Brief • 1 min Read

While much remains to be seen around the ultimate timing and penetration of these pledges, the possible implications are breathtaking.

The Harris Poll is conducting a 5-part EV Series that will explore a wide array of insights to better understand America’s attitudes, behaviors, and the overall impact an all-electric auto industry will have on society.

Part 1 explores consumer reaction to OEM EV announcements and gauges whether they have moved the needle in various purchase funnel and reputational measures. Part 2 looks at America’s readiness to accept EV’s, loyalty toward Auto Manufacturers who plan to offer EV, top concerns over EV’s, and finally, openness to trying new technologies/advancements in relation to EVs. Part 3 looks at EV infrastructure as a potential inhibitor or facilitator of EV purchase as well as the impact the future threat of gas shortages as witnessed through the recent cyber attack could have on the same. Part 4 examines the expectations for the next industry to make a commitment to clean energy as well as the sectors most impacted by the Auto Manufacturers pledge to go all electric. Finally, Part 5 investigates parking and charging infrastructure availability and its potential impact on demand for EVs.

We have seen that charging infrastructure needs play a role in EV acceptance. Beyond that, parking location can determine charging accessibility and further facilitate or inhibit EV consideration. Drivers park their vehicles in many potential locations and where they park has a bearing on the feasibility and ease of charging an electric vehicle. For instance, those who park their vehicles in their garage or driveway have more access to charging on demand than those who have street or lot/structure parking. They are more likely to find the EV ownership experience more pleasant and be more open to purchase. On the other hand, whether or not a parking spot is dedicated can also affect charging availability. Those who have to search for a different parking spot and/or consistent access to charging may not find the experience as seamless as owning a traditional vehicle.

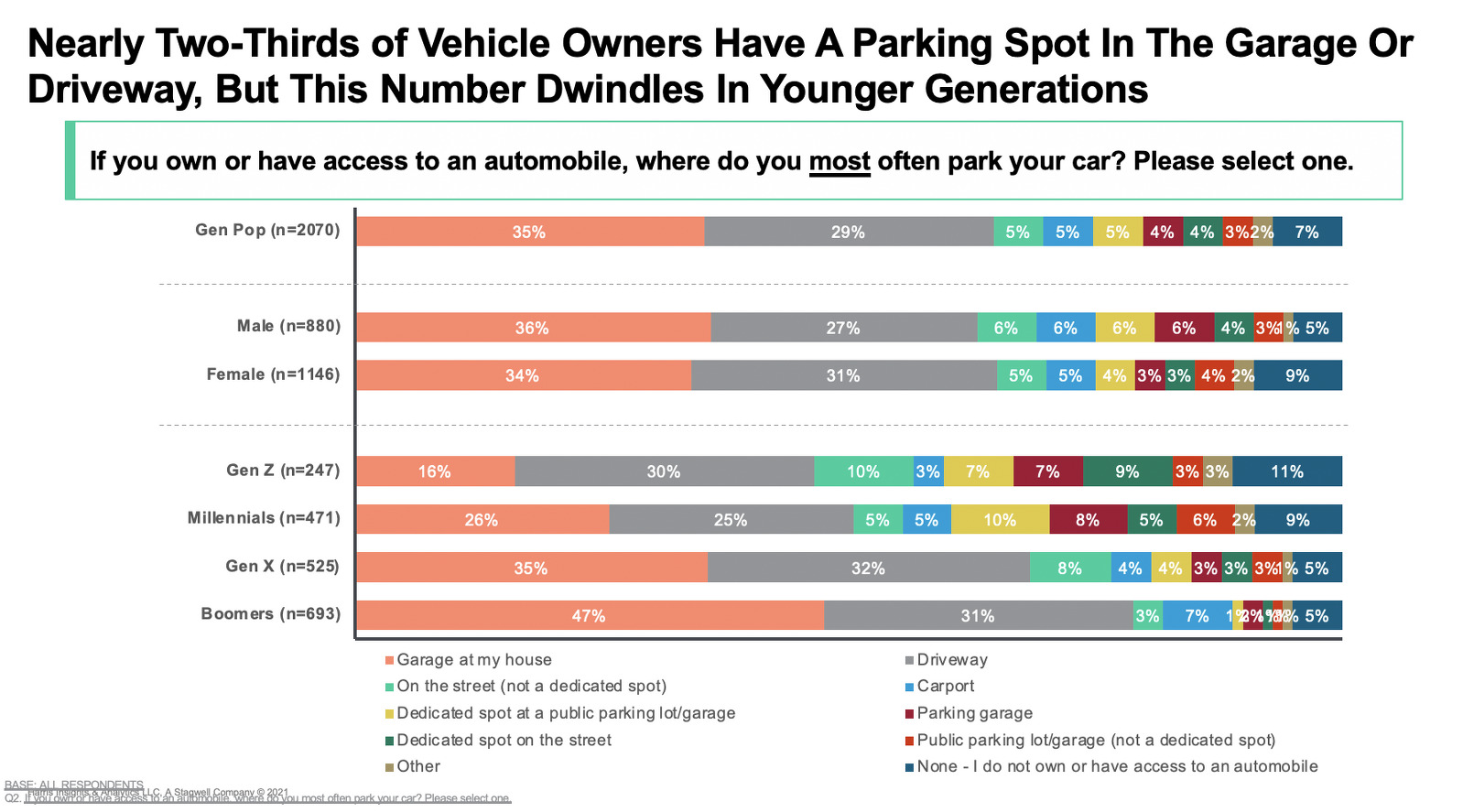

Nearly two-thirds of vehicle owners have a parking spot in the garage or driveway, which tells OEMs that they may be missing the market on the other third if consistent, convenient options aren’t available. This number dwindles in younger generations, which exacerbates the trend down the road if seamless options can’t be provided.

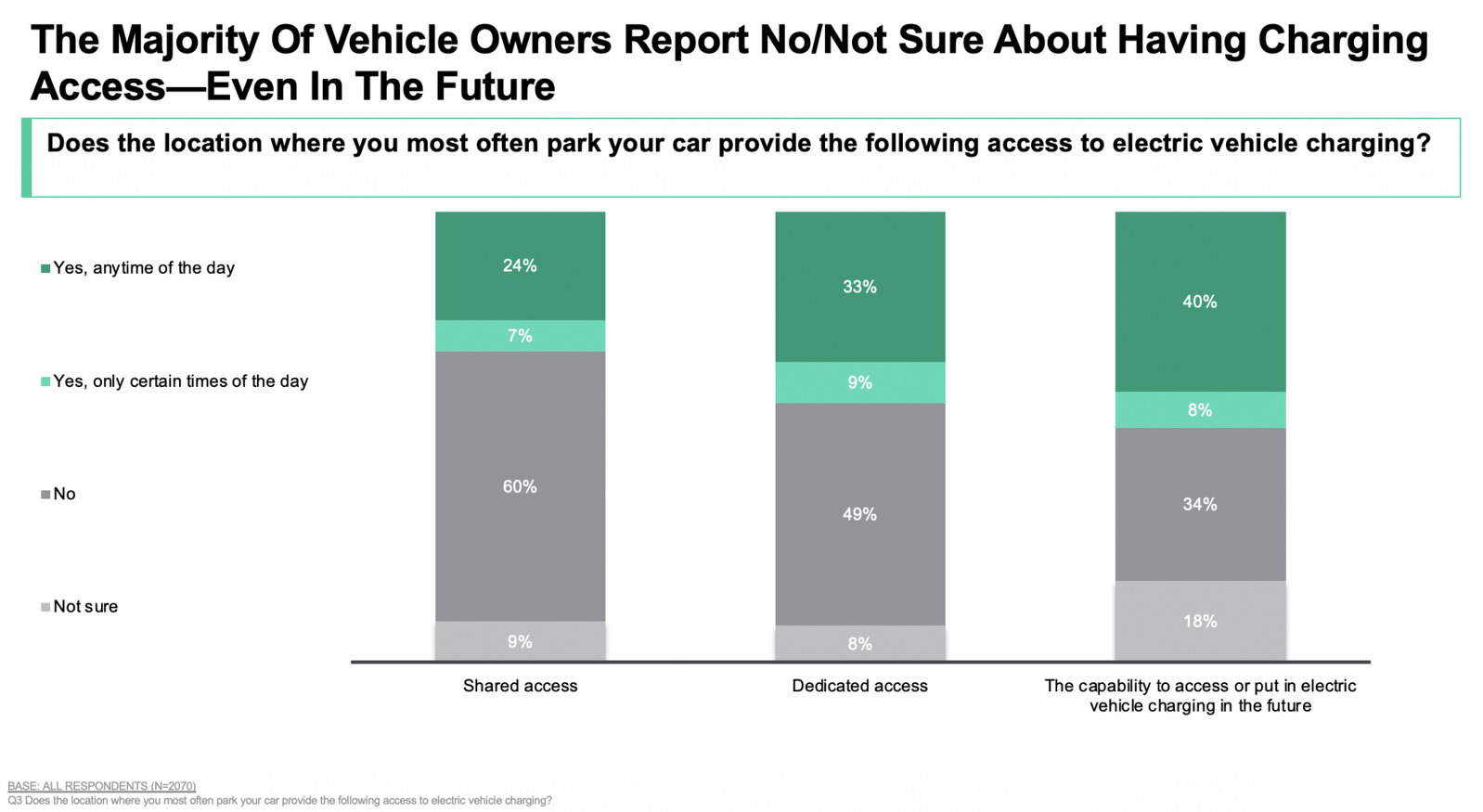

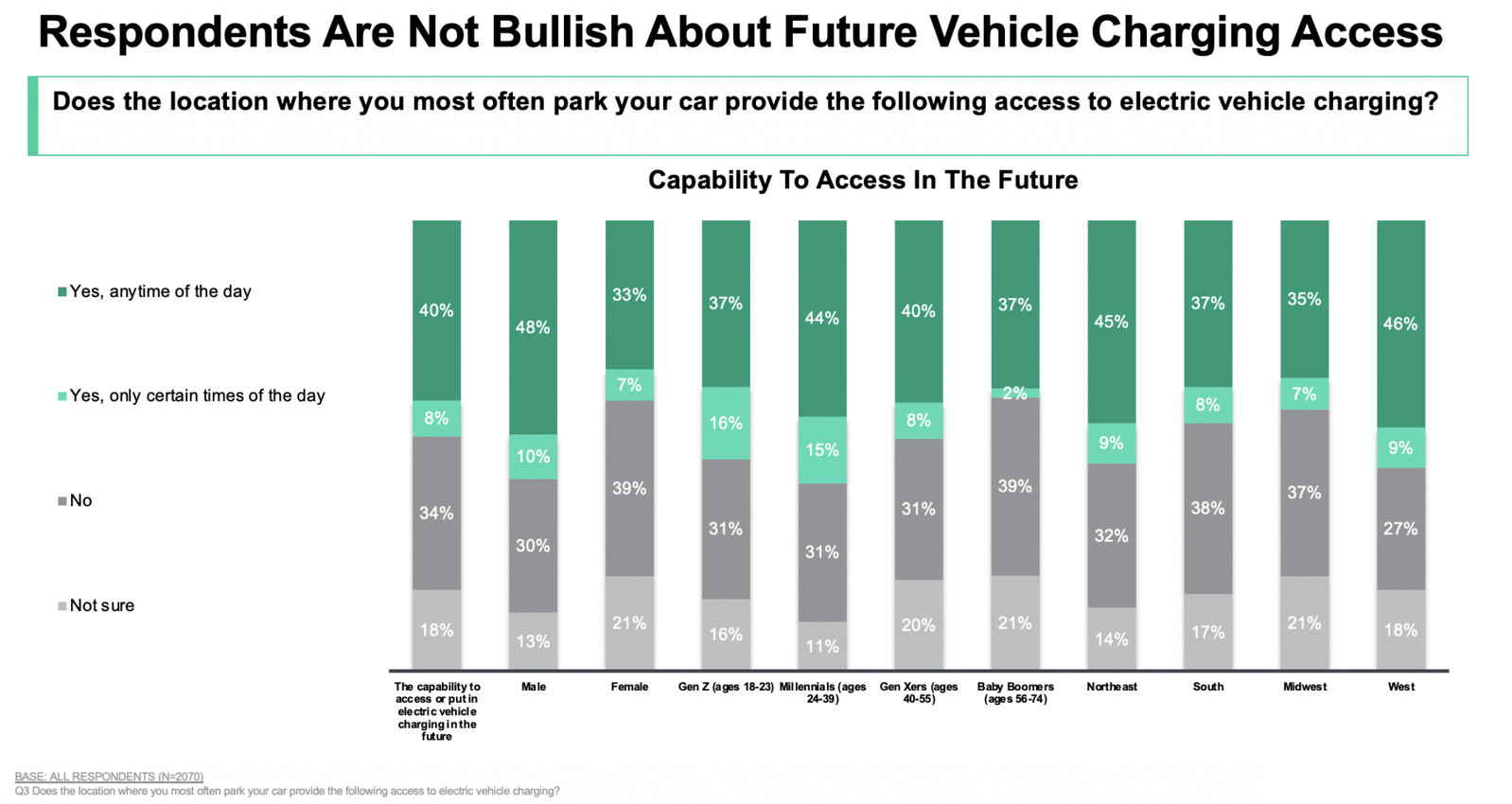

Digging further into the feasibility of charging, the majority of vehicle owners report no/not sure about having charging access—even in the future. More messaging and signage can alleviate this trend along with building more options.

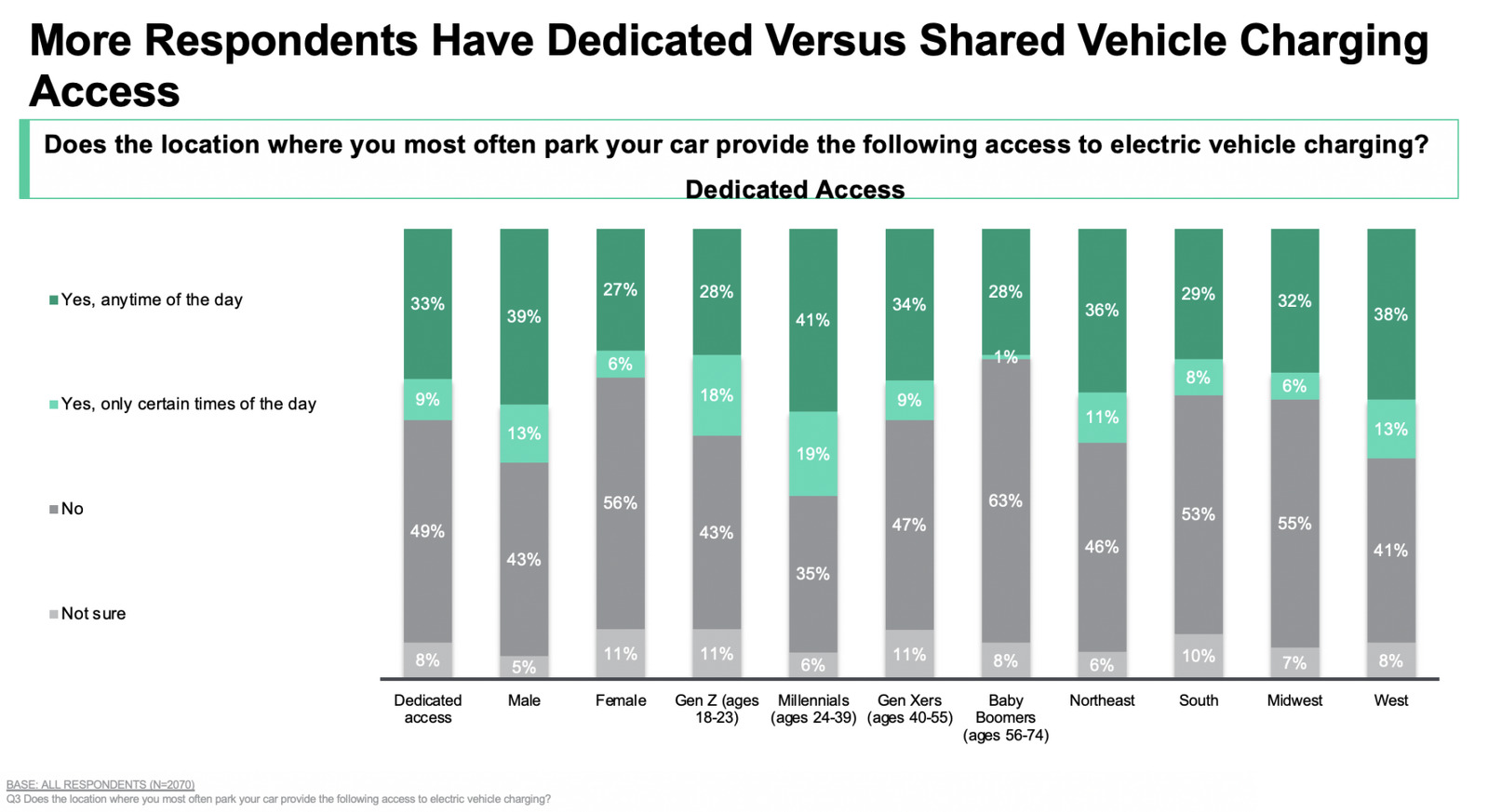

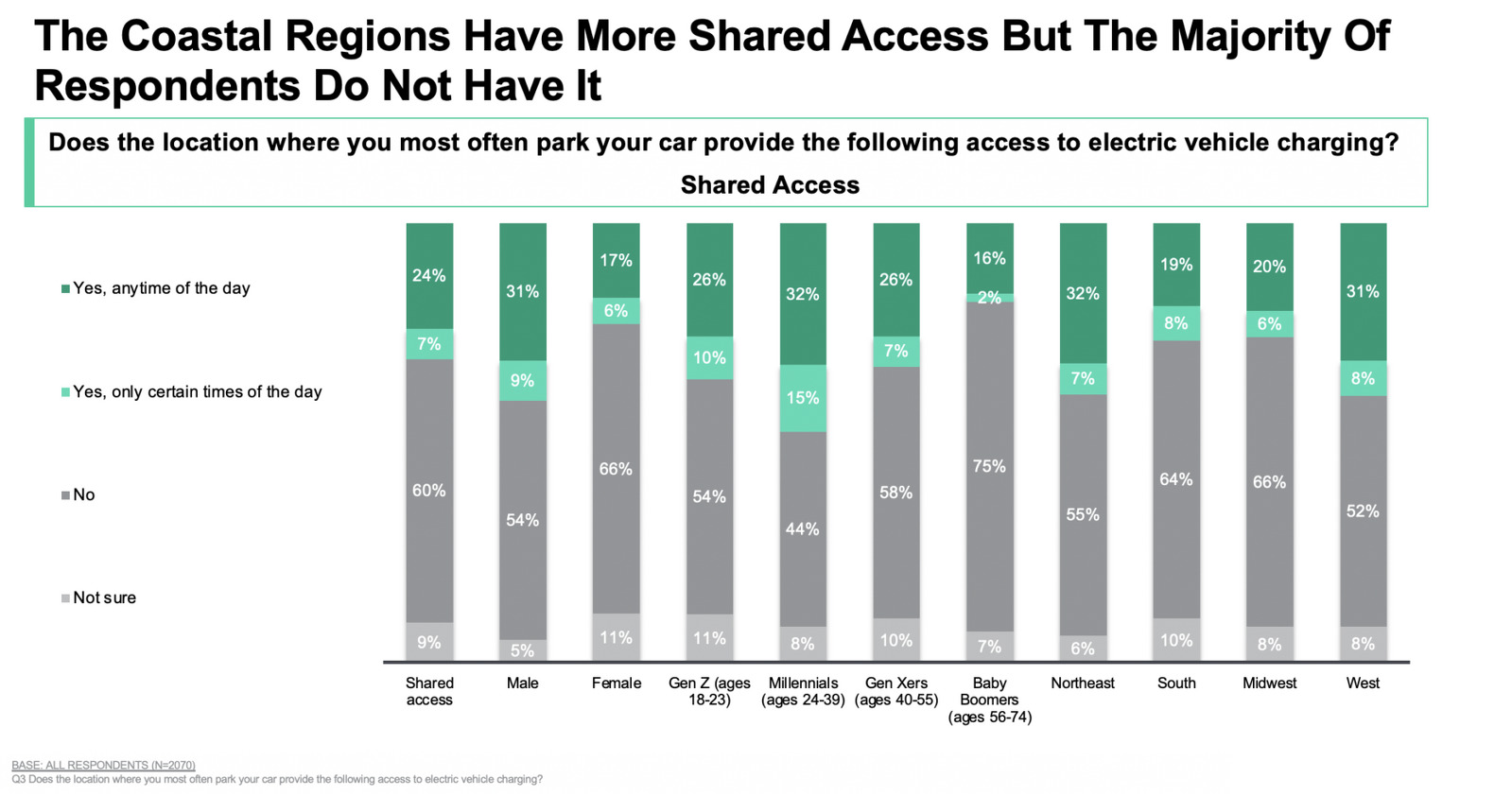

When looking at type of access, more respondents have dedicated versus shared vehicle charging options. When it comes to shared access, the coastal regions report relatively more shared access but the majority of respondents do not have it. Targeting pockets with less access such as regionally speaking and urban versus suburban can be key in exposing new areas for the EV market while building upon providing more access to the areas with higher penetration.

Looking forward, respondents are not bullish about future vehicle charging access. Fifty-two percent of respondents either don’t believe or are unsure if they will have charging access in the future. As auto manufacturers ramp up their EV roll-out plans and messaging about all EV line-ups, they should consider combining news about initiatives on parking solutions and increased charging access to boost the appeal of their announcements.

In summary, OEMs and infrastructure providers should assess the areas of the EV market they may be missing entirely for those who don’t have consistent proximate access to vehicle charging. Parking and charging availability is an important aspect of this experience and OEMs, cities and charging providers should work together on providing more parking solutions that facilitate charging access and ultimately fuel demand.

For part 4 in this series: The Road to EV: America’s Move to the Electric Vehicle Part 4

Check out the full series along with additional automotive insights.

Subscribe for more Insights

Subscribe to our newsletter for the latest trends in business, politics, culture, and more.

Related Content