Brief •

According to numbers revealed by TikTok, the number of monthly active users in the United States has more than quadrupled since the beginning of 2018 – and as of August represented almost a third of the U.S. population.

What was once a niche platform with a narrow audience is now one of the fastest-growing social media platform in the world, and brands are beginning to see the goldmine of opportunities for engaging with customers.

But with its own set of unwritten rules and a user base that skews younger, marketing on TikTok is also a potential minefield for brands – especially with younger consumers wary of their intentions.

This report will help guide brands and marketers to navigate the nuances of TikTok and connect with its core users.

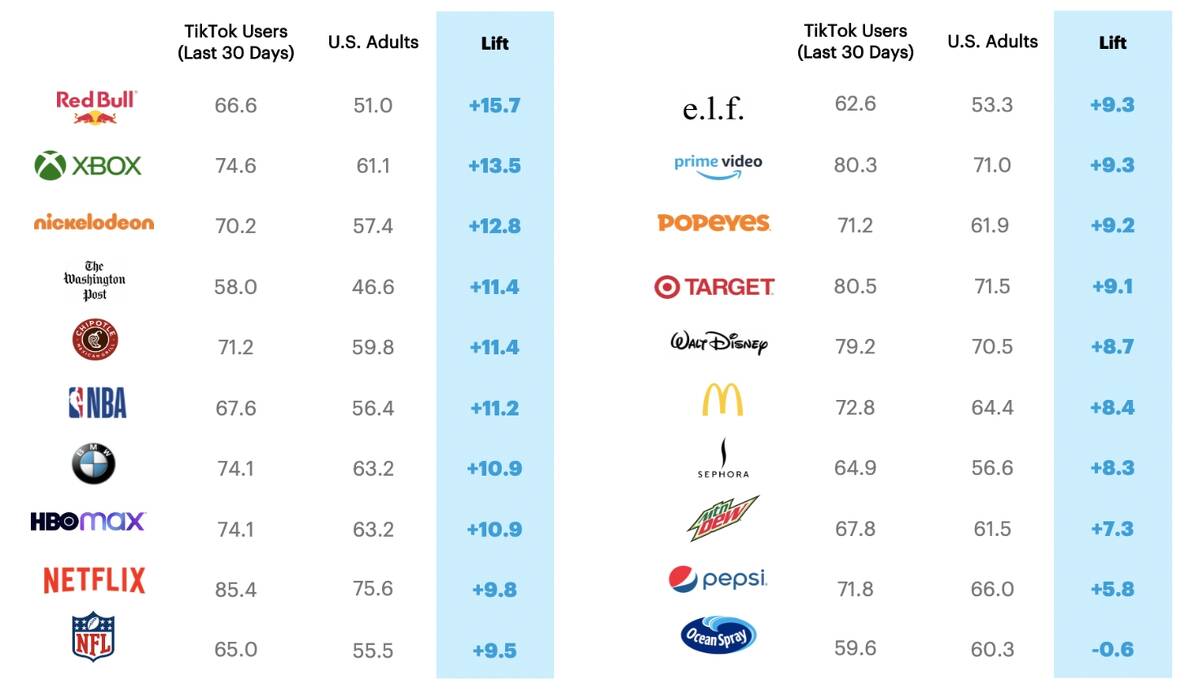

Brand Equity Index: TikTok Advertisers

Brands with a higher lift have successfully built equity and buzz with TikTok’sunique audience – meaning their in-app content, influencer engagement or ads are resonating with the platform’s users.

Interested in seeing the index for the other components of brand equity, such as momentum and consideration?

TikTok Trends

Usage

Most of TikTok users are devoted users, indicating a source of constant engagement that is valuable both to the platform and the brands that use it.

Unsurprisingly, the app’s audience skews younger – notably only 1% of baby boomers report using it – but it’s not all teenagers. While users are most likely to be Gen Zers (44% are on the app), Millennials report using the app most frequently. Gen Zers, however, are most likely to prefer using TikTok over other social media apps (41%), so even as TikTok’s popularity grows, Gen Z is likely to remain a cornerstone of its user base.

Sign-ups

Gen Zers, TikTok’s early adopters and stalwart ambassadors, joined the app primarily because it aligned with their values, giving them a creative outlet and a connection with others who share their unique interests.

After TikTok established itself with Gen Zers as a source of creativity and entertainment, personal networks greased the wheels for TikTok’s meteoric rise: Nearly half of all users (46%) said they joined because friends and family were frequent users of the app.

Content

Gen Z’s primary reason for joining – creativity – is also reflected in the types of accounts they follow, including comedy & entertainment, dance and fashion. Savvy brands should create and curate their content accordingly.

And while comedy accounts are a clear front-runner, tastes diverge among the generations. Gen Zers are more likely to follow fashion accounts than their generational counterparts, meaning fashion and retail brands are especially well-suited to engaging them on the app.

Commerce

TikTok users are moving beyond mere content consumption to product consumption.

Consumers spent $32 Billion on apps in Q1 2021, and TikTok has shown strong potential as a commerce platform – as the popularity of the “TikTok leggings” reveals.

Almost half (48%) of TikTok users say they’ve bought a product or service after seeing an ad for it on the app, and 47% say they’ve purchased something based on the recommendation of a TikTok influencer.

Inexpensive products tend to fare better. In fact, two-thirds (66%) say they’ve spent less than $50 on a purchase they made based on the recommendation of a TikTok influencer.

Download the full report.

Fill in this form to learn more about the performance of some of the top brands advertising on TikTok and take a deep dive into how TikTok stacks up to other social platforms when it comes to consumers.