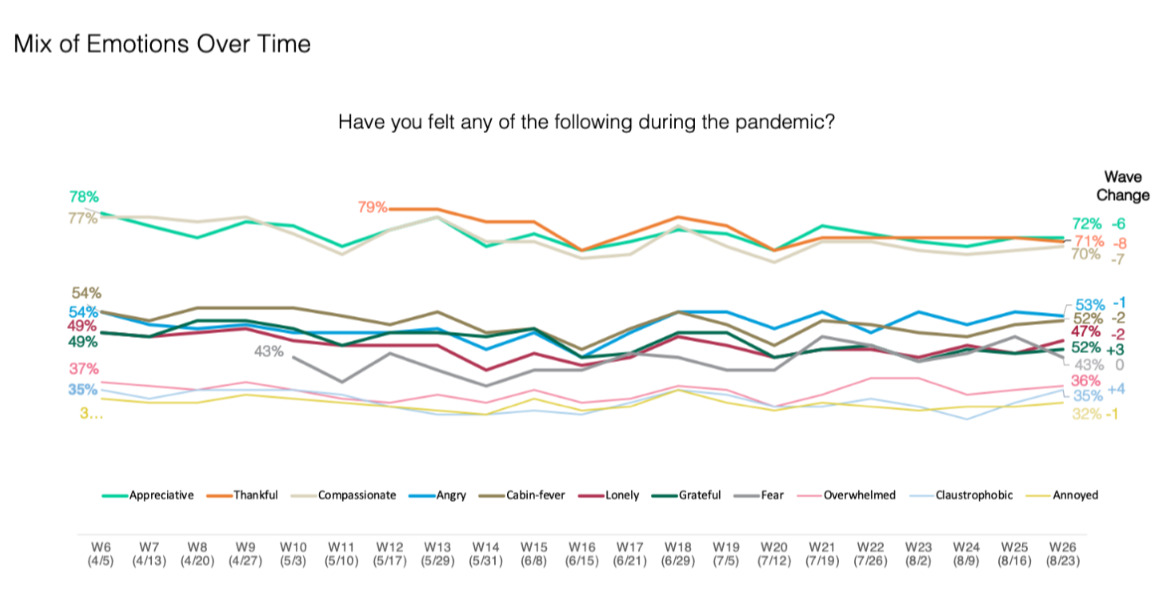

But another powerful thing happened while sheltering in place: thankfulness. Many parents found their older kids back at home, for others game nights resumed and families ate breakfast together. As this chart shows, a reflection of gratitude spread across the nation. In our data below, we can see thankfulness (72%), appreciation (71%), and compassion (70%) were from the outset the dominant emotions in the American psyche commanding an 18 percentage point lead over the next emotion, anger even to this day.

Missing You

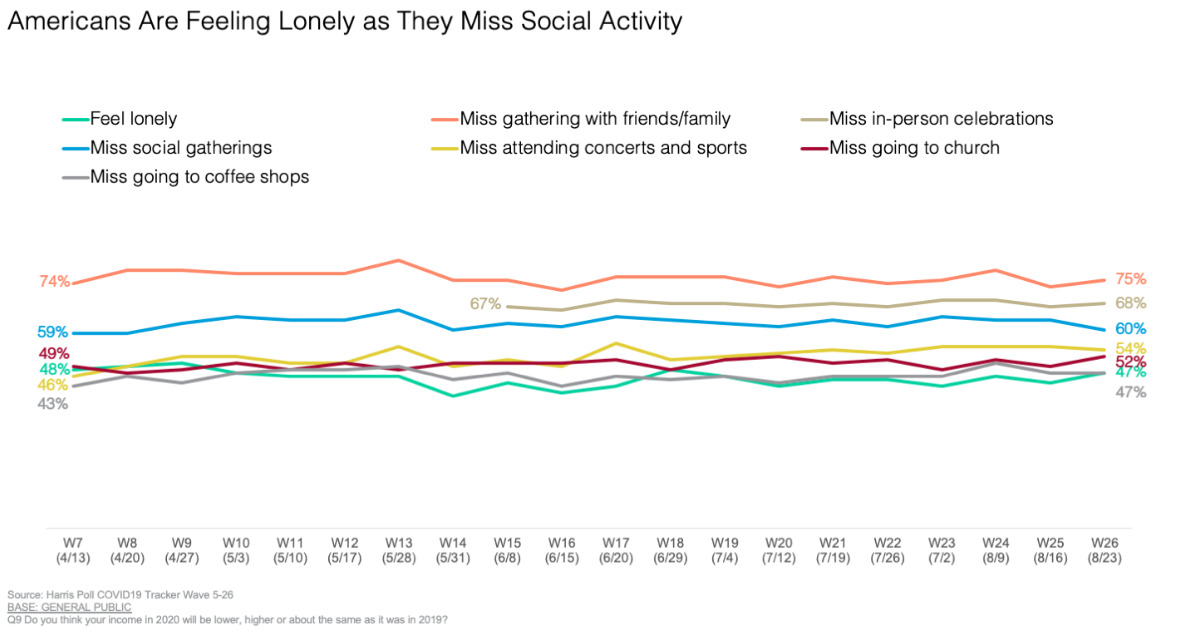

It was clear from the outset, Americans missed going out and socializing. Nearly three quarters (74%) missed gathering with friends and family which has held steady. Another (67%) longed for in person celebrations like holidays, birthdays and weddings. Without them, (47%) of people feel lonely and cut off from the traditional outlets for human connection. For instance, (52%) miss going to church, or (47%) my local coffee shop. All these feelings are more greatly pronounced by American teens and children.

Then as Spring turned to Summer, Americans began traveling. We saw pent up demand for cars rise, and people saying that certain leisure trips were essential like graduations and weddings (48%), while for business people – especially sales –(72%) said business meetings with prospective clients meant taking the risk.

Janeen Christoff wrote in Travel Pulse on this pent up demand to travel again, “The survey found that 31 percent are planning to “go on vacation/travel when things return to normal.” This is up 7 percent from last week.”

In the below chart we see that the marketplace has become a fight between fear and desire. In daily life, Americans continue to calculate risk and reward, making safety as a customer journey of paramount importance.

Two COVID Economies

By early May, the country had lost 20.6 million jobs since mid-March, resulting in an unemployment rate of 14.7%, a level not seen since the Great Depression.

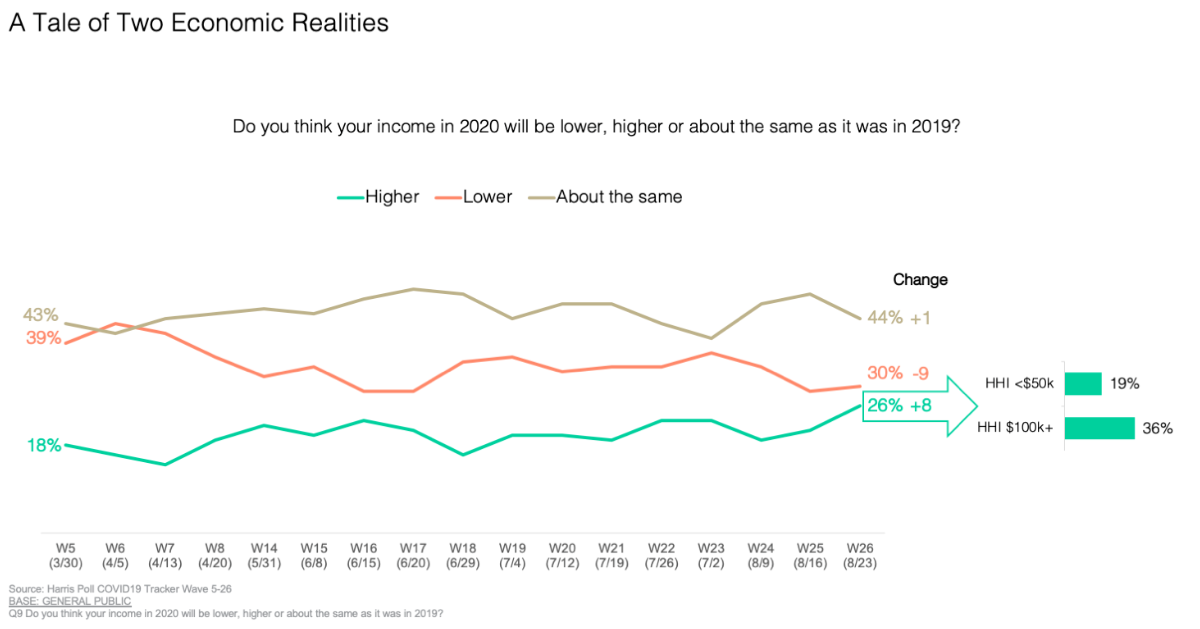

But concealed in that sobering data is that younger people, people of color, and lower household incomes are bearing the brunt of the pandemic. While (85%) of Americans said they were impacted financially, the virus exacerbated the income divide in America. We asked Americans, do you think your income in 2020 will be lower, higher, or about the same as it was in 2019? And a stark picture emerges of the have and have-nots. (36%) of Americans HHI +$100K felt their income would be higher this year vs. (19%) of Americans earning under $100K.

Lower-income households are more pessimistic about both the economy and their personal finances over the coming months: (25%) of Household Income <$50k say the economy will be doing worse in the months to come after unemployment benefits expire (vs 36% of Household Income $100k+). Personal finances: 48% HHI <$50K better vs 58% HHI $100k+. And by a two to one margin (63%) of lower-income Americans said the long-term effects of COVID financially would impact them more than (37%) the virus itself, whereas those earning more were less concerned by the financial impact and more on the health threat of the virus.

But the same goes for younger Americans and people of color. Gen Z/Millennials were nearly two times more likely to have stopped or cut back on savings compared to Boomers (43% vs 23% respectively) as well as to have missed (or will soon miss) a bill payment (38% vs 17% respectively). What’s more, is that younger people were also the ones most likely to be lending out a helping hand to others; Gen Z/Millennials were nearly three times more likely to have provided financial support for a family member or friend compared to Boomers (31% vs 11% respectively).

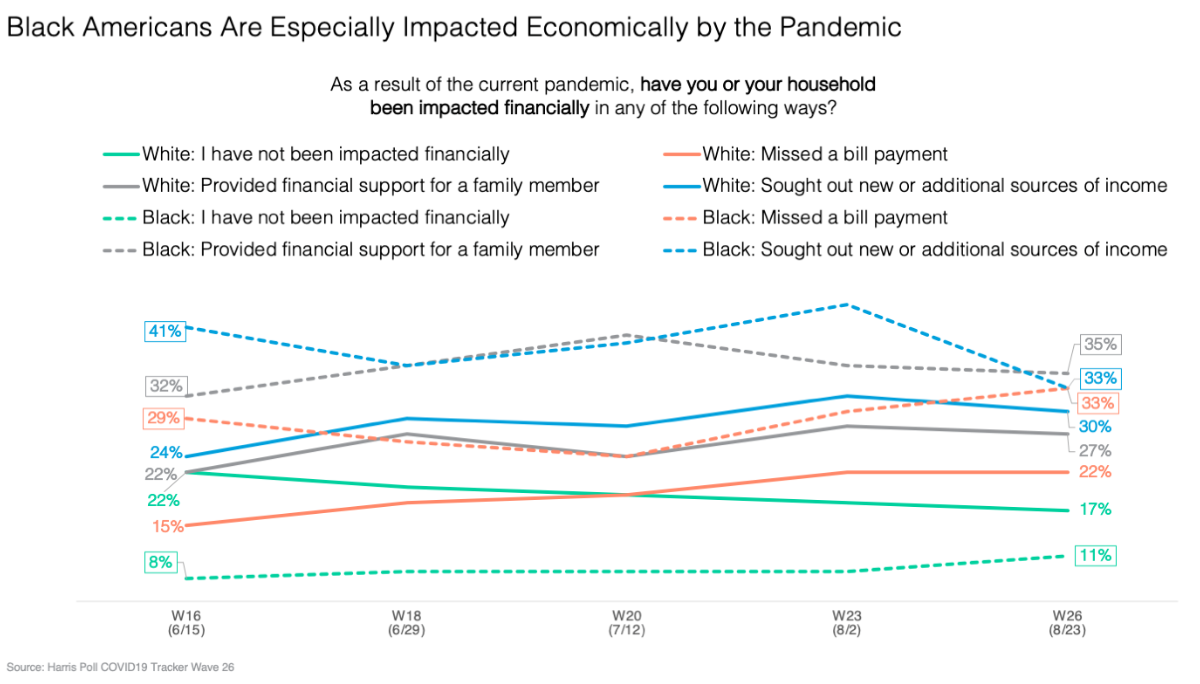

Black Americans were especially impacted economically by the pandemic, in fact only (11%) say they haven’t been impacted financially at all as a result of the pandemic. Over a third (33%) however have missed a bill payment (vs only 22% of white Americans) and the same amount have sought out new or additional sources of income (33%):

While lower-income Americans and those hit hardest by the pandemic face a harsh new reality, the ‘haves’ are bullish on their future: (63%) of the public with investable assets expect returns of 5% or more over the next 5 years. The number is even higher (69%) among institutional investors.

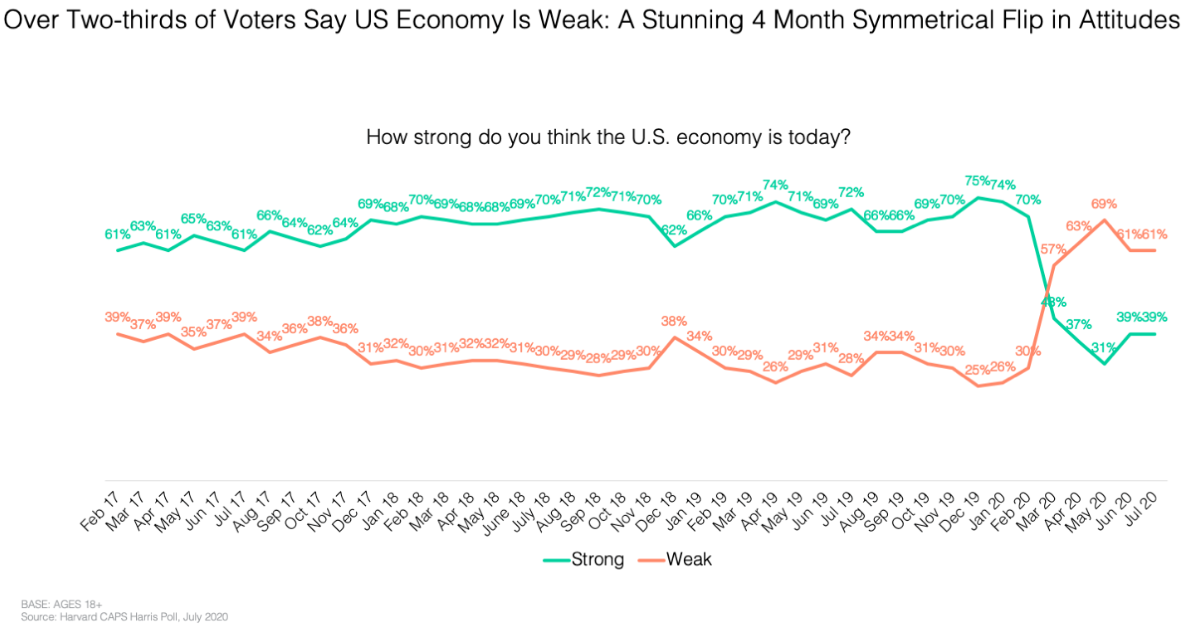

Overall, Americans think the economy is headed in the wrong direction. In our latest Harvard CAPS/Harris Poll, we find a dramatic flip in voter sentiment.

The Great Awakening

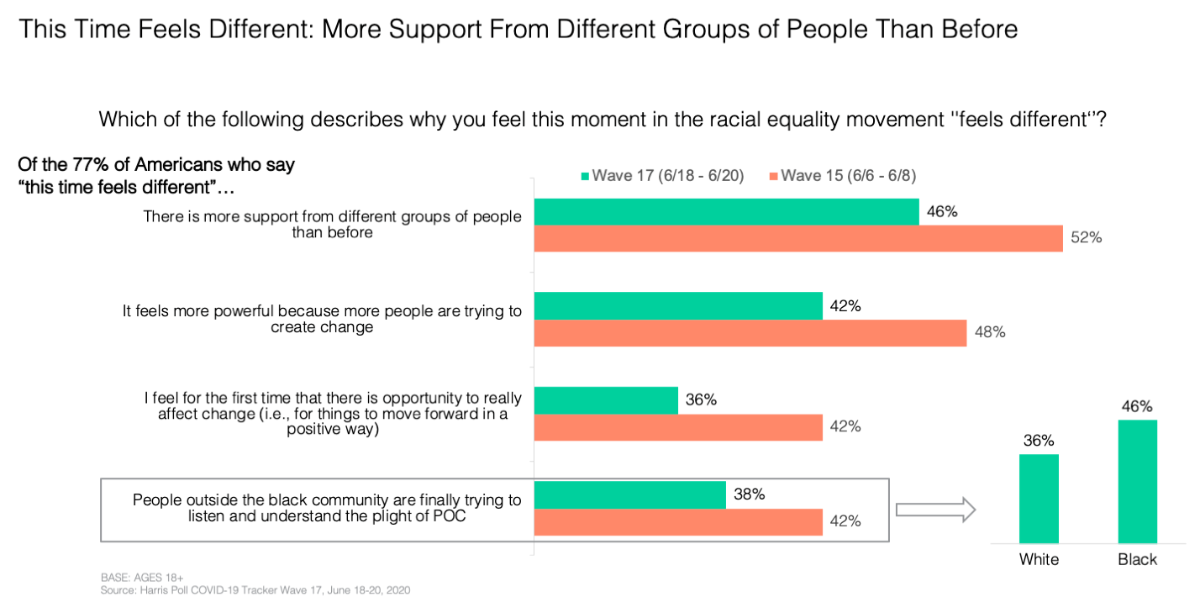

The third crisis to hit the country came on Memorial Day with the killing of George Floyd. Protests radiated out of Minneapolis across the nation, bringing with it a broader coalition of intersectional, multi-generational, and multi-cultural support. Perhaps for this reason, Americans in our surveys felt this time might be different:

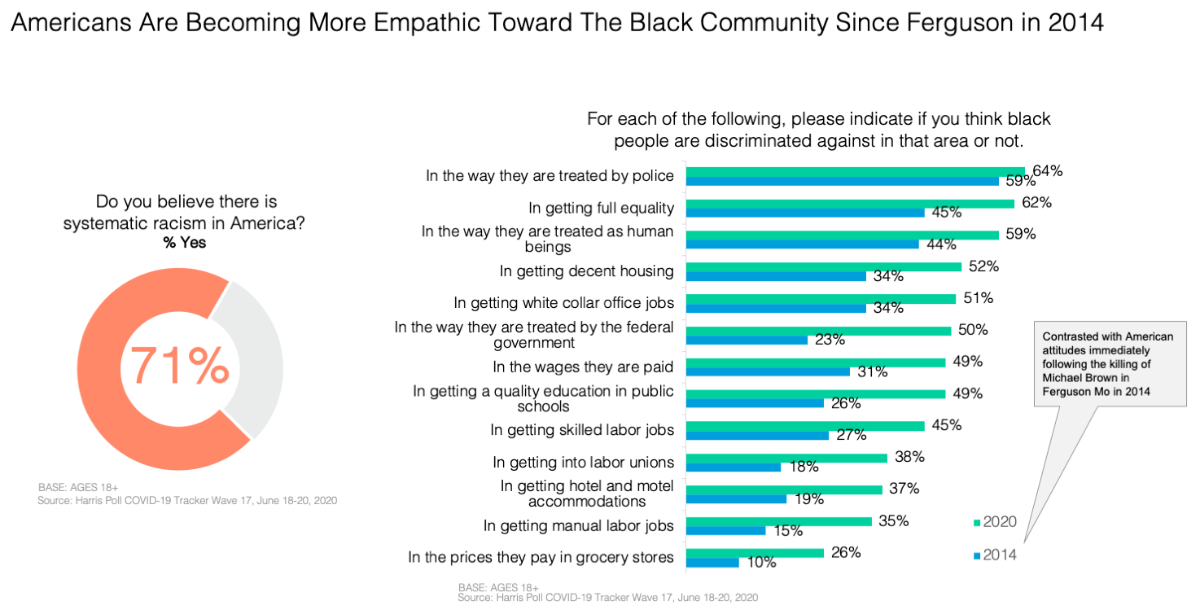

Curious, we went back to our Harris Poll questions asked in 2014 after the protests and rioting in Ferguson over the killing of Michael Floyd. And in asking the questions again this summer, we could see noted increases in empathy among the public toward the plight of Black people and greater acceptance of systemic racism in America.

On the cusp of pressing national tensions and awakening around race, we conducted polling to find how Americans felt about the NFL’s treatment of Colin Kapernick. Forbes’ Kurt Badenhausen wrote in Poll: 61% Of Americans Say Roger Goodell Owes Colin Kaepernick An Apology, “The global protests that started recently after George Floyd was killed in Minneapolis have helped shift the perception of Kaepernick and the brands that do business with him.”

A Country Facing Its Nadir

As the three crises became part of our daily lives, a heightened sense of uncertainty blanketed America; nearly 6 in 10 (58%) reported higher stress than normal (pre-COVID-19) with (83%) pointing to the future of our nation as a significant source of stress (vs. 66% in 2019). And with no way out in sight, (72%) of Americans reported that this is the lowest point in history they can remember (up from 59% in 2017). A gathering pessimism emerged where (65%) say the country is on the wrong track.

Grappling for control in a constant state of fear and anxiety, and without leadership to unify, Americans appear to be growing more isolated and estranged from each other. Only (25%) of Americans said they often consume content from others who have different values than their own, and (41%) say they feel confused and (26%) feel angry when they read content from people whose beliefs and values they disagree with.

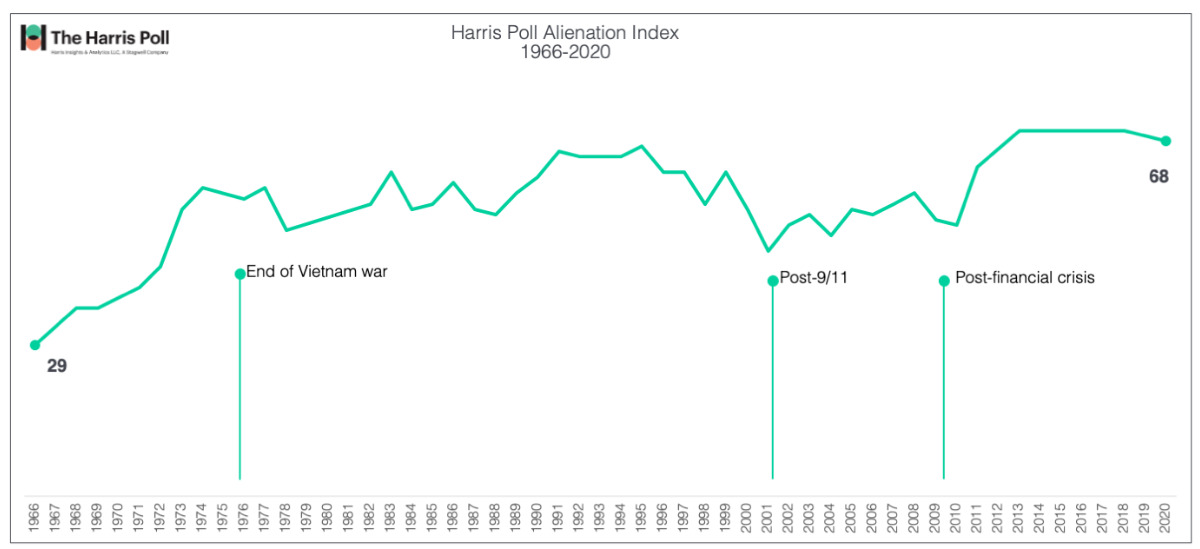

In our Harris Poll Alienation Index that we’ve been running each year since 1966, we find today, (68%) of Americans feel alienated, which is up from (52%) less than a decade ago after the financial crisis. Typically, every period of turmoil begins with isolation and ends in greater unity. We saw alienation nearly double in one decade from (29%) to (59%) in years from 1966 to 1977 during the Vietnam war only to fall 9 percentage points in one year following the end of the war from 1977-1978 (59% to 51%). Similarly, alienation dropped to its lowest point in three decades at (47%) right after 9/11 when communities came together (index dropped from 62% in 1999). Unfortunately however as the below chart shows, COVID alienation is higher than it was at the height of the Vietnam war with no unity on the horizon.

Togetherness is needed now more than ever.

The Calling to Business

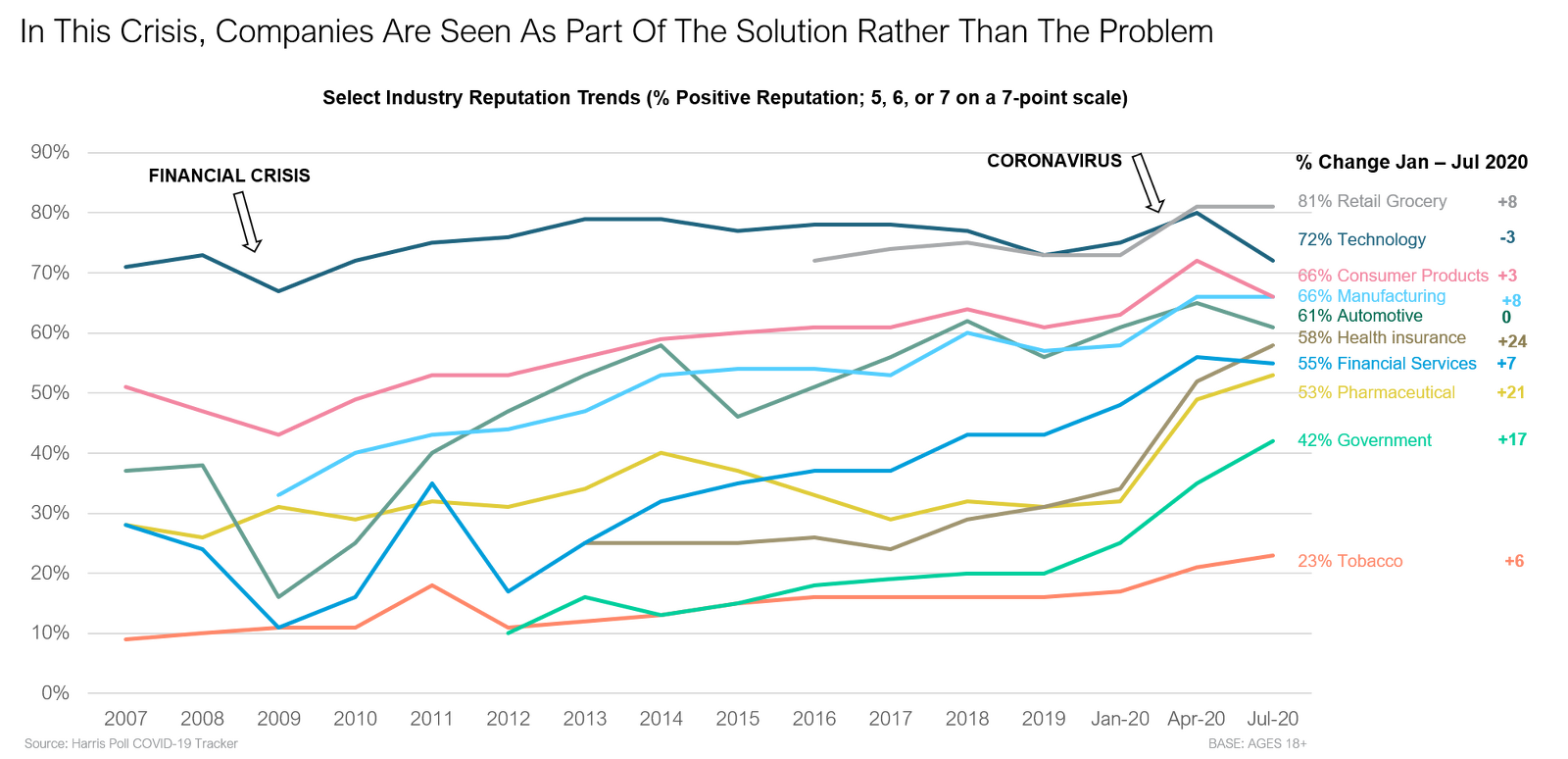

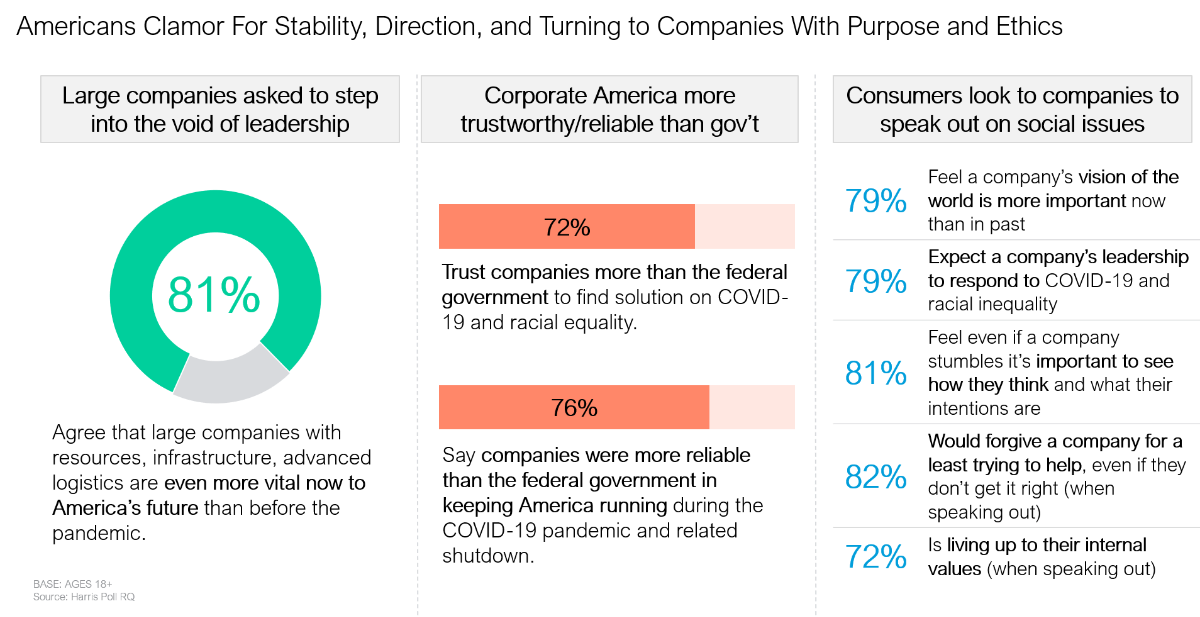

So, who will unite America?…. The public says business. In previous crises, companies were part of the problem. This time they are part of the solution. In our Axios-Harris Poll study of corporate reputation which surveyed over thirty-four thousand Americans, (72%) said “I trust companies more than the Federal government to help find solutions to issues related to the COVID-19 pandemic and racial equality movement.” Amid a vacuum of leadership, Americans turned to corporations—especially large ones—as vital leaders in solving the pandemic and restoring the American way of life. (81%) said “large companies with resources, infrastructure, advanced logistics, are even more vital now to America’s future than before the pandemic”

And as America’s needs became more essential and urgent, consumers turned to big companies that represented safety and reassurance. This signaled a flight from fancy, where popular industries heavily used that provided luxury and influence (e.g., hotels, retail/fashion) took a backseat to the industries that served the essential needs of Americans in crisis mode (Clorox was number 1 this year). In fact, (76%) of Americans said, “companies were more reliable than the federal government in keeping America running during COVID-19.”

But perhaps most importantly, many led with their values as they demonstrated ethics, accountability, and leadership to the public during a time of profound anxiety and crisis. This is the year of servant leadership and today, being a values-led company means speaking out against injustice and leading by example. For consumers, no action means no values.

While the public praised Corporate America for addressing COVID19, fewer feel they have adequately addressed racial injustice; (63%) know a great deal/fair amount about large companies responding to the pandemic vs racial injustice (51%). We see a bigger gap between the number of Americans who think companies are on the right track in addressing the pandemic (65%) vs racial injustice (49%). Corporate America proved itself capable leaders in addressing COVID-19 and now the public is holding them to similar standards in the fight for racial justice and equality.

A New (Not) Normal Ahead

An unfathomable spring and summer are now giving way to an uncertain fall and winter. Now with COVID flash-points closing up America’s universities and canceling Fall sports, Americans have grown less certain of any return to normalcy. In fact, in a Harris survey covered for USATODAY, nearly two-thirds (62%) of American parents believed their kids will be learning from home. The near same number (61%) said they’d be working from home. More than half (56%) of Americans intend to vote by mail and strongly support the Post Office. Only (42%) believe we’ll have an NFL season. Still, fewer believe MLB will finish to completion while (29%) believe there will be a CFB season.

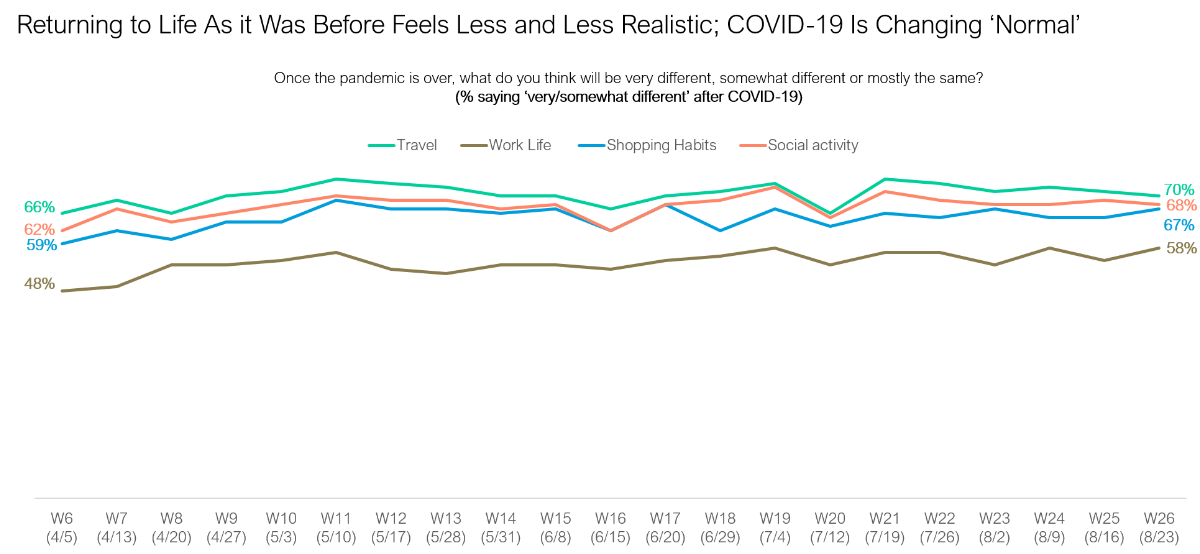

As summer closes into Fall, Americans are as wary as when we began. Six months into the pandemic, only one-in-five (22%) told us they’d fly in a plane this Fall. Only (28%) would stay in a hotel or travel for the holidays. Americans see short term dislocation becoming long-term change evident when asking them what in life has changed as they contemplate the future. Seven out of ten Americans perceive travel, socializing, and commerce/shopping as permanently changed; nearly six in ten (56%) believe the same of working.

Changed Lives; Changing Demand

Not surprisingly, an uncertain America has translated into marketplace turmoil. Sectors have both thrived and been fated by this pandemic. But by and large, the inside has beaten the outside. In place of going out to movies, concerts, bars, and eating out, in-home entertainment has reigned supreme. In our survey with The Wall Street Journal, (56%) of American families started spending more time streaming than before the pandemic. The near same number started virtual happy hours (57%), gaming (43%), podcasts (23%), and wellness apps (23%). And with live sports canceled and other out of home activities suspended, nearly a fifth of households reported watching four additional hours of streaming content a day.

As life came inside, half of the American parents (51%) admitted to giving in to more screen time to preoccupy kids. Beginning in March, nearly half (49%) bought a new Netflix subscription spent $60 a month for streaming services—well above the general population ($37/month on average).

Things lost in the outside also dislocated a myriad of supporting industries. Barron’s estimates that remote learning — which means no cafeterias, no garbage pickup, etc. — “could cost the economy $700 billion in lost revenue and productivity. So too are delis, convenience/gas stations, dry-cleaners, and a plethora of urban supporting retail for office workers. So far this year, (16%) of all retail industry loans are delinquent, according to statistics tracked by the data firm Trepp. Major retailers, including J.C. Penney, Neiman Marcus, and Modell’s Sporting Goods, have filed for bankruptcy, and new tenant demand for mall space has never been weaker, leading to Carl Ichan’s Big Short 2.0 of American malls.

The American-at home palette changed. On one hand, juice, home-cooked meals, and fresh food consumption grew, but so too did candy, snacking, fast food, and alcohol. Packaging forms changed too as single-portions for commuters were replaced by family-sized SKU’s consumed at home. And according to their intentions, any eating habits as the below chart shows might be imprinted, especially healthier/family-style eating.

More home-cooked and less ready-to-eat meals suggest Americans intend to continue working from home at least in some fashion. This tracks with our data on home remodeling, landscaping, bicycle purchasing, laptop, and technology upgrading and other investments in a living/working lifestyle. Meanwhile, spacious single-family homes in suburbs and exurbs are in hot demand, while rents are falling in Manhattan, where landlords are offering deals. Also, existing-home sales rose 20.7% in June over May, and median housing prices rose in every region of the country, according to the National Association of Realtors.

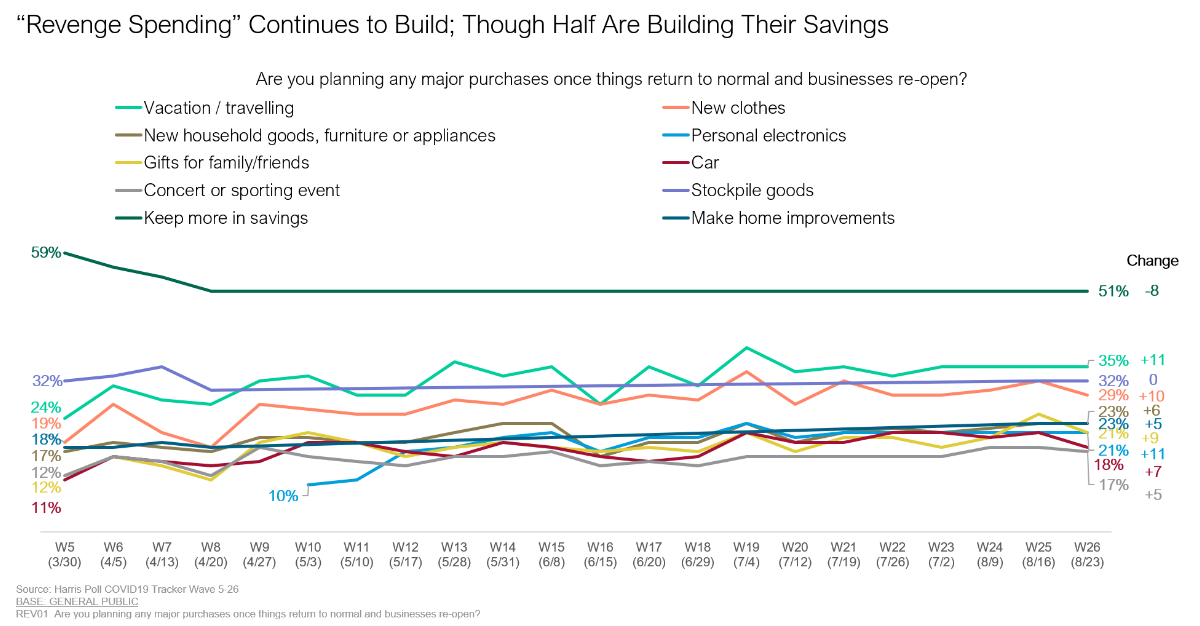

Cautious Demand

Consumer demand wasn’t just changing, it was also growing in some parts of the economy. For those whom the economic situation was not depressing their spending, interest in traveling, new clothes, cars, personal electronics all became priorities. But note how the biggest enemy against consumption is savings. At the outset of the crisis, (59%) of Americans set aside savings while nearly one-third (32%) stockpiled essential goods. While spending has cut into savings slightly (down eight percentage points today), the majority of Americans (51%) are saving before spending while stockpiling remains the same.

A Two-Speed Recovery

That vacations and new clothes are the top two purchase intentions, suggests the two-speed recovery in store for America. While wealthier citizens have so far emerged largely unscathed financially from the pandemic, many on low incomes have not. Domestic consumption — which accounted for (68%) America’s GDP in 2019 will suffer if the rich-and-poor gap that widened following the virus outbreak cannot be narrowed. Marketers must not only plan on these income gaps in their forecasting demand, but businesses must also assume overall consumption recovery will lag as America’s low-income spenders far outnumber high-income ones.

Of course, government policy has many means to stimulate economic recovery, but it can’t control how much average households want to spend. Our recent USA TODAY/Harris Poll survey demonstrates the stark pain that millions of out-of-work Americans are facing over the renewal of Unemployment Insurance. Over eight in ten (82%) Americans believe the expiration of the $600 unemployment bonus will have an adverse effect on the U.S. economy, and nearly three-fourths (72%) think economic growth will be a lot worse in the months to come.

Without correction, an uneven recovery in spending highlights what is already a growing income gap. Most high-income Americans managed to keep their jobs or businesses by working from home during the pandemic. These households also benefited from credit easing policies that sent their equity and housing soaring. In contrast, income growth has stalled or even turned negative among the hundreds of millions in the low to middle-income population as the pandemic took a toll on the jobs market. The shopping spree by the rich will not offset the spending cuts by the rest of the population. Looking ahead, we worry about per capita consumption unless we can ease the suffering of ordinary Americans. A strong housing and stock market has hidden their pain.

Digitally-Accelerated Consumerism

Another reality business must face is the hyper-acceleration of digital consumerism. Looking ahead, nearly 6 in 10 (58%) say they will either spend the same or more this winter holiday season compared to last year (36% and 22% respectively), and only a third (32%) say they will spend less. But how will they choose to spend? The threat of the pandemic remains high and many consumers have already become digital natives after being forced to go all virtual during the virus-related shutdowns.

For instance, (40%) of consumers relied on curbside pick up for groceries during the pandemic, (23%) for home goods and (22%) for both personal care and medical products. These numbers skew higher for Gen Z/Millennials and Gen X where nearly half use curbside pickup for groceries (47% and 49%), nearly a third for home goods (29% and 31%) and personal care products (31% and 32%).

Our data also indicates some of these digital tendencies are here to stay for the long term. Post COVID-19 when the curve is flattened, more consumers said they would get take out (54%) over dining in a restaurant (46%) and nearly 6 in 10 (57%) said they would be more likely to do a virtual happy hour over doing happy hour at a bar/restaurant (43%).

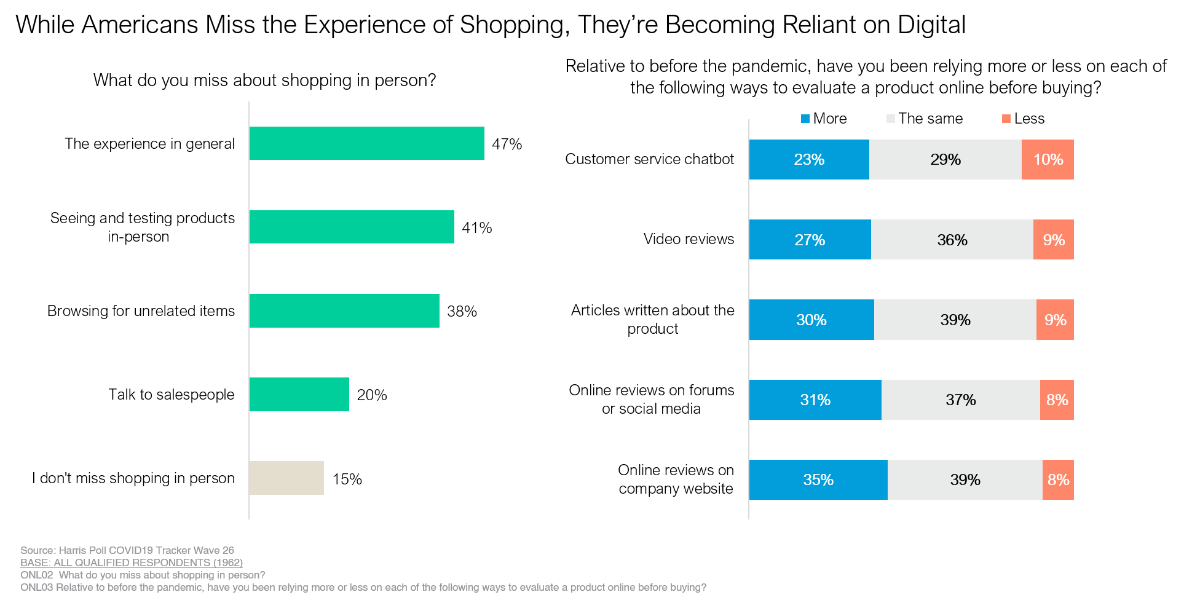

And, while many say they miss the experience of shopping (47%), nearly 8 in 10 (77%) say they have been satisfied with online shopping for things they used to do in-store. What’s more, is that consumers are becoming accustomed to the convenience of using digital resources before buying online:

Retailers hoping to get consumers back into their stores this winter will have to instill confidence and safety as (56%) will shop in-store only if they know the store has taken steps to protect their employees and customers from the spread of infection.

Where To From Here?

When are things going to get back to normal? Despite stock market gains and COVID cases easing across the country, but for rural communities and universities mostly, the majority of Americans who express fear and uncertainty will likely suppress consumer demand (in aggregate) until there’s a vaccine. COVID has become so intertwined with restaurants, shopping, traveling, it essentially controls the economy in the near term. Only a vaccine can change that.

Barring that, Americans are willing to wear masks, socially distance, and lockdown. Last week, (50%) of Americans believed there would be another lockdown in their state and (42%) within their community. The majority also empower a chain of command from federal to governors to mayors to make the call to control the outbreak. Over the summer, (80%) of Americans felt the lockdowns were effective and only (25%) would oppose another lockdown. And now the majority are seeing this virus, not unlike a forest fire, where testing, rapid shutdowns, and containment can stop embers from igniting again.

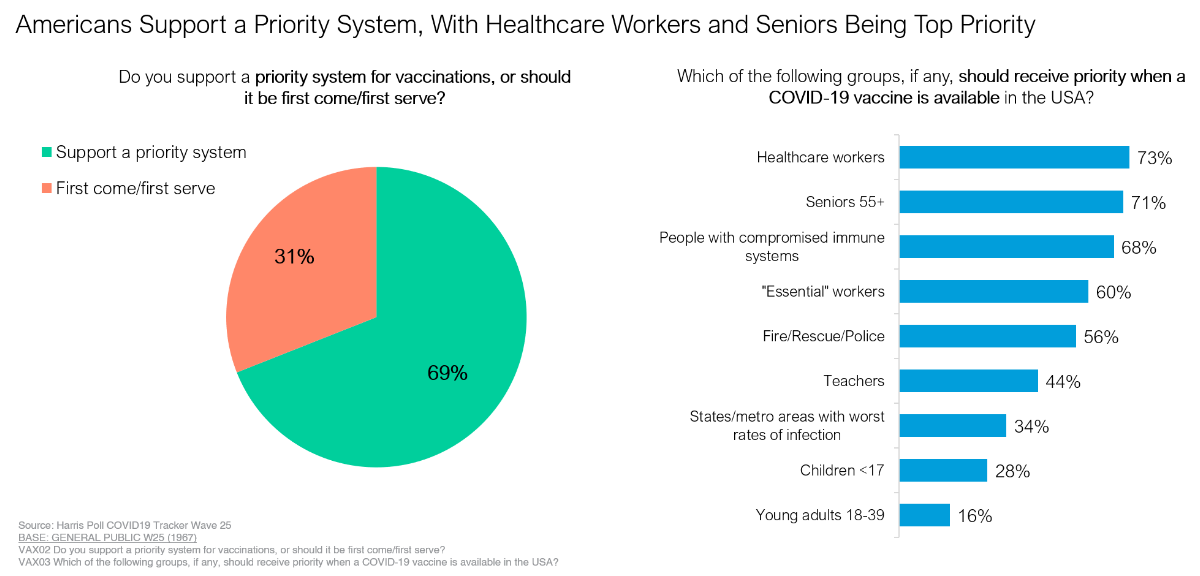

And when it comes to that silver bullet, Americans want to prioritize accuracy (91%) over speed (83%) in approving a vaccine. In an exclusive Harris Poll with Axios (69%) of Americans said they’d support a priority system for distributing a vaccine within the U.S. and (73%) said health care workers should get priority access followed by seniors (71%), people with compromised immune systems (68%) and essential workers (60%).

“This sort of structured, risk-based allocation would be a lot different from what most Americans are used to, in a health care system that typically allocates resources based on patients’ ability to pay”. But this egalitarianism is American in name only: We also found that (66%) of Americans said that if the U.S. develops the vaccine, it should only be made available abroad after all U.S. orders have been filled; just (34%) said it should be made available overseas immediately.

The Recovery is The Vaccine

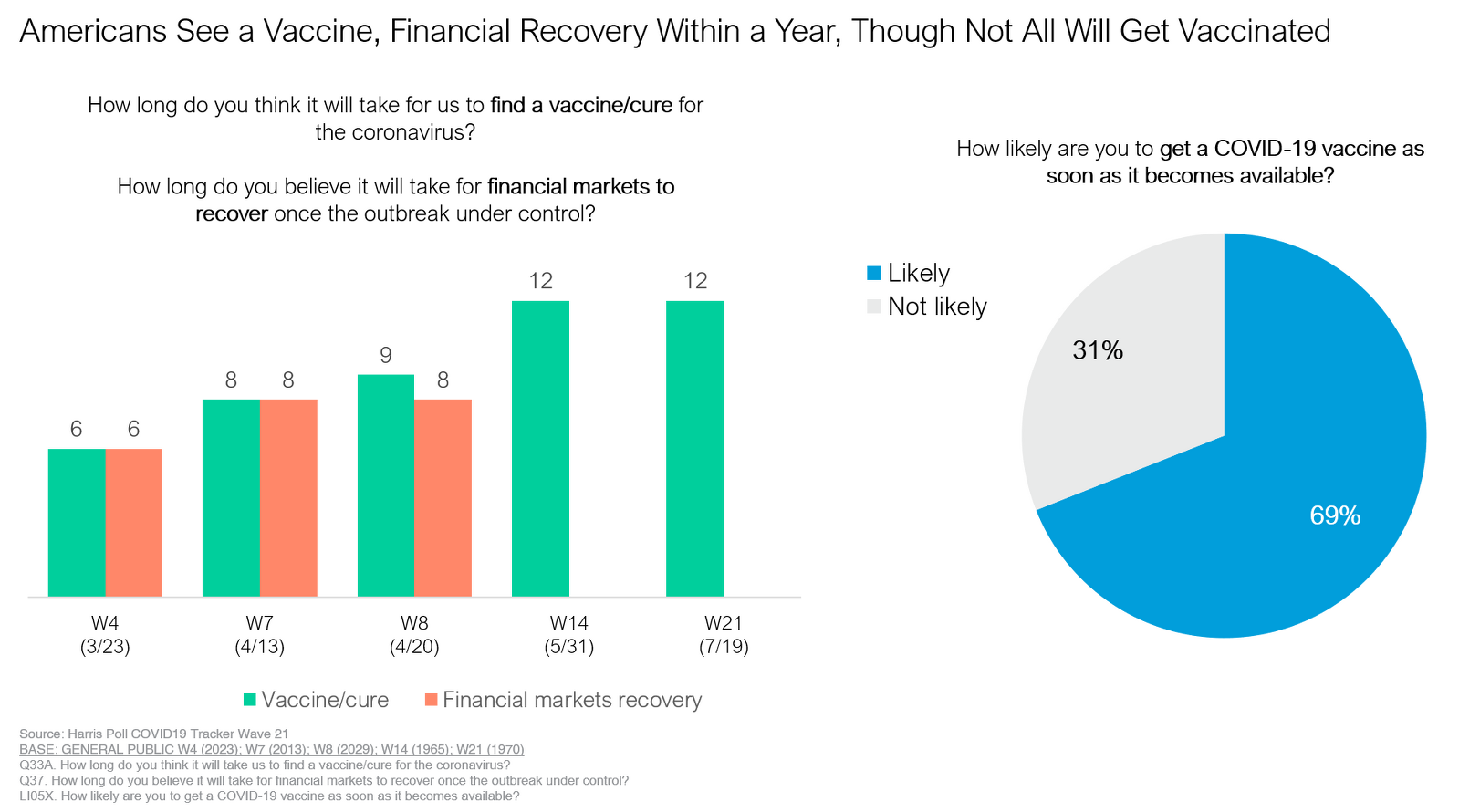

While the prospects for a number of vaccine trials appear promising, Americans – the consumers who drive the economy – see things getting better only when there is one. Most believe this will happen within a year and the majority intended to get vaccinated as the below chart shows.

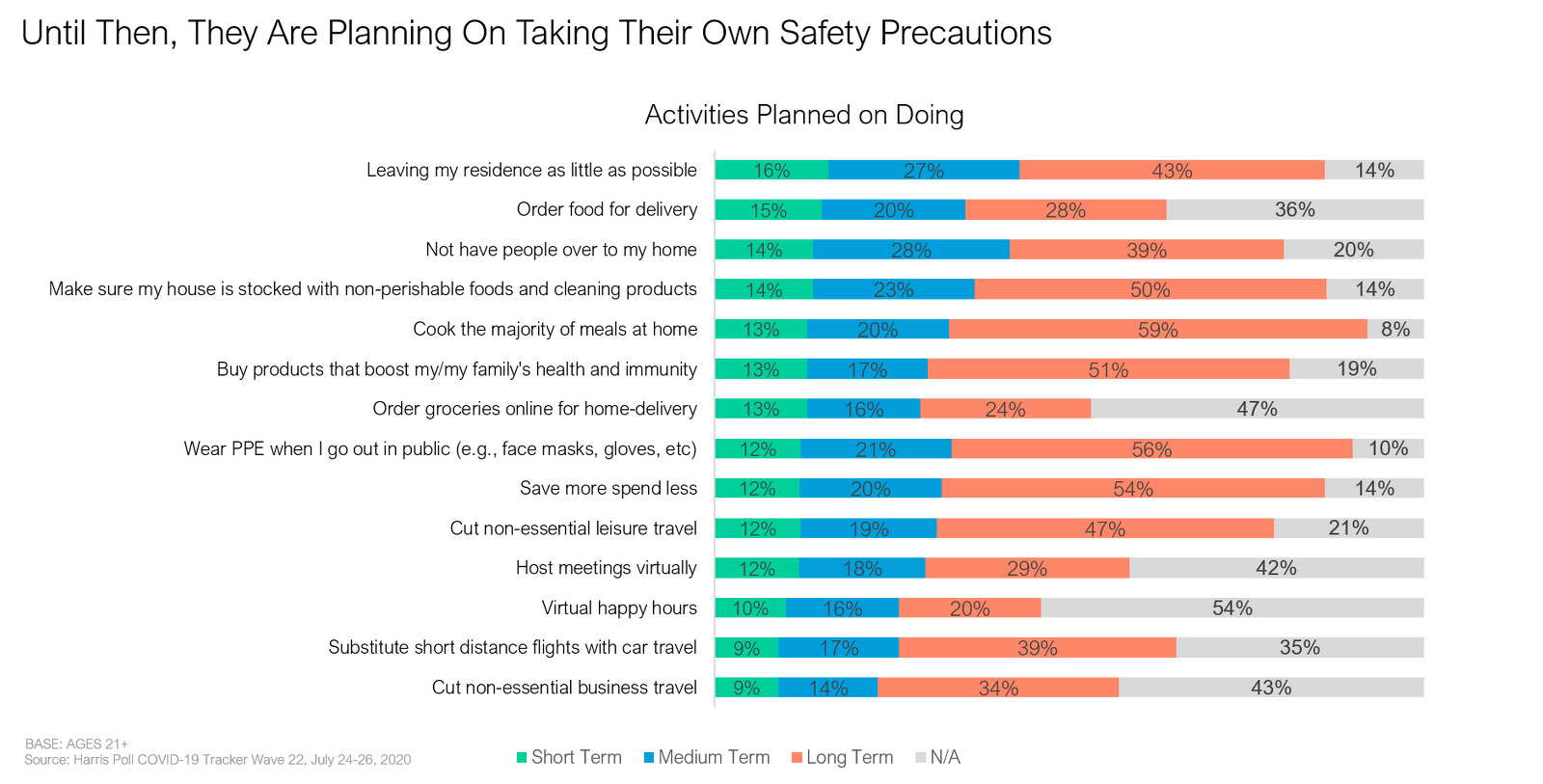

Until that happens, Americans are taking it day-by-day. Settled into the new national pastime: isolation. Notably many behaviors are centered on home and safety, even as frustration mounts over online education and the fear of kids falling behind.

This is six months in America. Let’s hope the next six will be better.

John Gerzema

CEO, The Harris Poll

jgerzema@harrisinsights.com

Special thanks to Tawny Saez, Andrew Higham, Emily Morton, Sean Groman, Logan Dobson, Bri Close, Matthew Fieder, Annie Prunsky, Charmaine Wiggins and the entire Harris team for their temerity and effort in this project.

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Download the Data

This survey was conducted online within the U.S. by The Harris Poll from August 21-23 among a nationally representative sample of 1,962 US. adults.

Download

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Download the Data

This survey was conducted online within the U.S. by The Harris Poll from August 21-23 among a nationally representative sample of 1,962 US. adults.

DownloadRelated Content