Brief • 5 min Read

America This Week: Gen Z’s AI Tax Break, What if Travis Kelce Is Your Neighbor? The Cost of Code-Switching At Work and The Rise of “Loud Budgeting”

The latest trends in society and culture from The Harris Poll

The Wall Street Journal reported that Americans remain down on an improving economy. One theory as to why is seen in our data: The perma-crisis (war, crime, immigration, inflation, divisiveness…) is tainting our view of a secure financial future. In our America This Week poll, fielded from February 2nd to 4th among 2,129 Americans, eight in ten Americans remain worried about the economy and inflation (86%, +2%-pts Jan. 2024) or a potential U.S. economic recession (78%, +2%-pts). All the crises above are also in the seventies and eighties.

This week, we have four new stories: Gen Z has discovered AI as a way to solve their tax headaches. A new pre-Super Bowl Zillow-Harris study awards Travis Kelce as America’s “most desirable neighbor” (no word on his brother Jason). With DEI increasingly under attack, a new Indeed-Harris Poll finds Black Professionals code-switching to keep their careers advancing. Lastly, loud budgeting is the new Gen Z way of saying, “I can’t afford that.”

Gen Z Embraces AI-Powered Tax Fillings: Fast Company-Harris Poll

Technology tips when it begins to enter the domain of the tedious. Our new research with Fast Company finds that tax filing with AI is growing in popularity among America’s young adults.

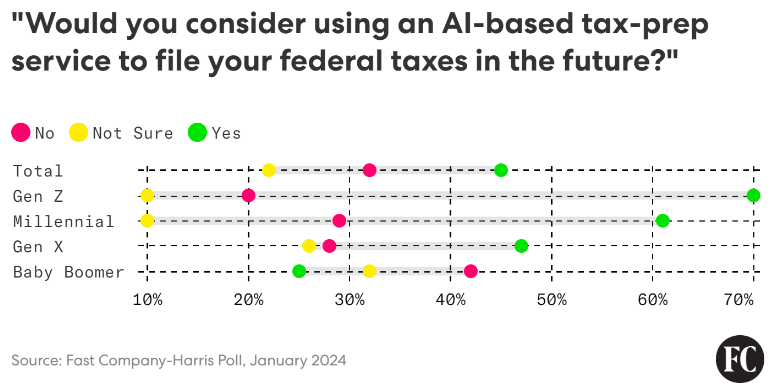

- Seven in ten (70%) of Gen Z would consider using AI-based tax preparation software to file their taxes, compared to only a quarter of Boomers:

- Over two in five (44%) Gen Zers have already used AI tech to ease the drudgery of tax filing (v. Boomers: 4%).

- AI may help ease Gen Z tax nerves: Two-thirds (67%) of Gen Z agree that completing tax filings alone is nerve-racking (v. gen pop: 57%).

Takeaway: AI is changing how Americans file their taxes by removing most of the mental load they face when deciding which actions would provide them with the best tax outcome, says Jamie Belsky, VP of product management at Intuit, the parent company of TurboTax. But there is skepticism around AI’s accuracy: Three in five (60%) Americans don’t trust AI programs to complete their filings accurately (Boomers: 70% v. Gen Z: 58%).

Travis, Won’t You Be My Neighbor? Zillow-Harris Poll

According to our new Zillow-Harris Poll in USA Today, the Kansas City Chiefs tight end (and Mr. Swift) Travis Kelce was voted America’s “Most Desirable Neighbor” among NFL players.

- According to our research with Zillow, Kelce was voted America’s “Most Desirable Neighbor,” especially among women aged 18 to 34. Teammate Patrick Mahomes and Baltimore Ravens receiver Odell Beckham Jr followed him.

- Among Superbowl halftime performers, Snoop Dogg is the person Americans most want to live next to, particularly among older millennials between 35 and 44.

- Of course, real-life neighbors can make or break big-game festivities: (60%) of Americans could be friends with a neighbor who actively supports a rival football team, but fewer than half (46%) would invite a neighbor who roots against their team to their big-game watch party.

Takeaway: Kelce’s numbers aren’t the only ones potentially boosted by the Taylor Swift effect. Our Harris Poll QuestBrand research found that NFL usage among Gen Z and Millennial women jumped after September 2023 with her first Chiefs’ game attendance. By the end of December 2023, young women’s usage jumped nearly 10 points from the year before.

The Harmful Cost of Code-Switching At Work: Indeed-Harris Poll

Code-switching is a term well-known among culture professionals. It refers to changing one’s language, tone of voice, or physical appearance to “fit in with the dominant culture.” Yet despite corporate H.R. speak of employees bringing their whole selves to work, code-switching is still widely prevalent in our new survey with Indeed in Fortune and USA Today.

- Black professionals are nearly three times more likely to code-switch than white ones (34% v. 12%), with almost half (44%) of Black professionals seeing code-switching as a necessity at work (v. gen pop: 29%).

- Nearly one-third (32%) of respondents who said their company had implemented DEI initiatives have code-switched. Worse, over half of respondents (56%) whose company is scaling back on DEI investments see code-switching as necessary.

- On the job, Black professionals code-switch to get hired or promoted, and around (40%) said if they stopped code-switching, it would have a negative impact, such as poor performance reviews or fewer opportunities for advancement.

- But, one in four (23%) Black professionals say code-switching harmed their mental health.

- Younger workers are code-switching too: Younger workers aged 18-34 (35%) are also more likely to have code-switched than their counterparts, with (42%) saying code-switching is necessary at work.

Takeaway: “Anytime you can’t be your authentic self, anytime you have to have it in front of your mind, ‘This is who I have to be in this space,’ that chips away at a lot, chips away at confidence,” says LaFawn Davis, senior vice president of environmental, social, and governance at Indeed. “Feeling like you belong has scientific and biological impacts.” DEI is currently under attack, but Davis says that while many leaders can get behind “inclusion,” they have a more challenging time with “belonging.”

Gen Z Fuels Loud Budgeting: Credit Karma-Harris Poll

Welcome to the era of “loud budgeting,” where speaking up about saving money and not overspending is no longer taboo, according to our new Harris study with Credit-Karma in Axios.

- What is it? Loud budgeting encourages vocalizing to family and friends when something doesn’t fit your budget and not caving to peer pressure.

- 7 in 10 (69%) Americans said they have financial regrets from 2023, with over half (53%) stating their economic situation worsened last year.

- Many can point to poor spending habits: Over 3 in 10 (41%) regretted not saving money, and a fifth (22%) overspent.

- Nearly half (46%) of Americans are expected to have credit card debt heading into 2024, and among those who do, a quarter (25%) are predicted to have $10,000 or more in debt.

Takeaway: The new personal finance trend born on TikTok quickly reverses last year’s social media fad of flaunting luxurious purchases. Loud budgeting has helped some young adults kick “delulu” — or delusional spending — and “doom spending” habits, said Courtney Alev, a consumer financial advocate at Credit Karma.

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Download the Data

This survey was conducted online within the U.S. by The Harris Poll from February 2nd to 4th, among a nationally representative sample of 2,129 U.S. adults.

Download

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Download the Data

This survey was conducted online within the U.S. by The Harris Poll from February 2nd to 4th, among a nationally representative sample of 2,129 U.S. adults.

DownloadRelated Content