Brief • 5 min Read

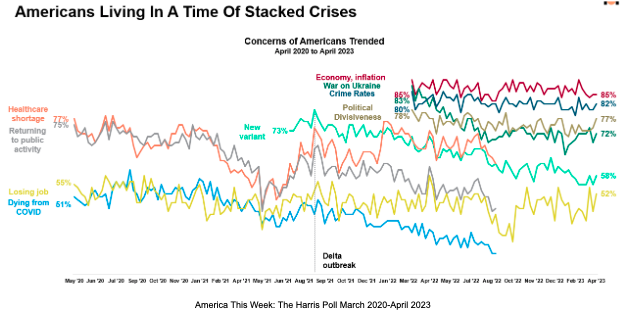

Now that we’ve crossed the third anniversary of COVID, we can see our national stacked crises by charting various public anxieties since Spring 2020. And even in our new America This Week survey, fielded from March 31st to April 2nd among 2,022 Americans, concerns remain high on the economy and inflation (85%), crime rates (82%), political divisiveness (77%), the War on Ukraine, and now the solvency of U.S. banks (69%).

But from trauma comes new optimism-driven consumerism, which Harris Poll CEO John Gerzema discussed at the NFL owner’s meeting in Phoenix last week. In our data, (61%) of Americans say, “My concept of a happy life has changed since the pandemic,” with (61%) agreeing, “I now try harder to live in the moment.” As such, Americans now spend more purposefully on seeking joy, spending on experiences over things, and (75%) seeking to spend on occasions they can do with friends and family.

This week, we’ve got four new polls on workforce well-being, the economic cost of abandoned shopping carts, my favorite new trend, ‘Grandfluencers,’ and everything you need to know about The Peeps Economy. Also, download the new ATW monthly summary tabs and deck here.

Workforce Well-being – The New Competitive Advantage: IWBI-Harris Poll

Our 2023 State of Workforce Well-Being Poll with IWBI finds new leverage when employers promote health, well-being, and equity in their work environments.

- Health as a must-have: More than four in five (84%) of employees agree that supporting the health of employees is a “must-have” for companies, and (87%) agree that employers should be “ethically obligated” to create a work environment that enhances the health, safety, and well-being of their employees.

- And a healthy work environment is non-negotiable: Nearly all employees (96%) agree that a healthy work environment is necessary for employee productivity, and early 4 in 5 employees (79%) say they would not feel any loyalty to a company that does not prioritize their health.

- But nearly one-third of companies fail this test: In our survey, (31%) of employees say they don’t believe that employee health and well-being are a top priority for their company.

- Nearly two-thirds of employees (65%) say they would quit working for a company that doesn’t proactively invest in employee health and well-being, which aligns with the recent Hue-Harris Poll State of Inequity report that found that seven in ten American employees would leave a job when mental and emotional health isn’t being prioritized.

Takeaway: Supporting employees from an overall health and well-being perspective is in employers’ best interest. According to employees, it can enhance a company’s reputation, attract and retain top talent, increase employee engagement and productivity, and boost companywide morale. But it’s also great marketing in that It could also attract customers, as our America This Week tracker found that when asked what brands could do to best support consumers given the current state of the economy, the top answer was paying their employees a decent wage over reward programs and discounts.

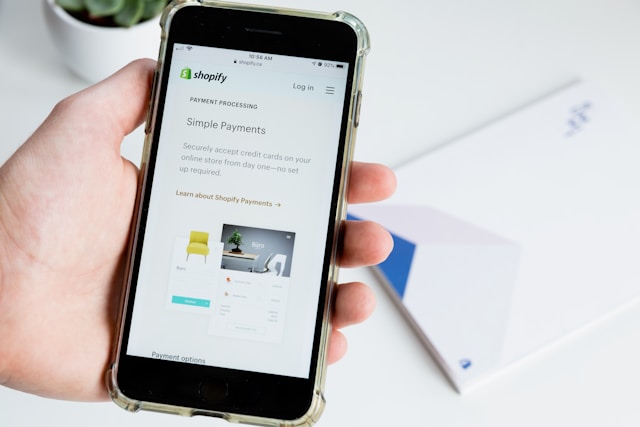

Lower Funnel Blues – Abandoned Shopping Carts Cost Businesses $2B Annually: Google Cloud-Harris Poll

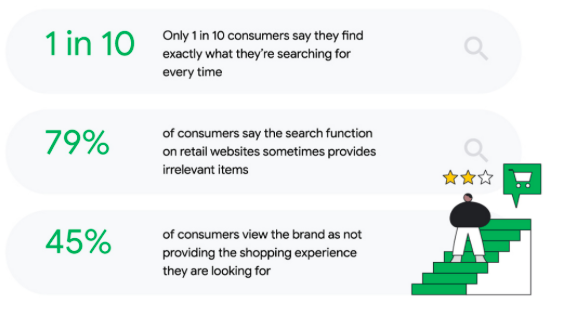

Search abandonment – when a shopper searches for a product on a retailer’s website but doesn’t find what they are looking for – is costing businesses billions of dollars, according to our latest research with Google Cloud, as covered by MediaPost.

- Search abandonment annually costs U.S. retailers $234 billion and rises to over $2 trillion globally.

- Over three-quarters of U.S. consumers (78%) view a brand differently after experiencing search difficulties, and (82%) avoid websites where they’ve experienced search difficulties in the past, such as receiving irrelevant items:

- Poor search results cost loyalty: U.S. consumers also say they are less loyal to a brand when it’s hard to find what they want on a website (78%).

- While successful searches drive purchases: Following a successful search for a particular item, 9 in 10 (92%) consumers will purchase it – with over three-quarters buying at least one other thing (78%). On average, three different items were purchased after a successful search.

Takeaway: Gone are the days when retailers could expect customers to search, filter and repeatedly refine to find what they want. People worldwide now hope site search engines understand their intent deeply, return relevant results and help them discover new products quickly with personalized recommendations. Generative AI will bring new levels of intimacy to this task, provided the data security issues already causing a cookie-less future are managed to create both personalization and security.

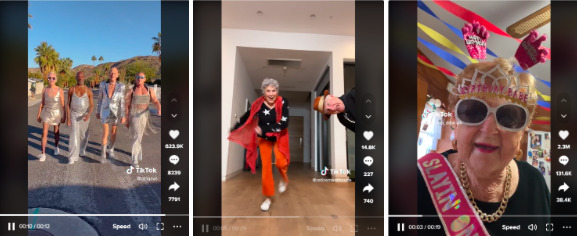

Granfluencers Are Drip: Ad Age-Harris Poll

Brands typically prioritize Gen Z influencers when seeking content creators to work with. Still, that narrow definition of an influencer is evolving, and influencers in older demographics are increasingly striking big brand deals, as seen by Harris Poll research, highlighted in Ad Age.

- The Ad Age-Harris Poll found that (12%) of consumers over age 58 had made a purchase based on an influencer’s recommendation, and one-third of these consumers cited influencers as at least “somewhat influential” in their purchasing decisions.

- The popularity of these “granfluencers,” who range from 50 to over 100 years old, is in part to America This Week data finding that over 4 in 5 Americans (85%) believe that social media isn’t just for young people – with all ages agreeing at similar rates (Gen Z: 84%, Millennials: 83%, Gen X: 88%, Boomer+: 86%).

@oldgays @retirementhouse @grandma_droniak

- Further, over three-fourths of Gen Z/Millennial social media users (78%) have learned a lot by watching content created by people older than them.

- And two-thirds of Gen Z/Millennial users (66%) even say they love watching social media videos of senior content creators (Gen X: 61%, Boomers+: 47%).

Takeaway: The success of granfluencers is a reminder that marketers shouldn’t trust demo stereotypes, as influencers come in all shapes, sizes…and ages. While Gen Z consumers may be the typical target for brands’ influencer marketing campaigns, those aiming to reach consumers over 50 – who comprise over half of all consumer spending in the U.S. And judging by the success of granfluencers Insta-traffic, they are attracting younger Americans as well.

The Peeps Economy: Instacart-Harris Poll

(From Instacart) This year, the first day of Passover (April 5) and Easter (April 9) are only a few days apart, serving as significant moments for food and families. As people gear up to gather with loved ones and mark the moment together, we share insights about the top feasting foods and treats expected to appear on holiday tables this April based on Instacart purchase data. I think we should hop in.

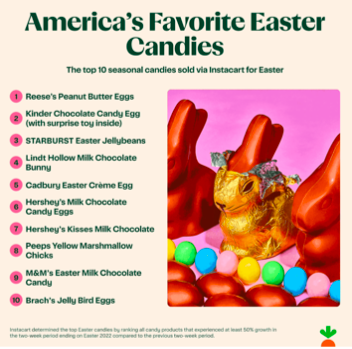

- Chocolate, chocolate, and more chocolate: When it comes to Easter candy, there’s no denying that chocolate reigns supreme, with 7 out of the top 10 sweets repping cocoa – with more than 3 in 5 of those planning to purchase Easter candy will be buying chocolate eggs (64%) and chocolate bunnies (61%).

- Peep the candy: Amid all the decadent chocolate, two types of jelly beans and the classic Peeps marshmallow chicks also stand out, holding a special place in Americans’ hearts and Easter baskets.

- The state-by-state candy standoffs: Reese’s Peanut Butter Eggs completely dominate, taking the top spot in 29 states, including the entire West Coast, followed by Reese’s Peanut Butter Cups and STARBURST Easter Jellybeans:

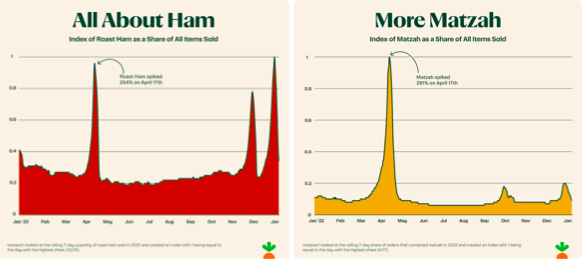

- It’s more than just candy this holiday season: As people gear up to gather with loved ones and mark the moment together, it shouldn’t be surprising that traditional holiday meal ingredients are making it into the grocery baskets – Matzah orders spiked by 291% in the week leading up to Passover and ham by 254% leading up to Easter.

For those celebrating the Spring holidays, we wish everyone a joyful celebration surrounded by loved ones!

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Download the Data

This survey was conducted online within the U.S. by The Harris Poll from March 31st to April 2nd among a nationally representative sample of 2,022 U.S. adults.

Download

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Download the Data

This survey was conducted online within the U.S. by The Harris Poll from March 31st to April 2nd among a nationally representative sample of 2,022 U.S. adults.

DownloadRelated Content