Brief • 5 min Read

Living Paycheck to Paycheck, Sports Team May Break You Up, Spent COVID Cash, and Retirement Planning Pitfalls.

The latest trends in society and culture from The Harris Poll

Good morning from Chicago. Our America This Week fielded October 13th to 15th among 2,079 Americans shows weekly upticks in critical economic and international security concerns in the wake of the escalation of Israel-Palestinian violence. And with the world turned again toward the Middle East, even the Republican House disarray is not impacting America’s views of political divisiveness, which declined.

(86%) the economy and inflation (+1%-pt from September 15th to 17th)

(80%) a potential U.S. recession (+4%-pt)

(48%) about losing my job (+2%-pt)

(69%) affording my living expenses (+1%-pt)

(73%) political divisiveness (-3%-pt)

(71%) the war on Ukraine (+7%-pt)*

*Israel-impact. Complete coverage coming this Friday in our Harvard-Harris Poll

This week, four new Harris Polls of note: With Barron’s, we find too many Americans are stuck living paycheck to paycheck. Then, with Vivid Seats, we learn that some American fans will break up over their sports team. And do you still have your pandemic cash? According to our new survey with USA Today, you might be in a small company. To end, we detail many significant missteps in retirement planning with The Transamerica Institute.

Nothing’s Left This & Every Month: Barron’s-Harris Poll

Many Americans are living in financial distress, at least some of the time. That’s the message of a new Harris poll with Barron’s, and it might not be suitable for economic growth.

- About two-thirds (65%) of working Americans say they frequently live paycheck to paycheck – as about (30%) of households report that they run out of money at the end of every month, while (35%) say they don’t have money left at the end of most months.

- Most Americans are affected: About (78%) of Americans earning less than $50,000 a year report they live paycheck to paycheck. Yet (51%) of Americans who make over $100,000 a year say they still run out of money.

- Living paycheck to paycheck isn’t new: About (66%) of those surveyed in March 2020 said they were spending down their wages, according to research from Reality Check: Paycheck-To-Paycheck series.

Takeaway: “While the number of people living on the edge financially has an immediate effect on household well-being, there are also longer-term economic costs, including higher debt levels and uneven retirement readiness. Those trends could also dampen overall economic growth” (Barron’s).

It’s Not You, It’s My Jets: Vivid Seats-Harris Poll

In a new Harris study with Vivid Seats, a surprising number of American fans chose their sports teams over love.

- Nearly half (45%) of Americans say a romantic relationship is more likely to last if both partners are fans of the same sports team.

- And it might even be a dealbreaker: Over a fifth (21%) of sports fans say they would break up with a significant other if they refused to root for their favorite team.

- Taken to the extreme, 1 in 10 sports fans would even go as far as to miss their wedding to see their favorite team play in the playoffs or a championship game in person – while a fifth (19%) would miss a medical procedure.

Takeaway: It’s clear that fandom has reached new heights in 2023 and that when it comes to relationships, forget complementary zodiac signs and look for complementary fandoms. As for some, the heart-pounding moments on the field overshadow even matters of the heart.

Dried Up Pandemic Cash: USA Today-Harris Poll

Remember revenge spending? According to a new Harris study with USA Today, that’s pretty much in the past. Americans whose COVID cash reserves are running low say they’ve been forced to or will have to reduce their spending, such as dining out, non-essentials, etc.

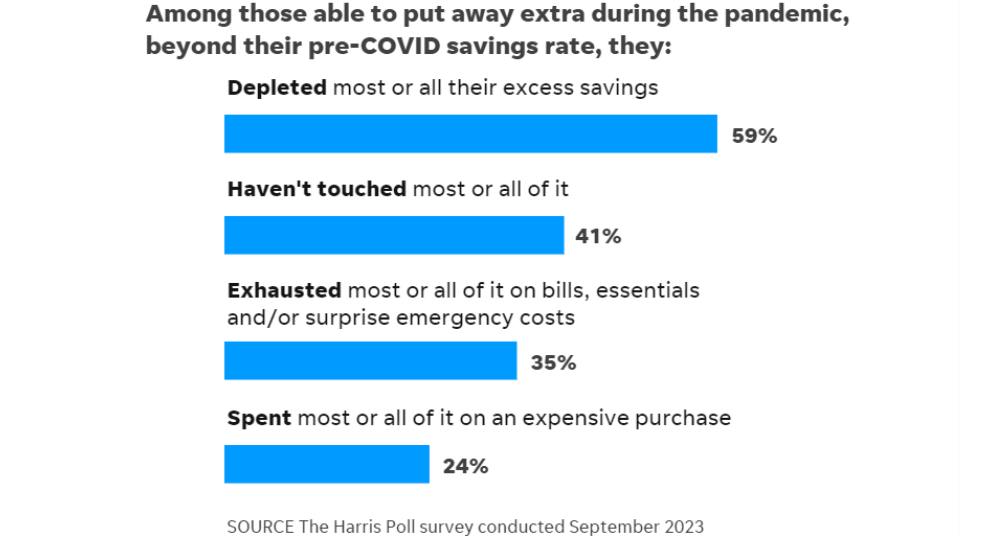

- Over seven in ten (71%) of Americans built excess reserves during the pandemic, but (59%) of those savers say they’ve depleted most or all of that money.

- Among that group, (90%) have pared back their spending or plan to do so, compared with (62%) who still need to deplete their COVID funds.

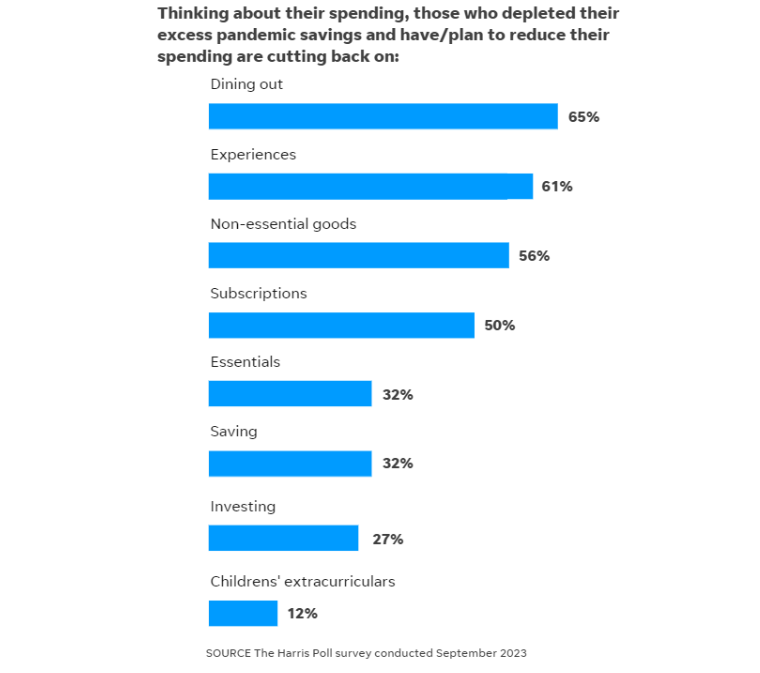

- Of those slashing spending, (65%) are dining out less, (61%) are cutting back experiences, and (56%) are buying fewer discretionary goods.

Takeaway: “The pandemic-related savings and government aid that have helped prop up the U.S. economy over the past three years are dwindling, posing new strains for low- and moderate-income households and hazards for a nation at risk of slipping into recession by early 2024” (USA Today).

Retirement Regrets: Transamerica Institute-Harris Poll

As a tsunami of Boomers move into their golden years, our new study with Transamerica Institute finds many common mistakes in preparing for retirement are leading to confidence cracks in one’s ability to live the retired life they imagine.

- Being overly optimistic about retirement ages: Two-thirds of 50+ workers (66%) expect to retire after age 65 or do not plan to retire. In stark contrast, (58%) of retirees retired before age 65, and the median retirement age was 62.

- Forgetting about life expectancy: When asked the age they plan to live, (47%) of retirees and (39%) of age 50+ workers say they are “not sure.”

- Claiming Social Security too early: 63 was the median age when retirees started receiving Social Security, with (31%) beginning at age 62 choosing to bear the reduced benefit. Just (4%) of retirees waited to receive benefits at age 70, the maximum age that brings higher benefit payments.

- Failing to plan long-term care: Only (14%) of retirees are confident they can afford long-term care if needed, and almost half (46%) indicate that they plan to receive care from family and friends. 3 in 10 (31%) don’t have any plans for long-term care.

Takeaway: “Many pre-retirees and retirees are experiencing pitfalls that could be potentially mitigated through improved planning,” said Catherine Collinson, CEO and President of Transamerica Institute. There is room for more planning as fewer than one in four aged 50+ workers and retirees have a financial strategy for retirement in the form of a written plan (23% and 19%, respectively).

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Download the Data

This survey was conducted online within the U.S. by The Harris Poll from October 13th to 15th among a nationally representative sample of 2,079 U.S. adults.

Download

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Download the Data

This survey was conducted online within the U.S. by The Harris Poll from October 13th to 15th among a nationally representative sample of 2,079 U.S. adults.

DownloadRelated Content