Brief • 5 min Read

In The Harris Poll, America This Week survey fielded from October 14th to 16th, 2022, among 1,999 U.S. adults, we find sustained concern over the economy and inflation (89%, +3%-pts from last week) and a potential U.S. recession (85%, +3%-pts). Additionally, worries over a new COVID-19 variant increased this week (60%, +3%-pts) in light of health experts eyeing a collection of immune-evading COVID variants that may drive a winter surge.

To hear about these stories and more, check out our America This Week: From The Harris Poll podcast on Spotify and Apple Podcasts, where our CEO John Gerzema and CSO Libby Rodney dive into the numbers. For any polling ideas, reach out to atw@harrispoll.com.

Here’s what else you need to know this week:

- In the latest CVS Health-Harris Poll National Health Project details the pervasive but invisible issue of the “Pink Tax” and other costs women burden.

- The latest Harvard CAPS-Harris Poll October survey just dropped. American voters have a lot to say about inflation and the economy. Link to the full poll here or listen to https://www.markpennpolls.com

- Then, our co-CEO Will Johnson in USA Today details the potential population bomb in the U.S. as more and more Americans choose not to have children.

Lastly, even in face of pandemic economic uncertainty, Americans can weather the credit storm and even increase their credit score compared to pre-pandemic numbers.

The Pink Tax: CVS Health-The Harris Poll National Health Project

In a new CVS Health-The Harris Poll National Health Project Survey featured in Boston Business Journal, we detail the growing financial burden of the Pink Tax and paying for menstrual products on American women.

- The “Pink Tax” refers to the common trend of consumer products (like razor blades, shaving cream, etc.) being priced higher to women than comparable products marketed to men.

- Growing financial burden: Women with periods report that period and feminine hygiene products were more affordable before the pandemic than today (pre-pandemic: 66% v. today: 50%). Nearly half (45%) of women with periods are regularly stressed about affording period products, exacerbating financial stressors as almost nine in ten American women are already worried about inflation and rising prices.

- The pervasive but invisible issue: While more than half say women’s care products are unfairly priced, nearly two-thirds (62%) are unaware of the concept of the pink tax, including (59%) of those who currently get their period.

- Additionally, nearly six in ten (58%) Americans are unaware that some states have sales tax on period/feminine hygiene products, including (60%) of women who currently get their period.

- Consumers expect corporations to help ease the burden: Nearly all (92%) of those with periods believe corporations who sell period products should make them more affordable, more accessible (89%), and more environmentally friendly (86%).

Takeaway: To fight straight-out pricing discrimination, in response, CVS Health is reducing the prices of their store brand period products in their core stores by 25 percent; paying the so-called “Menstrual Tax” on menstrual products in their stores in twelve states and partnering with national organizations who are working to eliminate the menstrual tax in 26 states.

Check out our America This Week: From The Harris Poll podcast this week, where we’ll dive into why it’s time for businesses to be in the business of women’s health.

A Red Wave in The Midterms? Harvard CAPS-Harris Poll

According to the October Harvard CAPS-Harris Poll findings featured in The Hill, our Harris Poll Chairmen (and Stagwell Chairman/CEO) Mark Penn reports the Republican party may be inching closer towards a wave election by connecting with voters on their critical issues of inflation, crime, and inflation.

- When asked to pick the three most important issues facing the country today, voters identified inflation (37%), the economy and jobs (29%), immigration (23%), and crime (18%).

- And nearly three-quarters (73%) of voters believe that inflation is increasing (v. coming down: 12%, staying the same: 14%).

- Overall, two-thirds (65%) think the U.S. economy today is weak (v. strong: 35%), and over half (57%) say their financial situation is getting worse (+20%-pts from October 2021: 37%).

- Americans are also concerned about a recession: Over 8 in 10 (84%) voters think the U.S. is in a recession now or will be in one in the next year (currently in a recession: 46%, will be in one: 38%).

- Americans lean towards a hawkish foreign policy on oil and Russia: (65%) oppose easing sanctions on countries like Iran and Venezuela to lower gas and oil prices; instead, they want a greater output of American oil and gas.

- And that (54%) think the U.S. should cut military sales and technical aid to the Saudi Arabian government in response to their oil production cut.

- Additionally, Penn details how voters split on whether or not Biden’s policies on Ukraine are pushing us toward nuclear war (pushing: 52%, preventing: 48%), and a majority remain supportive of providing aid to Ukraine (supplying weapons to Ukraine: 58%).

- Lastly, if Russia uses a nuclear weapon on Ukraine, (59%) of Americans are willing to send in NATO.

Takeaway: “Republicans are inching closer towards a wave election as they connect with voters on their key issues of inflation, crime, and immigration. The GOP is now winning the generic Congressional ballot 53-47 among likely voters,” says Penn.

Download the full report and listen to Mark/The Hill’s Bob Cusack podcast.

America’s Population Bomb: USA Today-Harris Poll

Americans are having fewer children than are needed to keep population numbers stable in a new USA Today/Harris Poll opinion piece with co-CEO Will Johnson, who looked into the reasons Americans have for choosing not to have children.

- Of those without children, about half (52%) do not want to have a child in the future, while (20%) remain unsure.

- For those who decided against having children, over half (54%) want to maintain their personal independence/finances, followed by work-life balance (40%), housing prices (33%), the current political situation (31%), safety concerns (31%), and climate change (28%).

- Men and women were generally similar in their reasoning: Over half of men (55%) and women (53%) reported that their desire to maintain independence influences their decision not to have children.

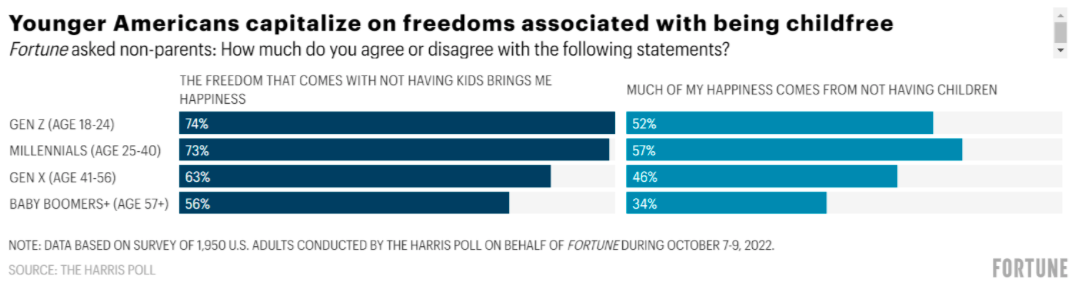

- No kids, no happiness problem: In a recent survey with Fortune, (65%) of those without kids say being childless brings them happiness, especially younger individuals:

- And we found that even though (76%) believe society expects parenthood to bring people happiness and a sense of fulfillment, (77%) of nonparents are happy with their lives overall, just slightly less than parents (82%).

Takeaway: “In an age when a significant portion of Americans are living paycheck to paycheck, there’s still no federal paid parental or sick leave, and many women face professional and financial consequences for being mothers, it’s not entirely surprising that many younger people are forgoing kids” (Fortune).

The Credit Score Bump: NerdWallet-Harris Poll

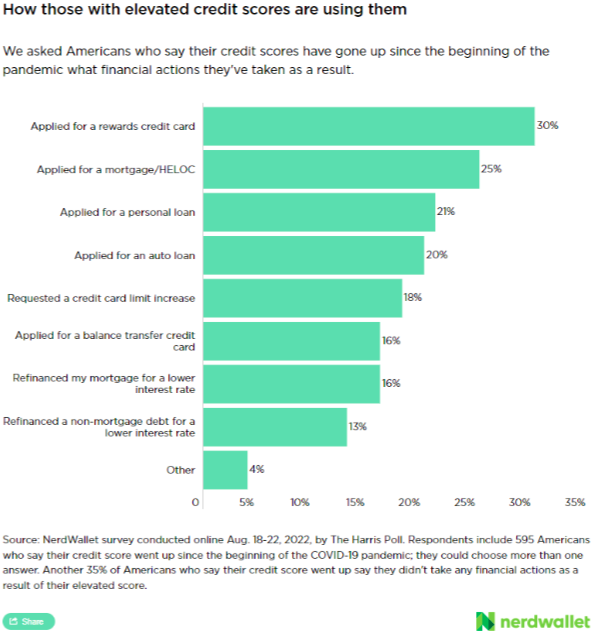

The pandemic disrupted many Americans’ finances, and you might expect credit score damage to be a given. Still, according to our latest survey in partnership with NerdWallet, that wasn’t the case for several Americans:

- More than a quarter (27%) of Americans say their credit score has gone up since the beginning of the COVID-19 pandemic, with just (14%) saying it decreased.

- About 7 in 10 Americans (69%) with increasing credit scores attribute the gain to paying down debt, while for those who saw their scores drop, close to half (47%) attribute it to taking on or increasing debt.

- Better credit spurred action: Two-thirds (65%) with higher credit scores took financial action as a result, such as applying for a rewards credit card (30%) or a mortgage/home equity line of credit (25%).

- Many plan to boost their credit this year: More than 3 in 5 (61%) Americans plan to take action over the next year to improve their credit, with half (49%) planning to pay off or pay down debt.

Takeaway: “Credit scores play a huge role in consumers’ financial lives, impacting not only access to loans and credit cards but also often car and homeowners’ insurance rates, among other things,” says Kimberly Palmer, personal finance expert at NerdWallet, “That’s why it’s worth putting effort into understanding and building your credit score, especially after the tumultuous last couple of years.” However, credit misconceptions remain, with nearly half (46%) of Americans incorrectly believing that closing a credit card you don’t use can help your credit score.

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Download the Data

This survey was conducted online within the U.S. by The Harris Poll from October 14th to October 16th, among a nationally representative sample of 1,999 U.S. adults.

Download

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Download the Data

This survey was conducted online within the U.S. by The Harris Poll from October 14th to October 16th, among a nationally representative sample of 1,999 U.S. adults.

DownloadRelated Content